Walmart’s Q1 Earnings Could Shift Everything

- Revenue surpassed $681B and EPS rose nearly 26% YoY, driven by platform growth and operational leverage.

- Consensus EPS is $0.58, a 3.3% YoY decline with 24 downward revisions and soft revenue expectations.

- Forward P/E of 37.47x and P/S of 1.11x reflect high expectations despite modest projected growth.

- eCommerce, advertising, automation, and vertical integration drive future profitability amid competitive and macro uncertainty.

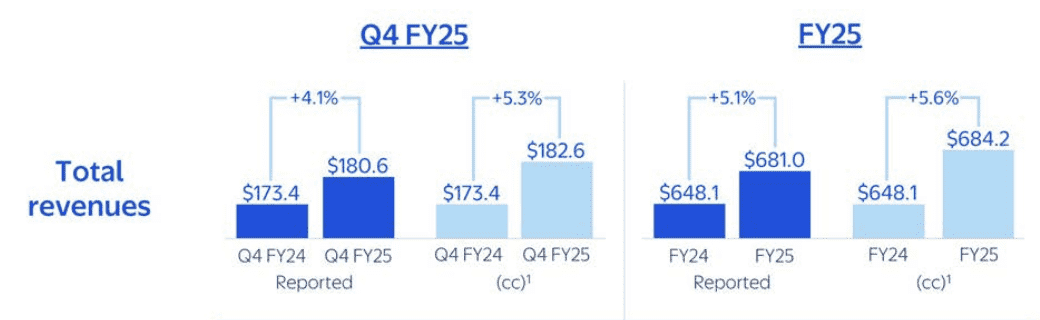

TradingKey - As Walmart (WMT) approaches its Q1 FY2026 earnings report on May 15th, investor sentiment is optimistic but decidedly laced with apprehension. On an initial inspection, the retail behemoth seems resistant on a structural level, its 2025 revenues surpassing $681 billion and consolidated EPS rising nearly 26% versus its prior-year performance.

Source: Walmart Earnings Release (FY25 Q4)

Below the surface, though, recent analyst revisions indicate simmering doubt: consensus EPS for Q1 FY2026 has experienced 24 negative revisions and no positive revisions in the last three months. The future direction of the stock rides on Walmart being able to continue its margin expansion and top-line traction in the face of deflationary forces and increasing operating bills. Walmart comes into this quarter with an EPS estimate of $0.58, which is down a -3.3% YoY, the sole forecasted contraction in its future quarterly guidance.

Source: Walmart Earnings Release (FY25 Q4)

On its part, consensus revenue is estimated at $164.5 billion, an increase of 2.85% YoY, while top-line visibility is obscured by North America cost-of-living malaise and a defensive macro environment worldwide. These modest numbers are in stark contrast to previous quarters, in which Walmart consistently beat out on EPS by $0.07, $0.02, $0.05, and $0.01 in its previous four quarters, respectively, implying that the bar has been meaningfully lowered.

Yearly forward projections indicate recovery on the horizon: FY2026 EPS is predicted at $2.61 and FY2027 at $2.94, which implies 12.6% annual growth and a forward PE multiple compress from 37.3x to 33.2x. Top-line growth projections mirror a stable climb from $702.2B in FY2026 to $734.2B in FY2027. These numbers conceal a nascent but important question: can Walmart grow out of its base in a more margin-constrained retail environment? With levers of automation, private-label expansion, and eCommerce incorporation available, the next quarter will either confirm Walmart’s operating thesis, or prompt a re-rating of expectations.

Revisions, Reactions, and the EPS Pivot Point

A forensic analysis of forward earnings revisions reveals widespread pessimism. There have been 24 downward revisions in EPS for Q1 FY2026 over the last three months with no single upward revision. Revenue expectations have also been reduced by 13 analysts over the same timeframe. The pessimism in these quarterly revision trends is even more pronounced: Quarterly consensus EPS of $0.58 in Q1 is a -3.3% YoY fall, the sole negative print in FY2026 guidance. The subsequent quarters are more robust with YoY EPS growth anticipated returning in Q2 through 4.88%, in Q3 through 4.18%, and in Q4 through 8.43%.

However, valuation multiples are still high. Walmart has a forward P/E multiple of 37x times FY2026 EPS falling progressively to 33x FY2027 estimates. On a forward P/S basis, it has a 1.11 times multiple for FY2026 and 1.06 for FY2027. These are rich multiples for a low-single-digit revenue growth company. The risk is duration mismatch: forward pricing assumes persistent margin expansion and monetization levers, which can come undone if execution goes awry or macro headwinds are more severe.

The stock's capacity for holding onto its valuation will depend on validating three aspects in the forthcoming release: margin resilience in spite of inflation in operating expenses, visibility of ongoing eCommerce expansion with accretive economics, and incremental proof that platform revenues (advertising, logistics, data) are growing incrementally at high incremental margins. Get it wrong on any one of these vectors, and the market can start repricing the stock toward an expectation of normalized growth.

Source: Seeking Alpha

Inside the Engine Room: A Platform-Like Operating Model

Walmart's business model has moved far from traditional retail into a platform ecosystem context in which monetizable adjacency layers are part of its value stack.

Source: Marketplace Pulse - Walmart U.S. Retail Sales

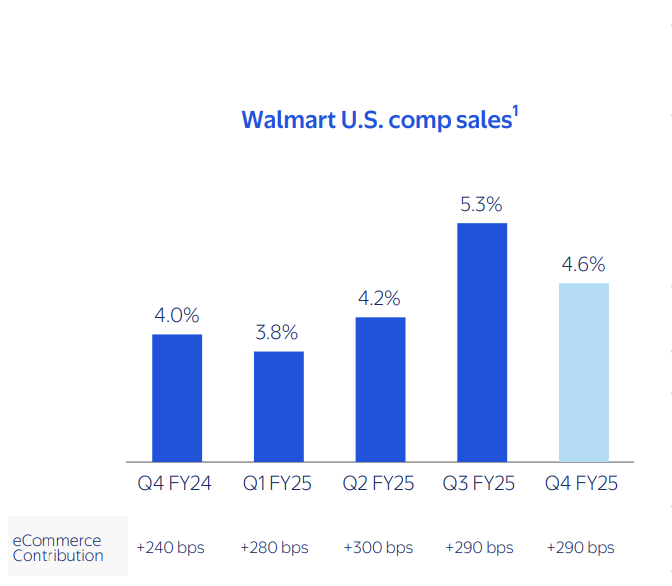

Though its core continues in mass merchandising, its value stack has expanded to include high-margin growth drivers in the form of in-advertising, third-party logistics, and monetizing its data. Walmart U.S. continues as the firm's cornerstone, delivering $462.4 billion of net sales in FY2025, 69% of total consolidated revenue, due mostly from grocery and health and wellbeing segments.

Source: Walmart FY25 Q4 Presentation

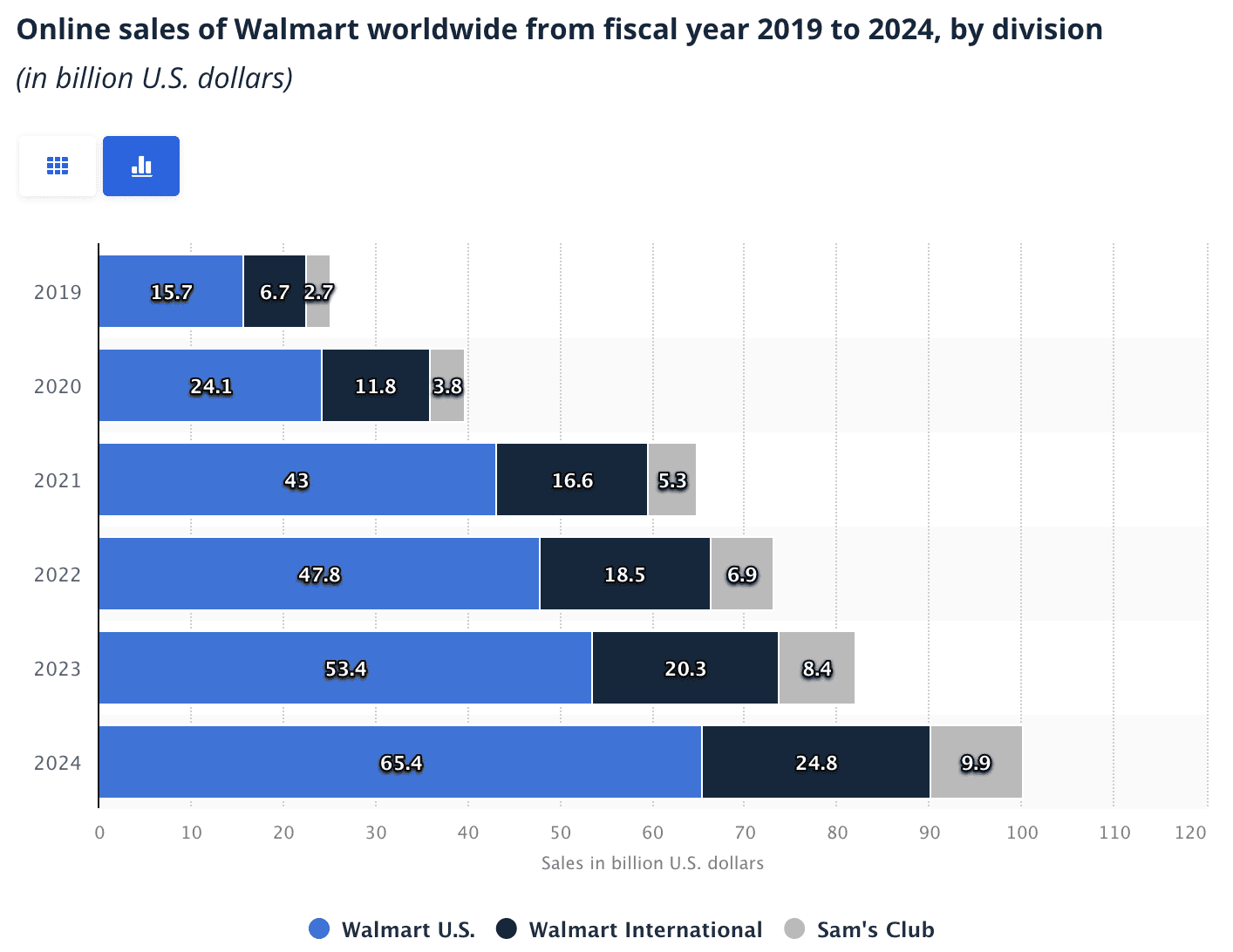

Of particular interest is that eCommerce provided $79.3 billion in Walmart U.S. sales while store-fulfilled pickup and delivery represent nearly 3% of comparable sales growth.

Source: Statista

The company's omni-channel presence is strengthened by 4,605 stores and 29 eCommerce dedicated fulfillment centers. Walmart+ has turned into a moat for Walmart, increasing engagement through unlimited shipping, fuel offers, and Scan & Go features. Walmart acquired Vizio in December 2024 for $1.9 billion in a sign of a more ambitious march into connected devices and advertising. Internationally, Walmart continues rationalizing its presence, shutting down non-core geographies and making heavy investments in PhonePe, its India-based digital payments subsidiary.

Complementing its capabilities in the platform is Walmart’s growing vertical integration. From source through last-mile delivery, the company’s supply chain is being increasingly automated, with 164 U.S. distribution centers serving retail and online stores. The logic is straightforward: minimize frictions, enhance working capital productivity, and shield margins from exogenous shocks. And yet, complexity adds an overlay of operating risk, especially as Walmart navigates international regulatory risk and cross-border execution in countries such as Mexico, Canada, and India.

The Competitive Gauntlet: Margin Compression or Enduring Differentiation?

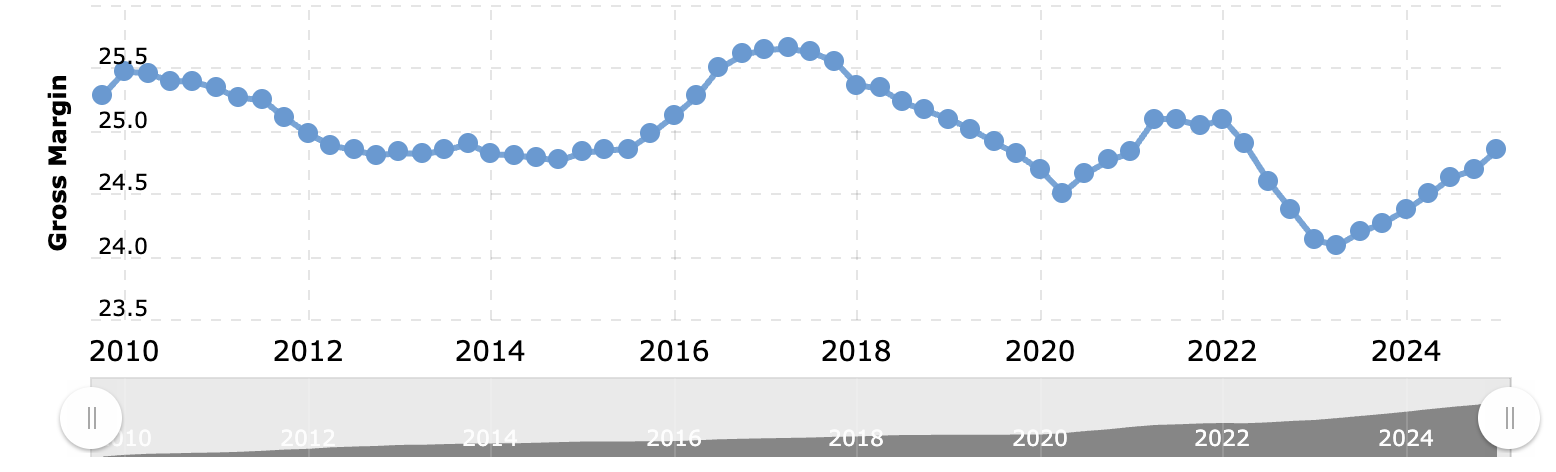

Walmart is not only in competition with Amazon, Target, and Costco but also has an entire network of category-specific disruptors, the fintech newcomers, the health platforms, and even ad-listing networks, to contend against. Offering its customers every-day low prices (EDLP) depends on its every-day low cost (EDLC) approach, but today's inflation-deflation whiplash in the industry is challenging both principles. Walmart increased its YoY gross margin by 40 basis points in FY2025, thanks mostly to a mix shift into higher-margin businesses and stringent pricing.

Source: MacroTrends - Walmart Gross Margin

Elevated marketing expense and variable compensation increases, as well as depreciation due to continued infrastructure investment, diluted some of these gains partially.

Rivals are also tightening their own value chains. Amazon is applying generative AI and AWS integrations to shorten fulfillment timelines and grow Prime capabilities. Costco continues to capture high-margin share through membership renewals and decreasing SG&A leverage, while Target is redesign private brand offerings in an effort to regain market share. Walmart's solution is monetization: its self-run ad platform, fulfillment-as-a-service, and data insights tools now generate multiple revenue streams in addition to traditional retail.

Even so, its expansive physical presence is Walmart's best defense in competition. More than 90% of Americans are within 10 miles of a Walmart, providing it with unparalleled logistical clout. At the same time, however, it has to balance carefully between fueling eCommerce expansion, at a higher cost of fulfillment in some cases, and in-store profitability. The FY2026 Q1 report would act as a benchmark for whether or not the balance is being achieved.

Risks To Monitor: Inventory, Execution, and Strategic Dilution

Even with robust omnichannel capacity and top-line revenues, Walmart is not entirely immune from structural risks. To begin with, managing inventory continues to be an ongoing headache during a disinflationary environment. With an increase in unit volumes while having stable average ticket sizes, margin pressure from product mix becomes a risk. Second, risk from execution hangs over its head: Walmart expansion into high-margin adjacencies hinges on co-ordination among tech, logistics, and digital marketing, the misstep in any one segment would jeopardize the entire monetisation stack.

Third is dilution driven by strategy. The Vizio buy and international portfolio repositioning imply a more aggressive capital deployment approach. These transactions pay off in the long run but create short-term noise if revenue contributions are lumpy. Finally, regulatory and FX exposure in China, India, and Latin America add one more source of volatility that can compress international segment operating earnings unless carefully managed.

Conclusion

Walmart begins Q1 FY2026 with restrained hopes but richly priced. With earnings per share set to eke out a small contraction and revenue expansion slowing, investors are anticipating proof of depth in monetization rather than breadth.