What Is a Negative Interest Rate? How Do Europe and Japan Differ in Motivation Behind NIRP?

TradingKey - As Japan’s wage-inflation outlook improves, the Bank of Japan (BOJ) officially ended its era of negative interest rates in 2024. However, under persistent deflationary pressures and a strong Swiss franc, the Swiss National Bank (SNB) cut its policy rate to zero in June 2025, signaling that Europe may be on the verge of returning to negative interest rates.

What Is a Negative Interest Rate?

A negative interest rate policy (NIRP) is an unconventional monetary tool where central banks set policy rates below zero percent. In normal circumstances, positive interest rates are standard — for example:

- A depositor places $100 in a bank at a 1.5% annual interest rate and receives $1.5 after one year.

- A commercial bank lends $100 to a borrower at a 3% interest rate, who then repays $103 after one year.

However, due to various macroeconomic conditions, NIRP has gained traction in European countries and Japan, where even banks must pay to deposit money with the central bank, and in rare cases, borrowers repay less than they borrowed, or individuals face fees for holding savings.

How Did Negative Rates Emerge?

Negative interest rate policies first appeared during the European debt crisis, when the Danish central bank lowered its short-term deposit rate below zero. The ECB adopted it in 2014, followed by the BOJ in 2016, making it a global phenomenon.

Types of Negative Interest Rates:

- Central Bank Policy Rates Below Zero

Central banks impose negative rates on excess reserves held by commercial banks to encourage lending rather than hoarding liquidity. This goes against traditional economic logic — banks are charged for keeping funds at the central bank.

Example: - ECB cut its deposit facility rate to -0.1% in 2014

- BOJ set its excess reserve rate to -0.1% in 2016

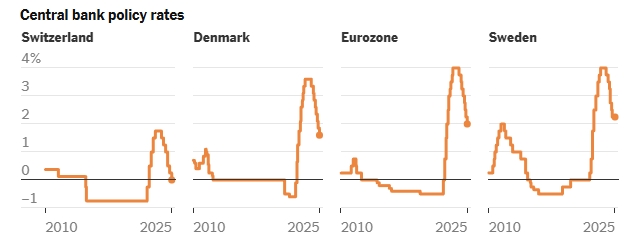

Major European Central Banks' NIRP Policies, Source: The New York Times

- Nominal Negative Interest Rates

Rarely applied to retail customers due to the risks of bank runs. Some large institutional deposits or high-net-worth accounts face negative returns or additional fees.

Example: - Swiss banks charged a 0.6% annual fee on deposits over €500,000.

- Danish banks offered the world's first negative-rate mortgage loan in 2019, though total repayment still exceeded principal due to service fees.

- Real Negative Interest Rates

Occurs when inflation exceeds nominal interest rates, e.g., 1% inflation > 0.5% nominal rate. This is common globally, including in China and the U.S.

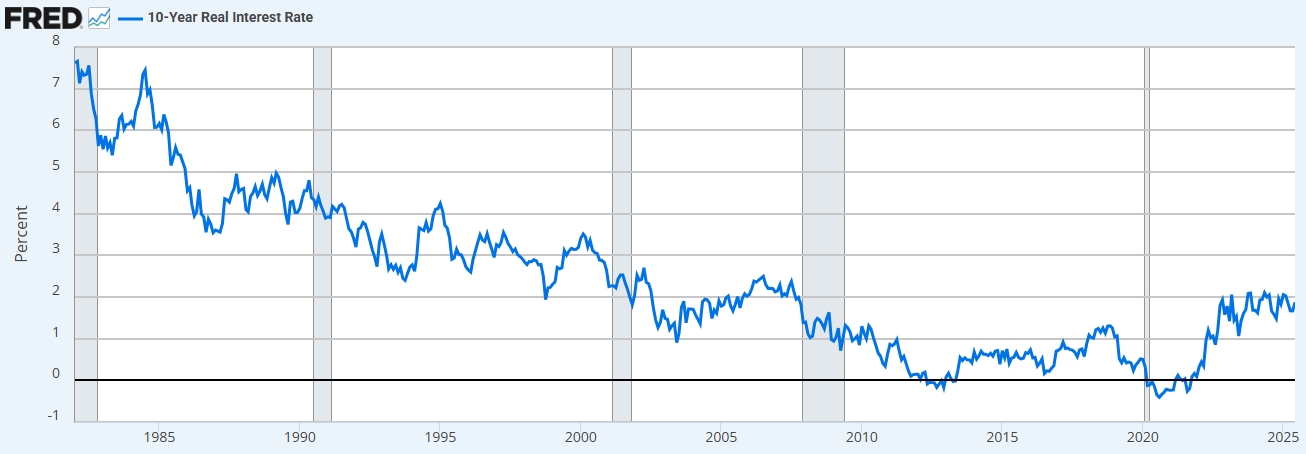

U.S. 10-Year Real Interest Rate, Source: St. Louis Fed

- Negative-Yield Bonds

When bond prices rise, yields fall — sometimes into negative territory. Central bank asset-buying programs have led to large volumes of bonds yielding negatively, particularly in Germany, Japan, and France.

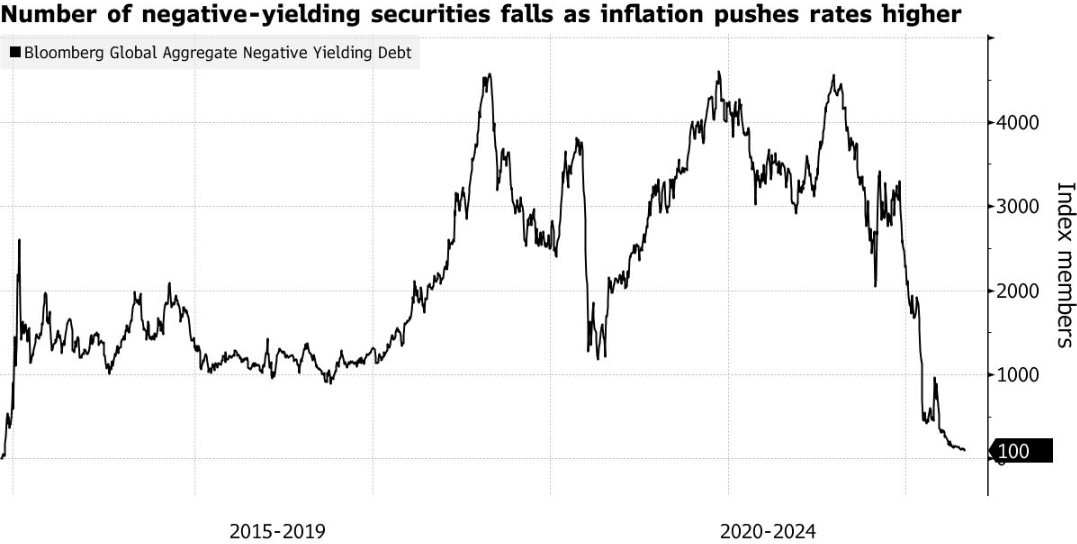

According to Bloomberg, in the 2010s, the number of global negative-yielding bonds surged past 4,500, peaking before the ECB began normalization in mid-2022. In Q3 2021, these bonds accounted for over one-fifth of global government and corporate debt, totaling around $15 trillion, with Japan, Germany, and France representing more than half of the market.

Global Number of Negative-Yield Bonds, Source: Bloomberg

Why Are There Buyers for Negative-Yield Bonds?

Negative-yield bonds mean investors will receive less than their initial investment if held to maturity — essentially paying governments to hold their money. Despite this apparent loss, institutions, central banks, and large funds continue to buy them, driven by:

- Safe-haven demand

- Anticipated capital gains from further rate cuts

- Regulatory or portfolio mandates

In response to the aftermath of the 2008 financial crisis, both the ECB and BOJ launched massive asset purchase programs, pushing up bond prices and lowering yields across sovereign and corporate fixed-income markets.

Bonds remain crucial for institutional investors such as central banks and pension funds, which value stable cash flows even amid negative returns. If investors expect further easing, purchasing bonds early could still offer capital gains.

After the 2020 pandemic, central banks resumed asset purchases, again boosting the scale of negative-yielding bonds.

Differences Between European and Japanese NIRP

While both Europe and Japan implemented negative interest rate policies, their motivations differ:

1. Economic Stimulus Tool (Offensive Use)

The BOJ, ECB, and Sweden’s Riksbank used NIRP to stimulate weak economies, combat deflation, and boost inflation expectations toward the 2% target.

- Japan has battled prolonged deflation since the 1990s

- Eurozone economies faced severe downturns after the 2008 subprime crisis and subsequent Eurozone debt crisis

These central banks aimed to:

- Encourage lending and spending

- Depress currency values

- Weaken long-term bond yields

2. Currency Management Tool (Defensive Use)

For Denmark and Switzerland, negative rates were primarily a means to prevent excessive inflows of foreign capital and curb unwanted currency appreciation.

- Both are small open economies; the Swiss franc and Danish krone have been safe-haven currencies during the Eurozone crisis, attracting capital inflows that pushed exchange rates higher, harming export competitiveness.

The ECB’s 2014 NIRP was also paired with Targeted Longer-Term Refinancing Operations (TLTROs) to prevent fragmentation within the eurozone banking system — especially as core countries like Germany accumulated liquidity, while peripheral nations faced outflows.

Impacts of Negative Interest Rate Policy

There remains no consensus on the effectiveness of NIRP.

Short-Term Benefits

- Boosted credit availability

- Stabilized exchange rates

- Helped the ECB contain the Greek debt crisis

- Allowed Denmark to maintain its peg to the euro

Long-Term Drawbacks

- Japan’s deflation persisted despite years of stimulus

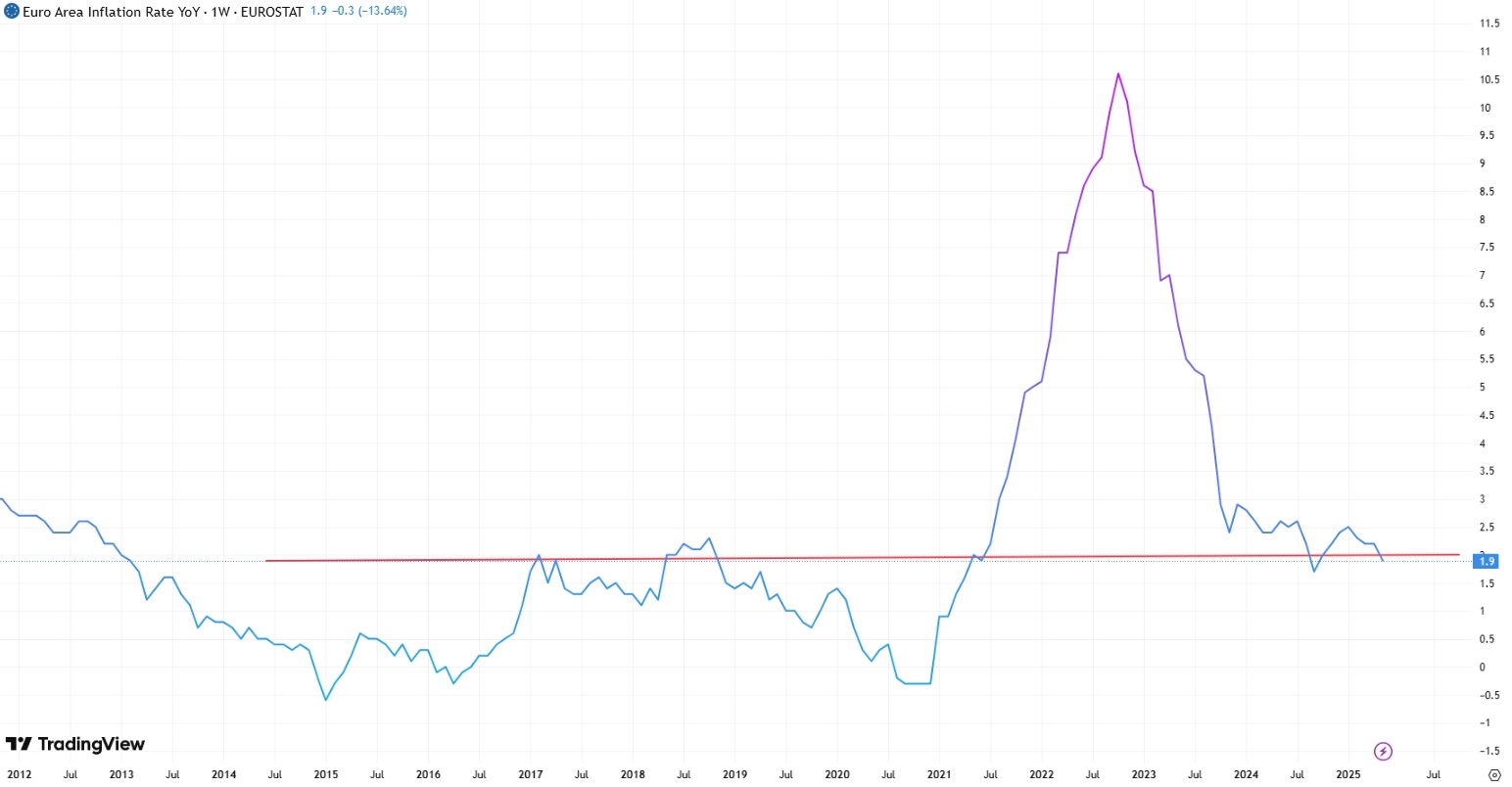

- Eurozone growth remained uneven — it took four years to stabilize CPI above 2%, post-ECB intervention

Eurozone CPI YoY Chart, Source: TradingView

Additionally:

- NIRP can lead to a liquidity trap, where ultra-low rates fail to spur investment (e.g., Japan)

- Commercial banks suffer from compressed net interest margins and difficulty passing costs to retail savers

- Large-scale negative-yielding bonds distort risk pricing and impair market functionality

Is Europe Returning to Negative Rates?

Under pressure from Trump 2.0 tariff threats, capital has flowed into the Swiss franc, a traditional safe-haven currency. The franc appreciated nearly 10% against the U.S. dollar in the first half of 2025, contributing to downward pressure on domestic inflation — given that imported goods account for about 23% of Switzerland’s CPI basket, the May 2025 CPI turned negative at -0.1%.

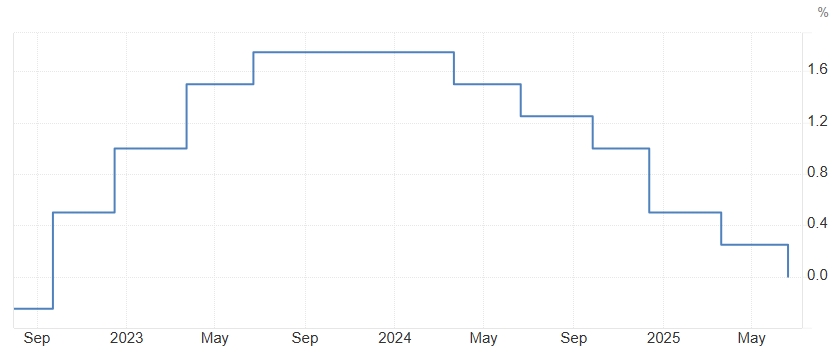

Faced with both deflation and currency strength, the Swiss National Bank cut rates by 25bps to 0% in June, ending two-and-a-half years of positive rates. It hinted at further cuts, potentially leading Europe back into negative territory later this year.

Swiss Policy Rate, Source: Trading Economics

Economists widely expect the SNB to cut rates again at its September meeting, signaling that the era of negative interest rates may soon return to Europe.