Why You Should Watch the Bank of Japan’s Rate Hikes? Has the Yen Lost Its Safe-Haven Status?

TradingKey - In global capital markets, the Bank of Japan's policy moves and yen exchange rate trends are often key indicators for investment decisions. In many cases, BOJ actions can influence global stock, bond, and currency markets, such as when a BOJ rate hike triggers international capital flows or U.S. stock sell-offs.

Japan’s role as the world’s largest net creditor nation supports the yen’s safe-haven status. Its long-standing low-interest-rate policy has also fueled carry trades, significantly enhancing the yen’s international standing.

Because of potential capital repatriation effects, BOJ policy shifts are not just regional events — they act as “leverage points” in the global financial system.

The Significance of BOJ’s Monetary Policy

The Bank of Japan’s monetary policy impacts not only Japan’s domestic economy but also global financial markets, exchange rates, capital flows, and bond markets, primarily due to large-scale yen carry trades and Japanese investors’ global asset allocation.

1. Yen Carry Trades – A Global Liquidity Engine

Because of Japan’s long-term ultra-low interest rate policy, international investors have borrowed cheap yen and converted them into dollars, euros, or emerging market currencies to invest in higher-yielding assets such as U.S. stocks, Treasuries, or emerging market equities. This is the essence of yen-based carry trades.

The yen is one of the world’s cheapest funding currencies. A BOJ rate hike would reduce this global supply of cheap money, forcing investors to reconsider shrinking returns.

When yen carry trades unwind (selling high-yield assets and buying back yen), it often leads to massive foreign asset sell-offs.

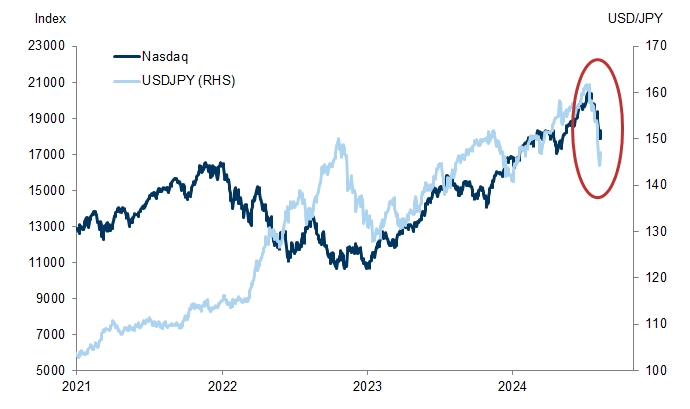

In August 2024 , the unwinding of yen carry trades caused significant turbulence in global capital markets. A Goldman Sachs report noted that the unusually tight correlation between the U.S. dollar/yen exchange rate and the Nasdaq Composite supported suspicions that yen appreciation triggered the unwind of yen-based carry trades. CFTC data showed that about 90% of these trades were closed out during that period .

Nasdaq vs USD/JPY, Source: Goldman Sachs, Bloomberg

Moreover, changes in BOJ monetary policy increase yen exchange rate volatility, creating risks for investors holding yen-denominated debt and weakening their willingness to take on leveraged positions.

2. Japanese Investors’ Global Asset Allocation – Capital Repatriation Risk

For decades, Japan has accumulated massive current account surpluses, making it the country with the largest net international investment position. As of March 2025 , Japan remained the top holder of U.S. Treasury bonds at $1.13 trillion, followed by the UK and China.

When the BOJ tightens liquidity and raises domestic interest rates, funds may flow back to Japan, intensifying offshore asset sell-offs. Both yen carry trades and Japan’s position as the largest holder of U.S. Treasuries contribute to global asset selling pressure through capital repatriation dynamics.

Invesco noted that rising Japanese bond yields have significant spillover effects globally. By June 2025, volatility in Japan’s multi-trillion-dollar bond market had reached its highest level in over two decades.

Bloomberg data shows that since Japan began loosening its Yield Curve Control (YCC) policy in 2022, the correlation between U.S. and Japanese government bond yield curves has steadily increased, highlighting how sensitive the U.S. Treasuries have become to yen bond volatility.

It is worth noting that the BOJ remains the largest buyer of Japanese government bonds, accounting for 52% of holdings. Although the BOJ adjusted its bond-buying reduction plan at its June 2025 meeting, it is expected to continue holding more than 50% of outstanding JGBs.

Why Is the Yen Considered a Safe-Haven Currency?

Historically, the yen has been a major global safe-haven currency, appreciating sharply during times of crisis — such as the 1997 Asian Financial Crisis, the 2011 European Debt Crisis, and the 2020 pandemic outbreak.

USD/JPY Exchange Rate, Source: TradingView

Research indicates that during 17 episodes of rapid VIX increases from 1990 to 2022, the yen appreciated against the U.S. dollar 14 times, underscoring its role as a crisis hedge.

Unlike the U.S. dollar, which benefits from American financial dominance, or the Swiss franc, which relies on Switzerland’s neutrality, the yen’s safe-haven status stems largely from yen-based carry trades and Japanese overseas investments.

There are two main reasons:

- During global risk events like financial crises or geopolitical conflicts, international investors rush to close out carry trades, buy yen, and repay yen-denominated loans — boosting yen demand and appreciation.

- Japanese companies and households, driven by risk aversion, tend to recall overseas risky assets and shift toward domestic safe assets, increasing yen conversion demand and supporting the yen’s value.

Importantly, Japan’s international investment positions are mainly held by the private sector, which makes capital adjustments more flexible. These investors predominantly hold highly liquid assets such as equities and bonds.

Additionally, Japan’s long-standing economic stability, low inflation, and accommodative monetary environment give it a stronger “safe-haven” appeal compared to other countries.

Its geographical location also insulates it from many global geopolitical tensions, allowing it to weather shocks better than other East Asian emerging markets.

These factors have made "buying yen during crises" a market instinct, reinforced by repeated historical patterns and forming a self-reinforcing consensus.

Reason | Explanation |

Low-interest environment – carry trade | Yen appreciation driven by carry trade unwinds |

Capital account openness – global investments | Increased yen conversion demand from capital inflows |

Economic stability | Stable macroeconomic fundamentals (low growth, low inflation, low interest rates) |

Market consensus | Historical performance reinforces safe-haven perception |

Source: TradingKey

Has the Yen’s Safe-Haven Status Weakened?

The yen’s safe-haven role is not immutable. After the military conflict between Israel and Iran in June 2025, the yen depreciated instead of strengthening — prompting Wall Street to question its traditional safe-haven function.

Merrill Lynch analysts pointed out that market reactions to recent geopolitical events seem to be redefining what "safe-haven" means — while oil rose and equities fell (as expected), the unusual weakness in the yen and Swiss franc, along with muted gains in the U.S. dollar and Treasury selloff, deviated from historical norms.

In fact, the yen also underperformed during the early stages of the Russia-Ukraine war in 2022, with only modest appreciation that lagged behind historical patterns.

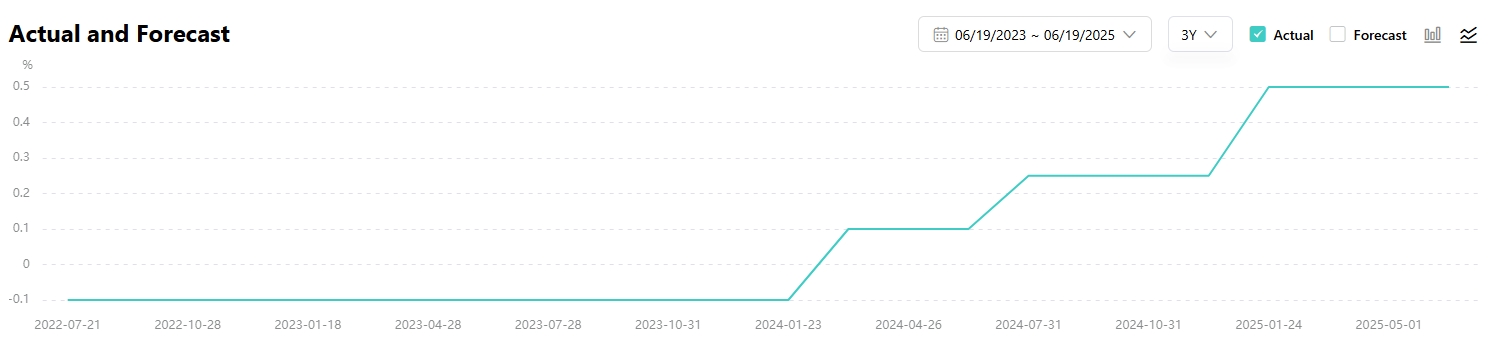

The yen’s weakened safe-haven function reflects Japan’s tightening monetary environment — low interest rates were the foundation of the yen’s strength during crises. Since March 2024, the BOJ has raised interest rates three times, and markets are closely watching for a potential fourth move.

BOJ Benchmark Interest Rate, Source: TradingKey

As the gap between U.S. and Japanese interest rates narrows, the yen loses its edge as a low-cost funding currency, reducing the profitability of traditional carry trades. Rising JGB yields are also encouraging Japanese investors to focus more on domestic opportunities.

At the same time, the prospect of U.S. rate cuts adds uncertainty to yen movements, making traders more cautious about initiating new carry trades.

With slowing global growth and escalating geopolitical tensions involving major oil-producing nations, Japan faces mounting external pressures that worsen its trade conditions — making it increasingly difficult for the country to remain unscathed during global risk events.

Despite growing doubts about the yen’s safe-haven role, Japan still maintains one of the few remaining low-yield environments globally. Given limited expectations for further BOJ hikes, this advantage continues to support the yen’s traditional safe-haven characteristics.

Future Outlook for BOJ Policy

Economists expect that uncertainty caused by Trump tariffs will likely delay the BOJ’s fourth rate hike until Q1 2026.

The BOJ’s May 2025 monetary policy outlook revised down Japan’s 2025 fiscal year GDP growth forecast from 1.1% to 0.5%, and 2026 growth from 1.0% to 0.7%, citing slower global growth and declining corporate profits due to trade policy uncertainties.

Stronger economic growth, wage increases, and sustained inflation are prerequisites for further BOJ rate hikes.

Former BOJ chief economist Seisaku Kameda believes the BOJ may want to wait until next year to see whether Japanese firms remain committed to raising wages before considering another rate hike — suggesting any further tightening could wait until January or March 2026.