Dogecoin Price Forecast: DOGE spot ETF hype sparks breakout hopes as supply in profit rises

- Dogecoin price is consolidating, hovering around the 50-day EMA, as optimism for spot ETF approvals surges.

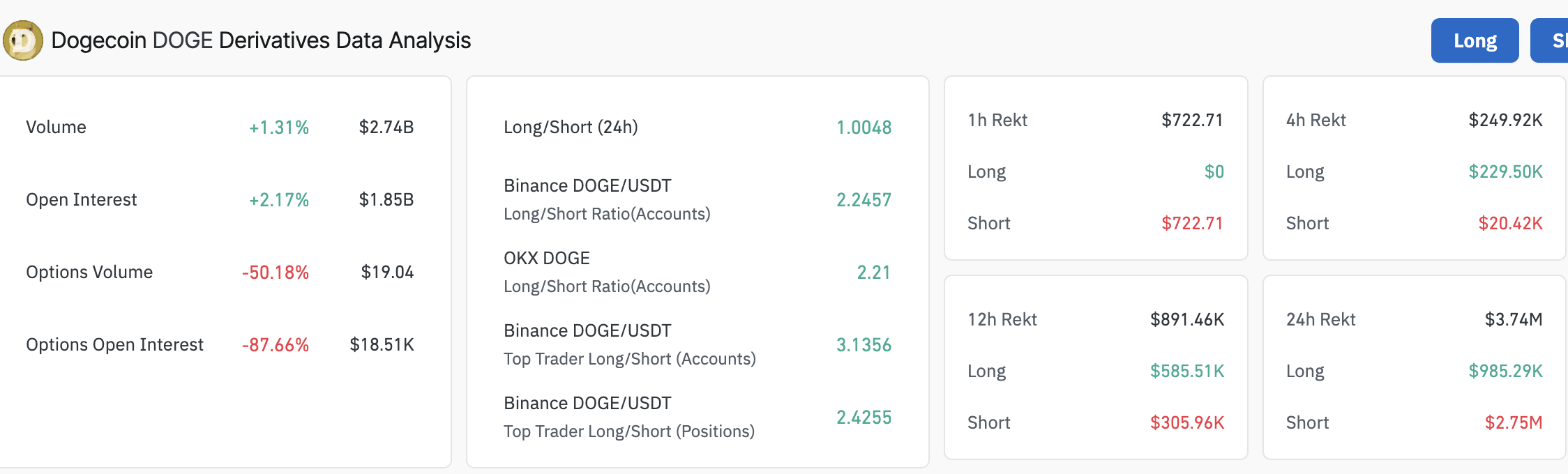

- Dogecoin on-chain metrics signal bullish potential as derivatives open interest rises 2.17% to $1.85 billion amid rising shorts liquidation.

- The 50-day EMA support at $0.179 could stop a potential reversal toward DOGE's April low at $0.13.

Dogecoin's (DOGE) price is trading broadly sideways at around $0.18 on Friday, as the broader crypto market recovers amid a boost in risk sentiment.. The largest meme coin by market capitalization could extend the previous month's bounce back from the April 7 low at $0.13, riding on the hype around the possibility that the Securities and Exchange Commission (SEC) approves DOGE spot Exchange Traded Funds (ETFs).

Dogecoin spot ETF hype surges

With crypto-friendly Paul Atkins taking over as the agency's chair, the change of leadership at the SEC has sparked hopes around Dogecoin. Leading fund managers, including 21Shares and Bitwise, have submitted applications to the SEC seeking approval to launch spot DOGE ETFs. This, and Nasdaq filing the 19b-4 form with the agency proposing to list and trade shares of the 21Shares Dogecoin ETF, marks a major milestone toward bringing crypto's top meme coin to mainstream financial markets.

Spot ETFs are financial products that allow investors to seek exposure to crypto assets without purchasing the actual coin on cryptocurrency exchanges or over-the-counter (OTC) platforms. Spot ETFs are regulated and can be purchased directly on stock exchanges.

Three DOGE ETF proposals from Grayscale, Bitwise, and 21Shares are under SEC review. Bloomberg's Eric Balchunas assigned them an 80% approval chance.

Santiment researchers said in their latest biweekly market update that "the partnership between 21Shares and the Dogecoin Foundation (via the House of Doge) to promote the ETF has added credibility to the project, sparking stronger engagement from both longtime DOGE supporters and traditional investors looking for new opportunities."

Crowd sentiment has also shifted, with Dogecoin viewed less as a meme or a joke coin but as an alternative option for a wider scope of investors, including institutions.

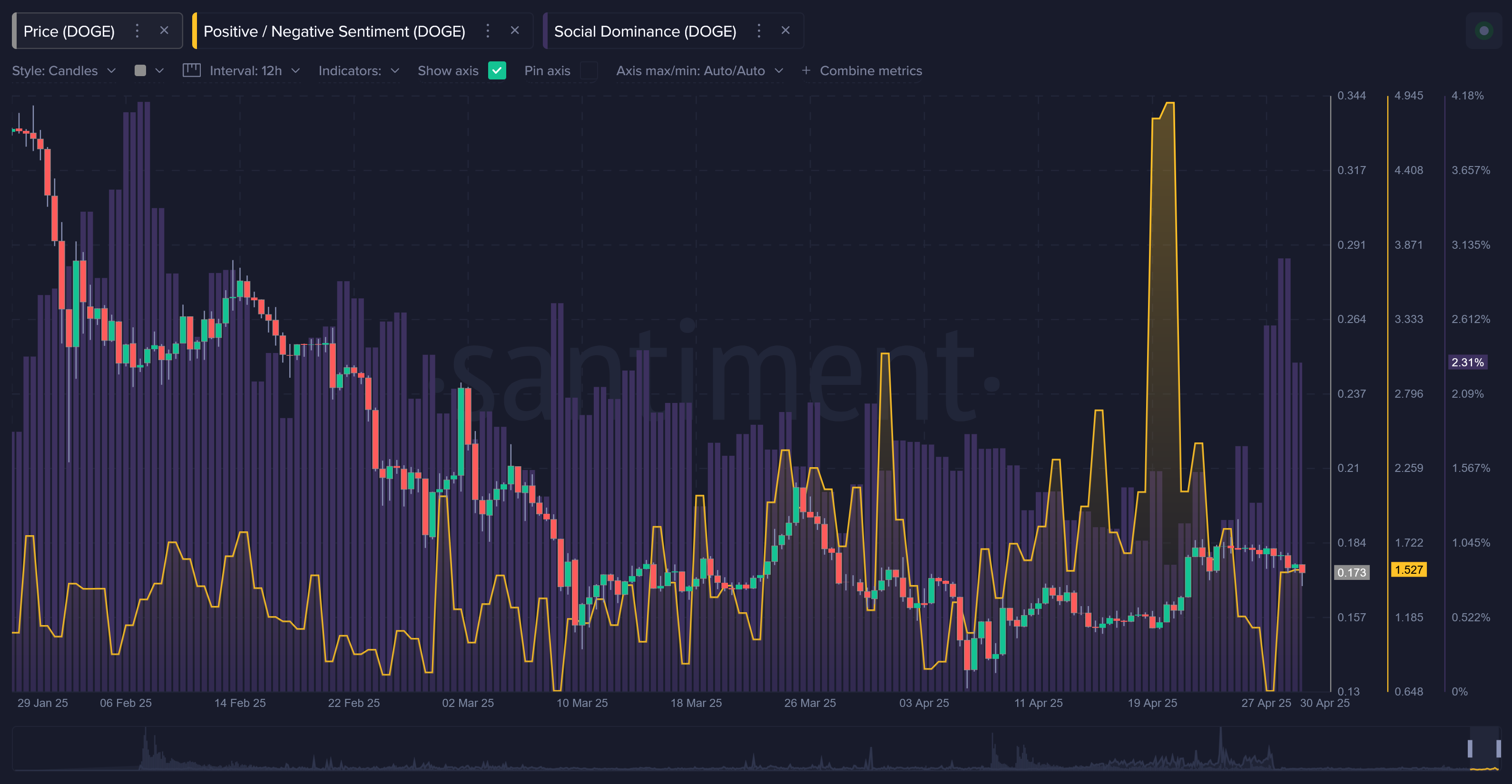

The social chatter around Dogecoin has improved significantly, per the chart below, shared by Santiment. Even though the SEC has extended DOGE ETFs review to June, the mood around the token signals growing optimism among traders.

Social dominance relative to other assets (purple) | Source: Santiment

Can Dogecoin resume bullish momentum as open interest rises?

A 2.17% increase in the derivatives' open interest (OI) points to growing anticipation in the market, as more traders open new positions. The long-to-short ratio is slightly above one, revealing that traders are leaning towards long rather than short positions.

In the last 24 hours, liquidations of short positions reached $2.75 million compared to approximately $722,000 of forcibly closed longs. The high amount of short liquidations suggests a short squeeze, where short sellers are forced to close positions at a loss. This trend could fuel upward price momentum.

Dogecoin derivatives' OI | Source: Coinglass

Meanwhile, the daily chart below shows Dogecoin's price hovering at $0.180, and slightly above the 50-day Exponential Moving Average (EMA) at $0.179. A daily close above this level could further encourage DOGE buyers, betting on the price rising to test the 100-day EMA resistance at $0.204 and the 200-day EMA at $0.218.

DOGE/USDT daily chart

The Relative Strength Index (RSI) indicator's position above the midline at 57.63 supports the bullish outlook. Continued upward movement of the RSI toward the overbought region could bolster the uptrend's strength.

However, losing the 50-day EMA support at $0.179 could cause instability, resulting in a pullback that would likely test support at $0.14 or even extend the down leg to DOGE's April 7 low at $0.13.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.