Ethena eyes 20% gains amid Arthur Hayes 2 million ENA grab, Anchorage Digital deal, new apps

- Ethena edges higher by over 20% on Friday as it bounces off a crucial support floor to extend the prevailing bullish run.

- Arthur Hayes acquires 2.16 million ENA tokens amid Ethena’s partnership with Anchorage Digital to achieve GENIUS Act compliance.

- Ethena plans to release new alpha dApps, including Ethereal, Strata, and Terminal, soon.

Ethena (ENA) edges higher by over 20% at press time on Friday, extending for a higher leg up as it bounces off a crucial support level. The recovery run could be backed by the recent 2.16 million ENA purchase by Arthur Hayes, former CEO of BitMEX, amid Ethena’s deal with Anchorage Digital to achieve compliance with the GENIUS Act.

Furthermore, Ethena plans to boost its ecosystem with the launch of new Decentralized Applications (dApps).

Arthur Hayes acquires ENA amid Ethena’s new deal

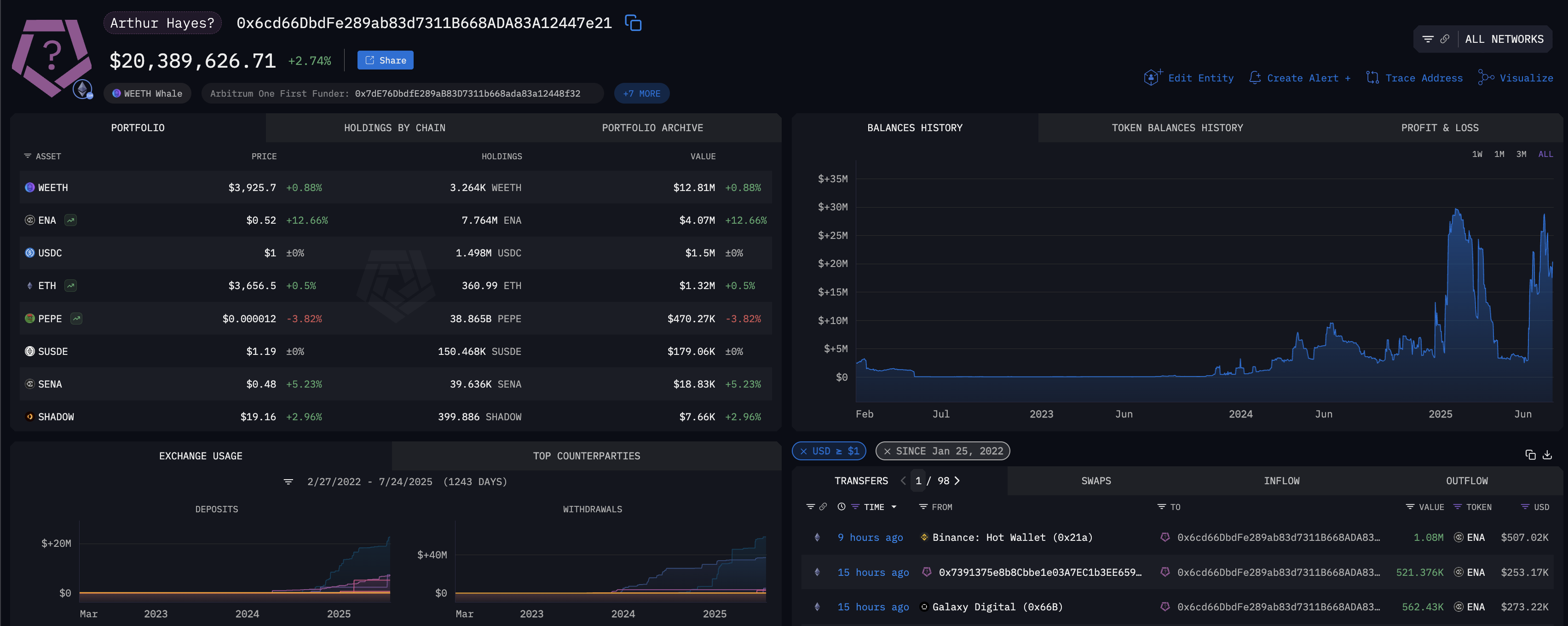

Arthur Hayes, the founder and former CEO of BitMEX, recently acquired 2.16 million ENA tokens worth over $1 million hours after the announcement of Ethena’s partnership with Anchor Digital, a federally chartered crypto bank, to boost USDtb as the first GENIUS Act-compliant stablecoin.

Arthur Hayes on-chain wallet. Source: Arkham Intelligence

The transition of Ethena’s offshore-issued stablecoin to the US by Anchorage would be a regulatory boost, achieving a US framework-compliant token for the US financial institutions.

Ethena set to launch new dApps to boost its ecosystem

According to the recent Alphaplease newsletter, Ethena’s ecosystem has three critical dApps in the pipeline: Ethereal, Strata, and Terminal. Ethereal, a Decentralized Exchange (DEX) with $740 million of Total Value Locked (TVL), aims to boost trading in the ecosystem.

Strata, a yield generation protocol, has recorded over $18 million in deposits before its launch, aiming to boost staking on the network. Additionally, the Terminal is another DEX focused on institutional asset trading, including yield-bearing stablecoins such as USDe.

Ethena eyes further gains to $0.65 as bullish momentum sparks

Ethena edges higher by over 20% so far on Friday as it held above the $0.46 support level with a long-tail candle on Thursday. The bullish run exceeds the $0.54 resistance last tested on Monday, amid a golden cross between the 50-day and 100-day Exponential Moving Averages (EMAs).

A clean push above this level could target the $0.65 level, marked by the January 28 close. Optimistically, a trend continuation could find the next resistance levels at $0.79, followed by the $1.00 psychological level.

The Relative Strength Index (RSI), currently at 77 on the daily chart, indicates increasing buying pressure as it bounces to the overbought boundary.

The Moving Average Convergence Divergence (MACD) and its signal line continue to sustain an uptrend, with rising green histogram bars indicating increased bullish momentum.

ENA/USDT daily price chart.

On the contrary, if Ethena fails to maintain a daily close above the $0.54 level, it could temper gains and retest the $0.46 support floor.