Pi Network Price Forecast: Bitget, MEXC offload and whale buys during short-term spike

- Pi Network edges higher, breaking out from its recent consolidation range.

- Bitget and MEXC exchanges offload PI to other exchanges amid the short-term recovery.

- A large-wallet investor acquires nearly 3 million PI tokens, marking the largest transaction in the last 24 hours.

Pi Network (PI) edges higher by over 4% at press time on Tuesday after breaking out of a consolidation range. A large wallet investor, popularly known as whales, has acquired nearly 3 million PI tokens, reflecting confidence in the breakout rally.

However, Pi network struggles to surpass the $0.50 psychological mark as Bitget and MEXC exchanges offload their holdings to other exchanges.

Whale adds 2.91 million PI tokens

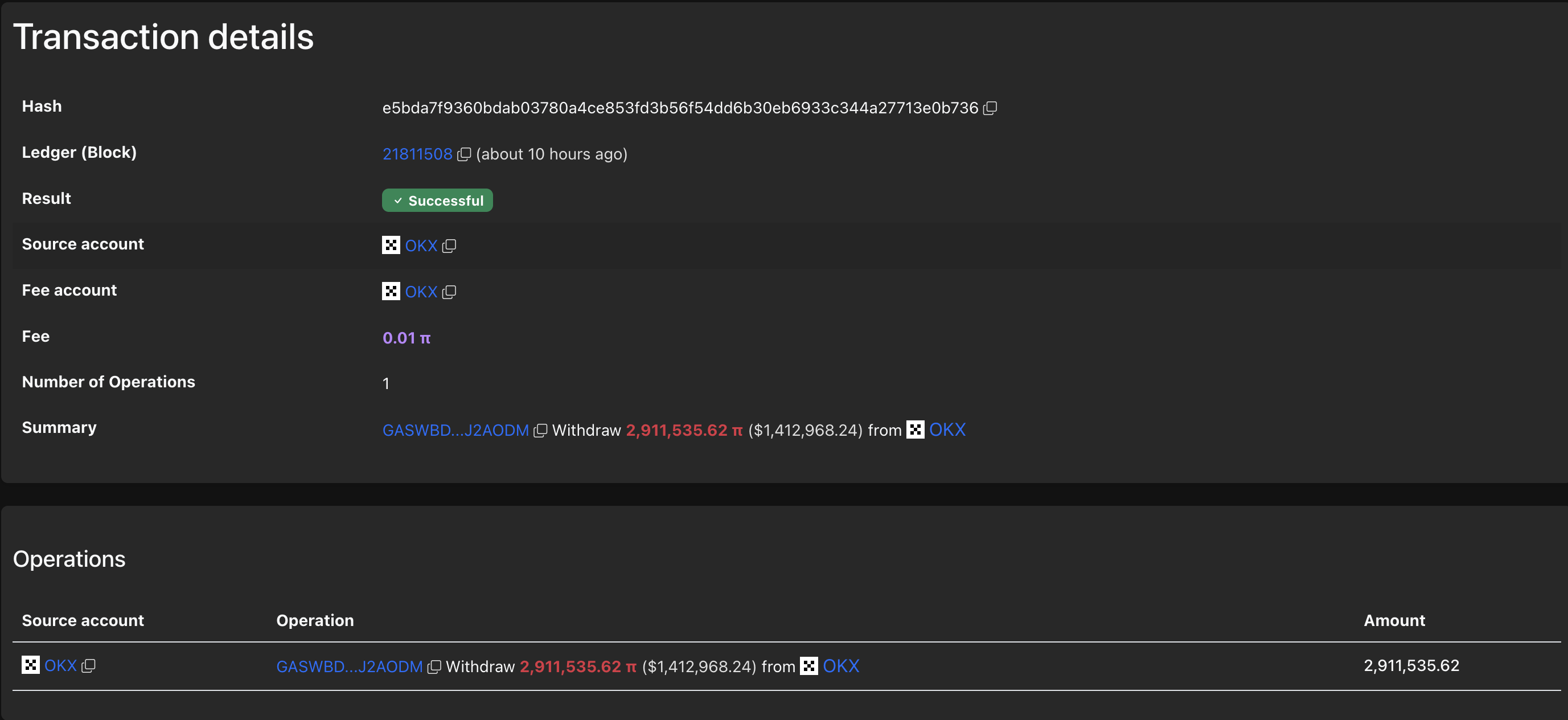

PiScan data shows that the largest transaction over the last 24 hours is the withdrawal of 2.91 million PI tokens, worth $1.41 million, to the “GASWBD…J2AODM” wallet from the OKX exchange. Typically, such high-volume withdrawals reflect the confidence of whales.

Whale transaction details. Source: PiScan

Bitget and MEXC offload PI holdings

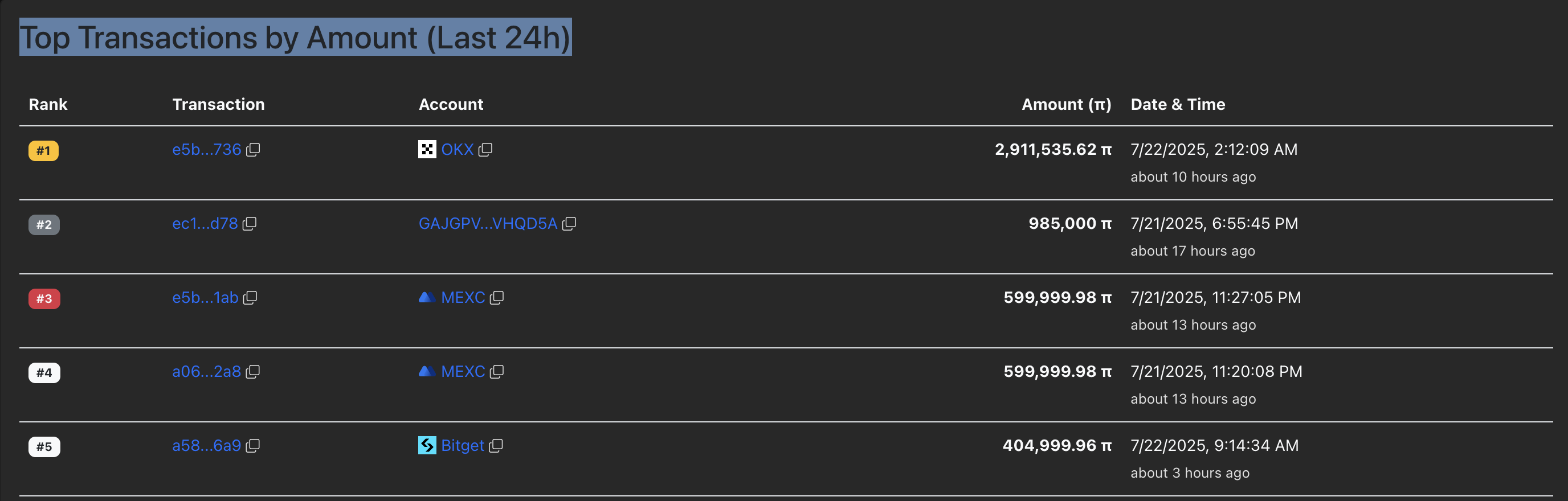

PiScan data of the largest transactions in the last 24 hours shows two high-value transactions of 599,999 PI tokens from MEXC exchange to Gate.io and OKX exchange. Similarly, Bitget deposited 404,999 PI tokens on Gate.io. The outflows from MEXC and Bitget suggest a potential sell-off or a strategic redistribution of PI tokens.

Top Transactions on Pi Network. Source: PiScan

Pi Network targets $0.50 breakout

Pi Network breaks out of a consolidation range to test the 200-period Exponential Moving Average (EMA) on the 4-hour chart at $0.4994. PI marks a 24-hour high of $0.5215 but fails to close a candle above the 200-period EMA, resulting in a minor pullback.

If PI succeeds in surpassing the 200-period EMA, it could stretch the uptrend to the $0.5223 level marked by the June 18 low.

The 50-period EMA inches closer to surpassing the 100-period EMA, generally known as a bullish crossover. Sidelined investors could consider this a buy signal as a short-term rally outpaces the medium-term trend.

The Moving Average Convergence/Divergence (MACD) and its signal line cross above the zero line. A resurgence of green histogram bars from the same line suggests increased bullish momentum.

The Relative Strength Index (RSI) stands at 68 on the 4-hour chart, remaining above the halfway line, indicating an increase in bullish momentum in short-term trading activity.

PI/USDT daily price chart.

On the downside, if PI fails to hold grounds above the 100-period EMA at 0.4656, it could extend the declining trend to the 50-period EMA at $0.4551.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.