XRP price targets new record high as digital asset fund inflows hit $4.4 billion

- XRP sits on a 25% weekly gain, underpinned by steady institutional and retail demand.

- XRP investment products saw a surge in capital inflow to $36 million last week as total net crypto fund inflows reached a record $4.4 billion.

- A spike in whale-to-exchange transactions risks XRP's uptrend if investors reduce exposure for profit.

Ripple (XRP) is gaining momentum and closing in on its all-time high of $3.66 on Monday. The international money remittance token has seen an over 4% price increase on the day as XRP trades near $3.60. Meanwhile, the bullish outlook is supported by institutional demand, which is driving the expansion of spot and derivatives markets.

Demand propels XRP price toward all-time high

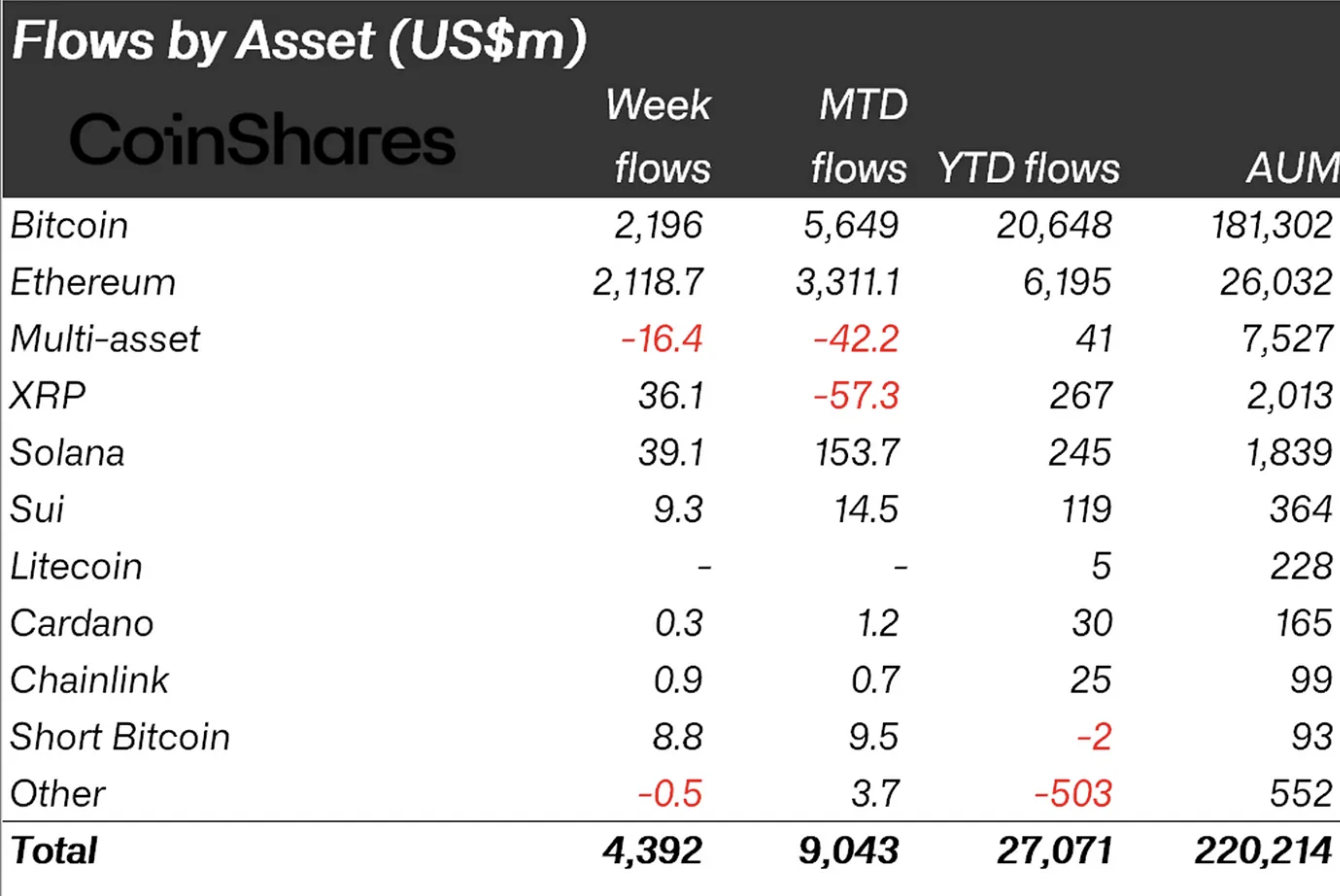

Digital investment products saw a significant increase in demand with inflows reaching $4.39 billion last week, according to a weekly CoinShares report released on Monday.

XRP-related financial products recorded a remarkable increase in the capital inflow, reaching $36 million, from posting outflows of $104 million the previous week. Their total year-to-date inflow currently stands at $267 million net with assets under management (AUM) averaging slightly above $2 billion.

Ethereum (ETH) was the best-performing cryptocurrency last week with inflows of $2.1 billion, slightly below Bitcoin's (BTC) $2.2 billion.

"Digital asset investment products recorded their largest weekly inflows on record, totalling $4.39 billion, surpassing the previous peak of $4.27 billion set post-US election in December 2024," the CoinShares report states.

Digital fund flows data | Source: CoinShares

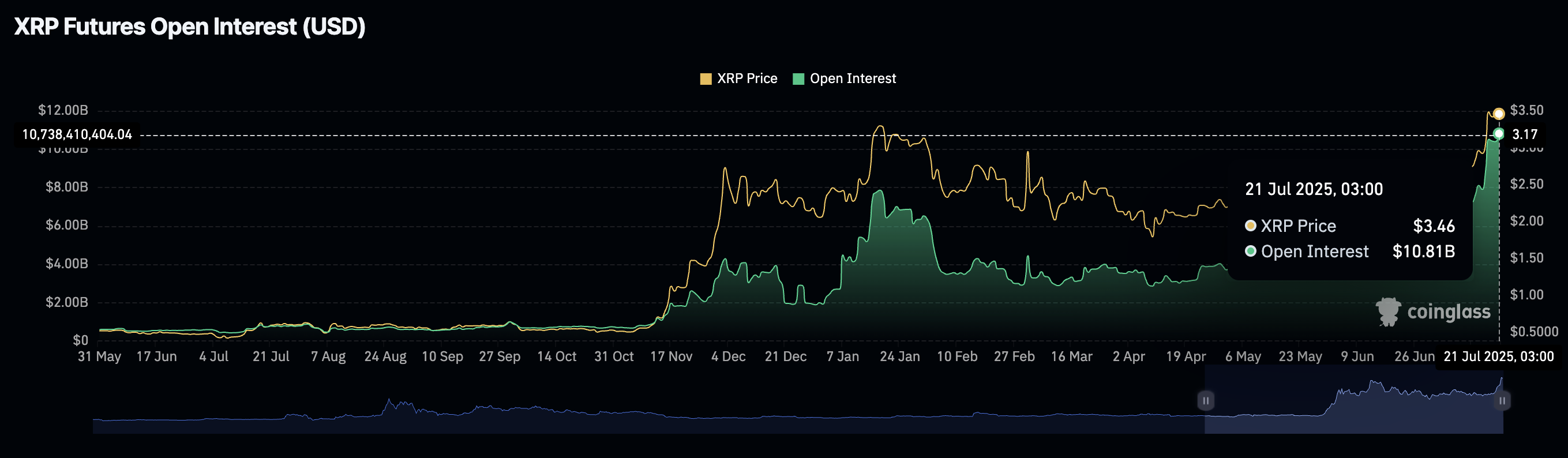

The surge in the XRP futures market's Open Interest (OI) underscores the soaring interest among traders. CoinGlass data shows that Open Interest, which represents the value of all futures and options contracts that have not been settled or closed, has expanded to $10.81 billion from a low of $3.54 billion in June. If traders continue to bet on XRP's price increasing to new record highs, OI could remain elevated in the upcoming weeks.

XRP Futures Open Interest data | Source: CoinGlass

Technical outlook: XRP bulls take control

XRP price is inching closer to establishing new record highs above $3.66, supported by a strong technical structure and positive market sentiment. The Moving Average Convergence Divergence (MACD) indicator reinforces the bullish outlook, flaunting a buy signal triggered on June 28.

In addition to XRP trading significantly above key moving averages, a recently confirmed Gold Cross pattern, formed when the 50-day Exponential Moving Average (EMA) crossed above the 100-day EMA, predisposes the token for the price discovery phase.

XRP/USDT daily chart

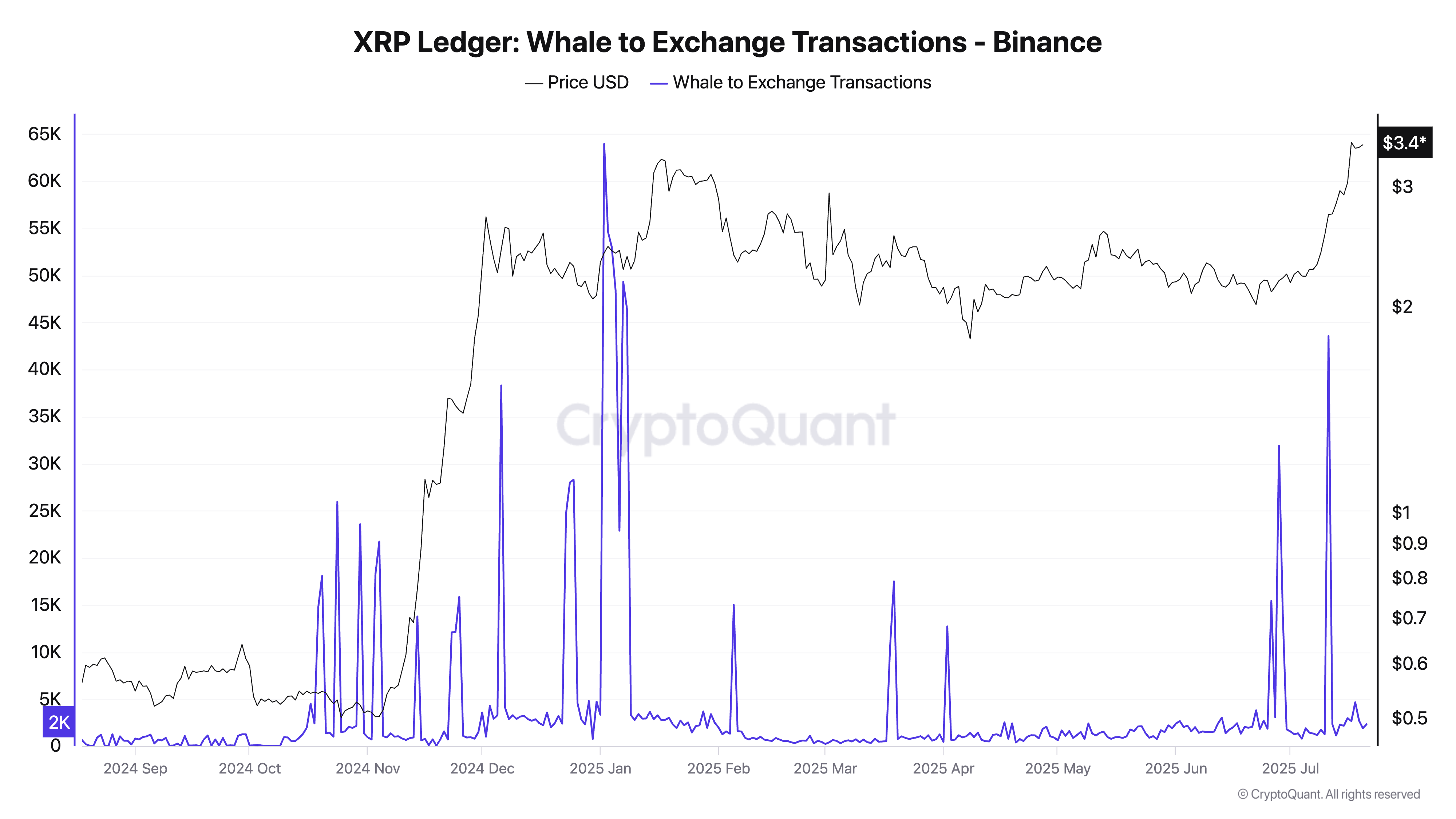

On the other hand, traders should be aware of the sudden increase in whale-to-exchange transactions, which exceeded 43,000 on July 11, according to data from CryptoQuant. There was another smaller increase in similar transactions, reaching 4,672 on Friday, followed by a subsequent decline to 2,339.

XRP whale-to-exchange transactions (Binance) | Source: CryptoQuant

Sharp increases in this metric can have a negative impact on the price of XRP, particularly if whales sell for profit as the token trades near its all-time high.

A reversal from the current price level could result from profit-taking activities, sudden changes in market dynamics and sentiment, particularly with the implementation of United States (US) President Donald Trump's higher tariffs on August 1.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.