Bitcoin Sees Influx Of New Capital: First-Time Buyers Add 140,000 BTC

On-chain data shows the supply held by new Bitcoin buyers has seen a jump recently, a sign that the latest price rally is backed by fresh capital.

First-Time Bitcoin Buyers Have Increased Supply By 2.86%

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Bitcoin ‘First Buyers.’ This cohort is part of Glassnode’s broader investor classification system that is based on behavior. The First Buyers include, as the name already hints, the holders who are buying the cryptocurrency for the first time. The supply associated with the group, therefore, can be considered as a proxy of the fresh capital entering into the sector.

Other groups part of the behavioral classification include Momentum Buyers, the investors who ride the tide of price trends, and Conviction Buyers, who step in to buy during price declines.

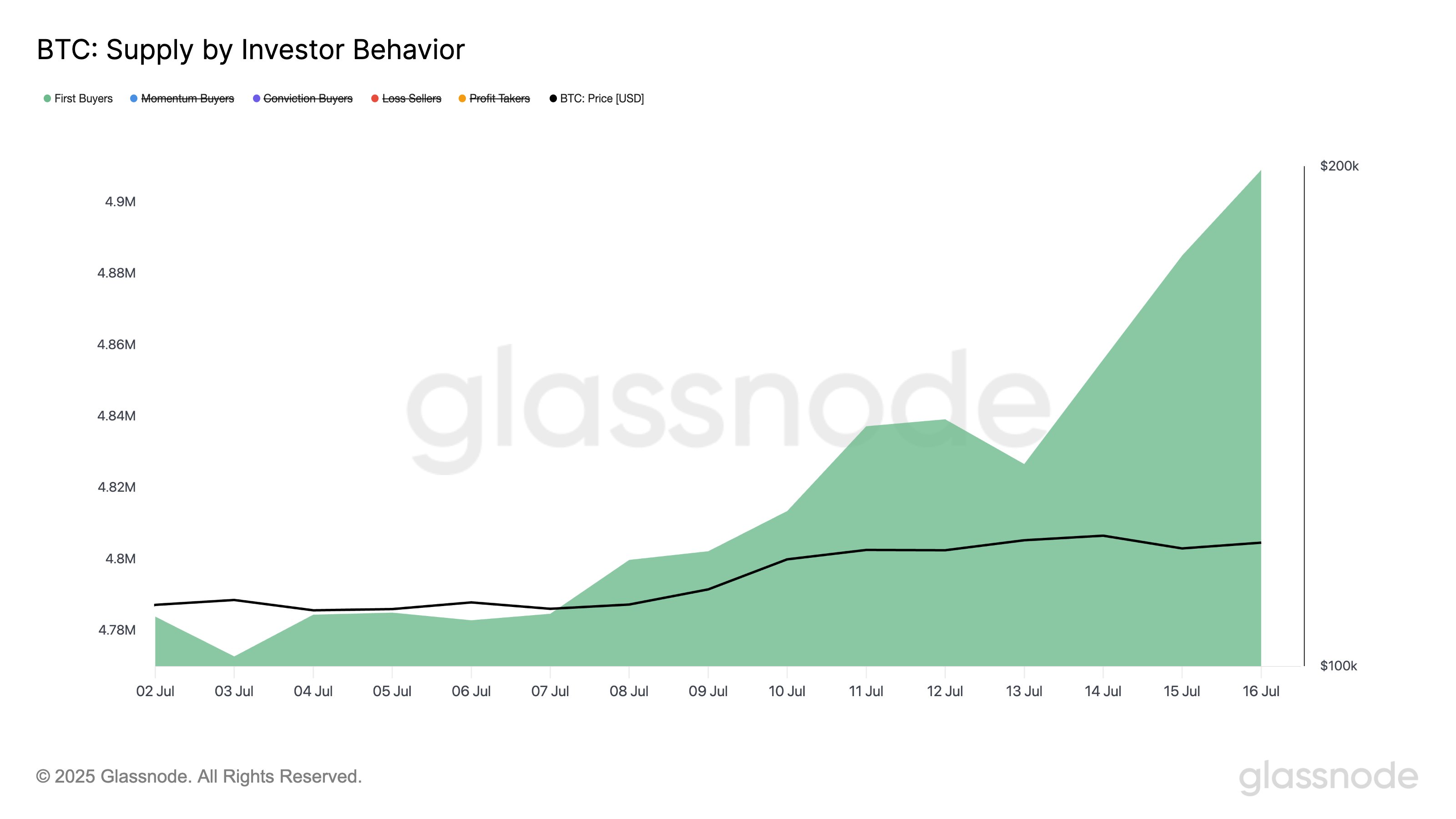

Below is the chart shared by the analytics firm that shows the trend in the Bitcoin supply held by the First Buyers over the last couple of weeks.

As displayed in the graph, the Bitcoin First Buyers have seen their supply go up during the last two weeks, implying that fresh capital has potentially been entering the market. More specifically, the cohort’s holdings have gone from 4.77 million BTC to 4.91 million BTC in this period, corresponding to an increase of around 140,000 tokens or 2.86%. This is notable and suggests the price surge to the new all-time high (ATH) has attracted real demand.

In some other news, the Bitcoin Puell Multiple has been relatively muted even after the price rally, as an analyst has pointed out in a CryptoQuant Quicktake post.

The Puell Multiple is an indicator that keeps track of the ratio between the daily value of coins being ‘issued’ by miners on the blockchain (in USD) and the 365-day moving average (MA) of the same.

In short, the indicator informs us about whether the Bitcoin miners are currently making more revenue from block subsidy compared to the norm or not. Historically, the indicator shooting up to an extreme value has generally aligned with some sort of top for the cryptocurrency.

As is visible in the chart, the BTC Puell Multiple is currently sitting around 1.2, which means that miners are making more than the average for the past year, but not by too much. If the past trend is anything to go by, this may be a potential sign that the current cycle still has room for growth.

Something to note, however, is the fact that the indicator’s peaks have been trending lower with each cycle. Thus, it’s possible that the metric would also top out at a lower level of miner revenue this time around.

BTC Price

Bitcoin hasn’t been able to sustain recovery since its low as its price is still trading around $117,000.