Crypto Today: Bitcoin strikes fresh record highs, as Ethereum, XRP edge higher

- Bitcoin price rallies to new record highs above $123,000 on Monday and is approaching the next key level at $125,000.

- Ethereum settles above $3,000, bolstered by steady interest from both institutional and retail investors.

- XRP surges 55% from June lows, encouraging risk-on sentiment near the critical $3.00 level.

The cryptocurrency market showcases immense bullish potential, with Bitcoin (BTC) extending the price discovery phase to new record highs above $123,000 on Monday. The surge in BTC price can be attributed to growing institutional and retail interest, evidenced by steady spot Exchange Traded Funds (ETFs) inflows and the increase in the futures contracts' Open Interest (OI) to $85 billion.

Altcoins are also edging higher, led by Ethereum's (ETH) break above the $3,000 level and Ripple's (XRP) uptrend, which holds a whisker away from the critical $3.00 hurdle.

Market overview: Bitcoin becomes world's fifth-largest asset

Bitcoin's uptrend to new record highs has propelled it onto the global leaderboard, becoming the world's fifth-largest asset after toppling Amazon (AMZN), Silver (XAG) and Google (GOOG). Bitcoin boasts a market capitalization of $2.4 trillion, with its 24-hour trading volume averaging $52 billion.

-1752488013436.png)

Bitcoin market capitalization | Source: CoinGecko

Gold (XAU) holds the crown of the world's most valuable asset, with a market share of around $22.6 trillion, followed by chip manufacturer Nvidia (NVDA), Microsoft (MSFT) and Apple (AAPL).

According to the chief investment officer at Kronos Research, Vincent Liu, the Bitcoin rally is infrastructure-driven, citing the rising demand for spot ETFs as an alternative asset for institutional investors, policy-influenced momentum in the United States (US) and macro liquidity, which is gradually turning favorable for riskier asset classes.

Data spotlight: Digital assets weekly capital inflow hits $3.7 billion

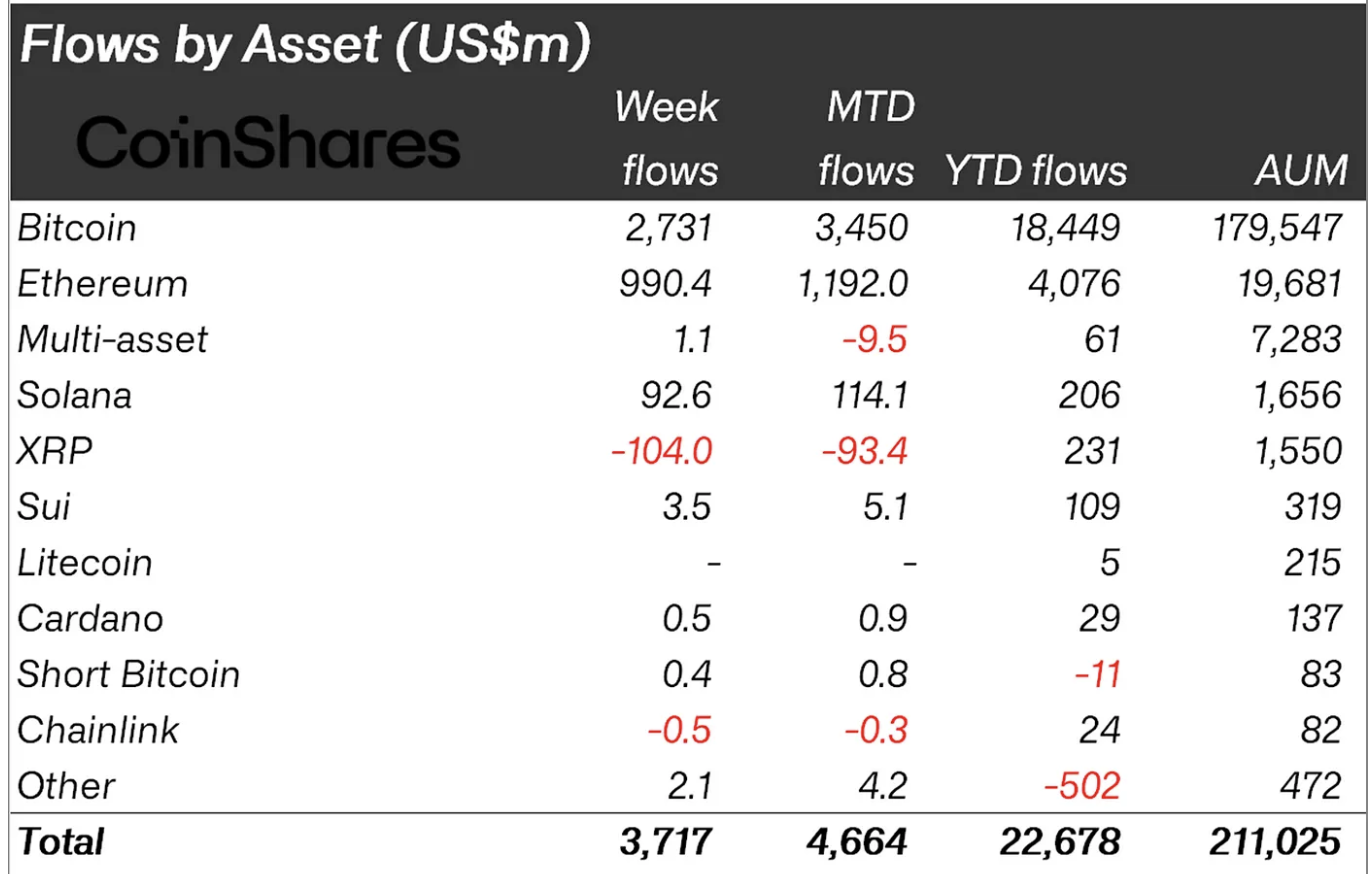

Digital asset investment products achieved inflows of $3.7 billion last week, the second-largest in history. According to CoinShares' capital flows report, released every Monday, assets under management (AUM) hit a new record high of $211 billion, underscoring rising interest in Bitcoin and other crypto-related financial products.

According to the report, Bitcoin dominated the inflows with $2.73 billion last week, while Ethereum extended its bullish streak with a significant increase to approximately $990 million in inflows.

"Assets under management surged past the $200 billion threshold for the first time, reaching a new record of $211 billion. Exchange Traded Products (ETP) trading volumes reached $29 billion, twice this year's weekly average," the CoinShares report highlights.

Digital assets investment weekly inflow data | Source: CoinShares

Notably, BTC spot ETFs experienced an extended surge in daily net inflow, with slightly above $1 billion recorded on Friday. BlackRock's IBIT was the best-performing ETF in the US, with a net inflow volume averaging $953.5 million. The cumulative total inflow currently stands at $52.4 billion, with net assets at $150.6 billion, according to SoSoValue.

Bitcoin spot ETF data | Source: SoSoValue

CoinShares highlights steady interest in Ethereum-related investment products, considering the $990 million in net weekly inflow. This represents ETH's 12th consecutive week of inflows and the fourth-largest on record. SoSoValue data shows that Ethereum spot ETFs posted approximately $205 million in daily net inflow on Friday, with the cumulative total averaging $5.3 billion.

Ethereum spot ETF data | Source: SoSoValue

XRP, on the other hand, experienced outflows of 104 million, stabilizing the AUM at $1.55 billion. Chainlink (LINK) was the only other asset in the red last week, with outflows of $500,000.

Chart of the day: Bitcoin bulls stay in control

Bitcoin price extended last week's rally into the weekend and the new week, with intraday gains on Monday hitting the highest level on record at around $123,218, according to Binance.

The path of least resistance seems upward, with BTC hovering at approximately $122,076 at the time of writing. According to the Money Flow Index (MFI), risk appetite remains elevated as more money flows into Bitcoin, as observed on the daily chart below.

Key areas of interest to traders would be finding support above $120,000 in upcoming sessions and the next critical level at $125,000 in case the price discovery phase continues this week.

BTC/USDT daily chart

Despite the bullish outlook, traders should also temper their bullish expectations, citing the Relative Strength Index (RSI) rise to overbought territory, currently at 78. Overbought conditions are often a precursor to pullbacks, which could trim the gains before Bitcoin price extends its price discovery.

Altcoins update: Ethereum, XRP in bullish hands

Ethereum price holds above the crucial $3,000 level while exchanging hands at around $3,057 at the time of writing. The daily chart below highlights the formation of a Golden Cross pattern following the crossing of the 50-day Exponential Moving Average (EMA) above the 200-day EMA on Thursday. This bullish technical outlook could uphold risk-on sentiment and pave the way for gains toward the $4,000 level.

ETH/USDT daily chart

Meanwhile, with the RSI in overbought territory, a trend reversal could be on the horizon, which might trigger profit-taking activities. A drop below $3,000 cannot be ruled out. Besides, it could allow traders to enter at a lower price level ahead of another breakout.

As for XRP, bulls appear to be having the upper hand, extending recovery by more than 57% from the June low of around $1.90. The cross-border money remittance token is trading at $2.98 at the time of writing, up 5% on the day and looking forward to the next breakout past resistance at $3.00.

XRP/USDT daily chart

The uptrending movement of the RSI into overbought territory emphasizes the bullish momentum, which is bolstered by the MFI indicator's rise to around 92. In case of a break above $3.00, the next target is the current record high of $3.40, reached in January.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.