US Treasury Secretary Predicts 15x Stablecoin Growth — Bitcoin ‘Super Cycle’ To Follow?

Over the past week, the cryptocurrency sector achieved a major milestone after the United States Senate passed the GENIUS Act. This landmark bill establishes the first federal standards for stablecoins, marking a significant victory for the digital asset sector and possibly the Bitcoin market.

In response to this significant breakthrough, US Secretary of the Treasury Scott Bessent highlighted that stablecoins could grow into a $3.7 trillion industry by the end of the decade, especially with the introduction of the GENIUS Act. “A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins,” Bessent said.

Besides the potential impact of a stablecoin market boom on the traditional sectors, there is also the significant effect such an amount of liquidity would have on the crypto market, especially Bitcoin. A renowned crypto journalist has come forward with how the Bitcoin price would react to a soaring stablecoin market value.

Could BTC Price Go On A Super Rally?

In a June 20 post on the X platform, crypto journalist Rafaela Romano shared an insightful analysis of the Bitcoin price performance in relation to a potential stablecoin market boom following recent legislative breakthroughs. This analysis is based on the “super” relationship between liquidity in stablecoins and the price of BTC.

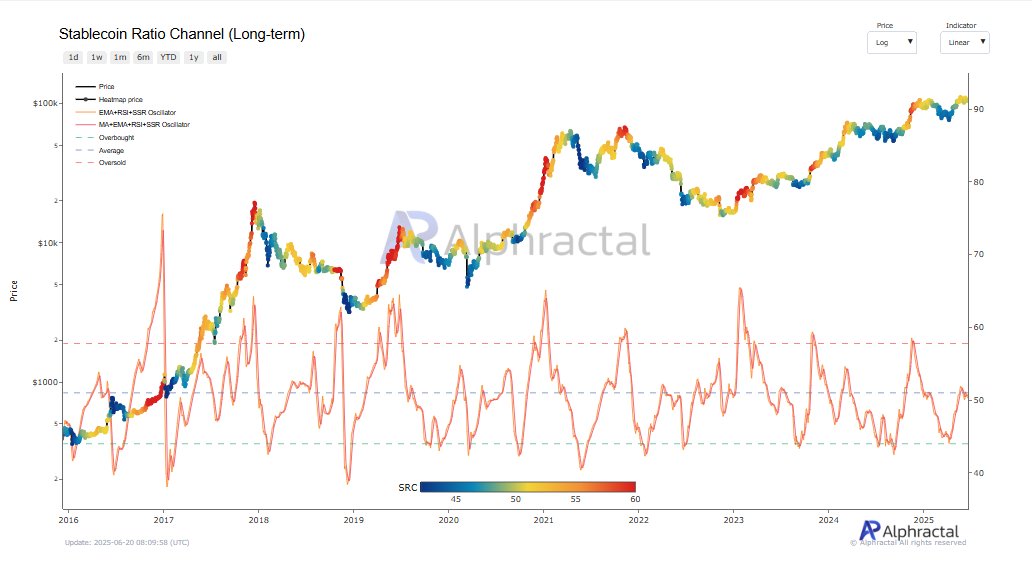

In the post on X, Romano highlighted the Stablecoin Ratio Channel (SRC) that indicates sustained bullish or bearish conditions based on changes in stablecoin supply. This metric suggests that shifts in stablecoin supply could precipitate significant market movement over extended periods.

The SRC (Long-Term) removes short-term noise by applying a 90-day Relative Strength Index (RSI) to the Stablecoin Supply Ratio (SSR) oscillator and smoothing it with a 7-day EMA. For context, SSR is calculated as the ratio between the Bitcoin supply and the supply of stablecoins.

Hence, a falling SRC metric suggests that the stablecoin supply is growing faster than the Bitcoin supply. As shown in the chart below, when the SRC reaches the green line, it indicates an oversold market condition for the premier cryptocurrency — a typical precedent for prolonged price rallies.

Hence, if the stablecoin market capitalization sees a 15x growth over the coming years, it means that the value of the SRC would likely plummet beneath the green line. Ultimately, Romano believes that this could mean a “super multiple” for the price of Bitcoin.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $103,550, reflecting an almost 1% decline in the past 24 hours.