Bitcoin NVT Enters Reversal Zone: BTC Dangerously Overvalued?

On-chain data shows the Bitcoin Network Value to Transactions (NVT) Golden Cross has surged into a zone that has historically signaled overpriced conditions for the asset.

Bitcoin NVT Golden Cross Has Crossed Above 2.2

In a new post on X, CryptoQuant author Darkfrost has talked about the latest trend in the NVT Golden Cross of Bitcoin. The NVT Golden Cross is an indicator based on another metric known as the NVT Ratio.

The NVT Ratio keeps track of the ratio between the BTC market cap and transaction volume. The idea behind the indicator is that the ability to transact coins (as gauged by the transaction volume) could be considered as a reflection of the asset’s ‘fair value.’

Thus, through the comparison of the cryptocurrency’s current value (that is, the market cap) with this fair value, the metric can tell us about whether the asset is overvalued or undervalued.

When the value of the metric is high, it means the market cap is high compared to the transaction volume. Such a trend could imply BTC may be becoming overheated. On the other hand, the indicator being low could suggest room for the coin to grow relative to its volume.

Now, the NVT Golden Cross, the actual metric of relevance here, is a signaling indicator like the Bollinger bands for the NVT Ratio that aims to locate tops and bottoms in its value. The NVT Golden Cross does so by comparing the short-term trend (represented by the 10-day MA) with the long-term one (30-day MA).

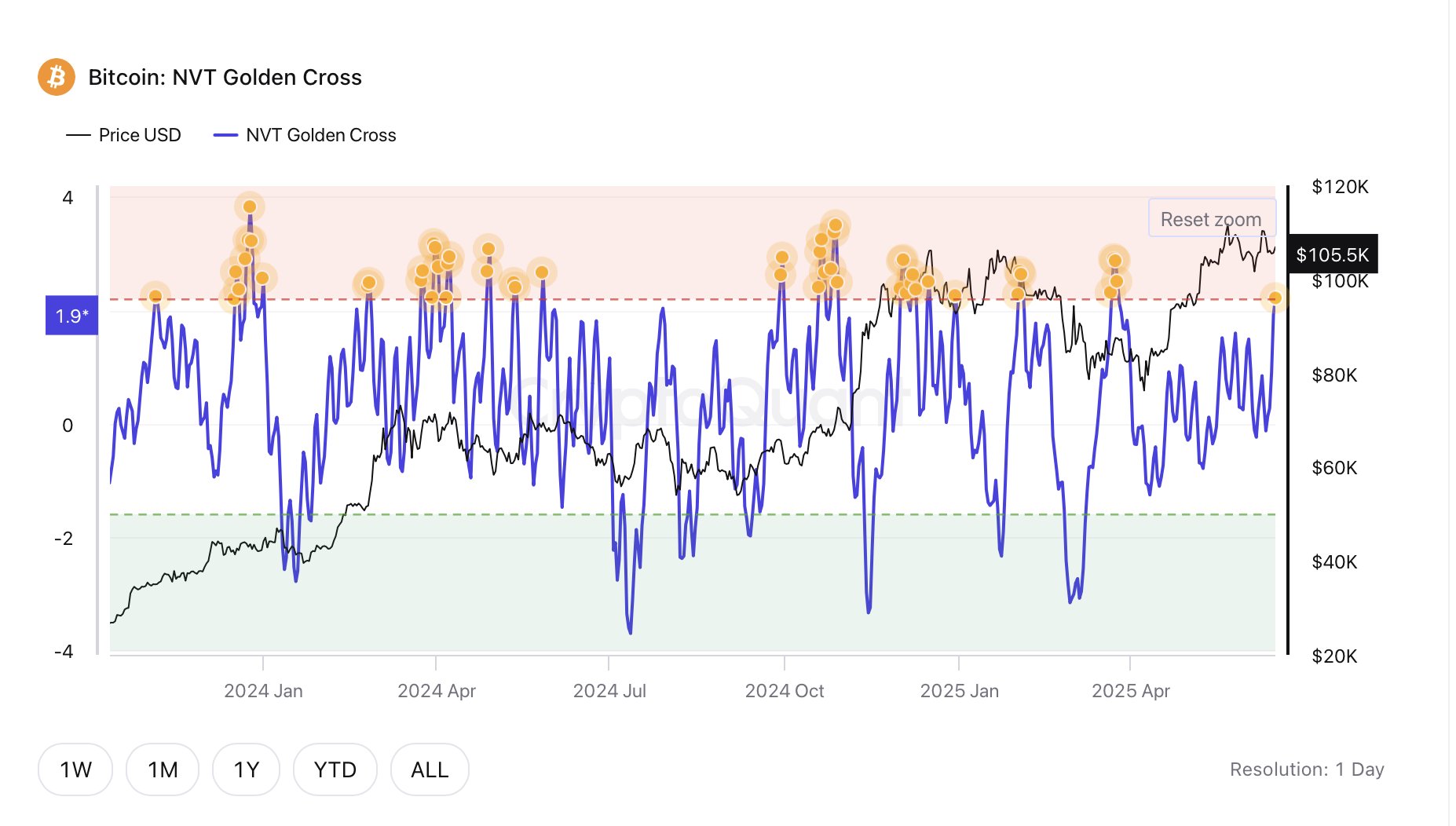

Below is the chart shared by the analyst that shows the trend in the metric over the last couple of years.

As displayed in the above graph, the Bitcoin NVT Golden Cross has recently registered a sharp uptick and entered into the region above the 2.2 mark (highlighted in red).

This zone is where the cryptocurrency’s market cap has historically outpaced the transaction volume to a degree that a reversion to the mean has tended to occur. In other words, it’s where price corrections to the downside have taken place for the asset.

Though, it’s visible from the chart that not every top in the NVT Golden Cross inside this territory coincides with a price top. And in many instances that it does, the decline in the asset isn’t to some major degree.

So far since the signal has appeared, however, the asset has indeed been going down, a potential sign that the same reversion effect may be in play once more. It now remains to be seen whether downside will be limited, or if this will be one of those instances where the signal was followed by an extended drawdown.

BTC Price

At the time of writing, Bitcoin is floating around $103,700, down almost 5% in the last seven days.