Pi Network Price Forecast: Rising CEX reserves amid .pi domains auction update warns turbulence

- Pi Network’s announcement of .pi domains auctions update and utility strategy stirs the community buzz.

- The PI supply reserve on available CEXs surge aligns with the Pi core team's offloading, increasing the downside risk.

- The technical outlook signals a decline in bullish momentum, indicating a potential correction ahead.

Pi Network (PI) edges lower by under 0.50% at press time on Monday after failing to join the broader cryptocurrency market recovery the previous day. Pi Network released an update on the .pi domains auction on Thursday, but it failed to boost sentiments amid a market-wide correction. Following a 3.52% recovery on Saturday, Pi Networks struggles to hold the gains as Centralized Exchanges (CEX) supply grows amid a bearish technical outlook and declining Pi core team wallet holdings.

Pi core team announces auctions update and utility strategy

Amid the ongoing auctions, the pioneers have the opportunity to acquire custom .pi domains. A recent update announced on Thursday brings a new feature, the statistics page, available on the domains auction app. The new page offers the most bids, the highest price, and the most recent trending bids in the auction.

Alongside the update, Pi Network urges the community to focus on the utility of such .pi domains. The network tags the domains as “functional Web3 identifiers” to anchor Pi apps and services.

Supply dump risk amid CEXs' balance surge and Pi Foundation outflows

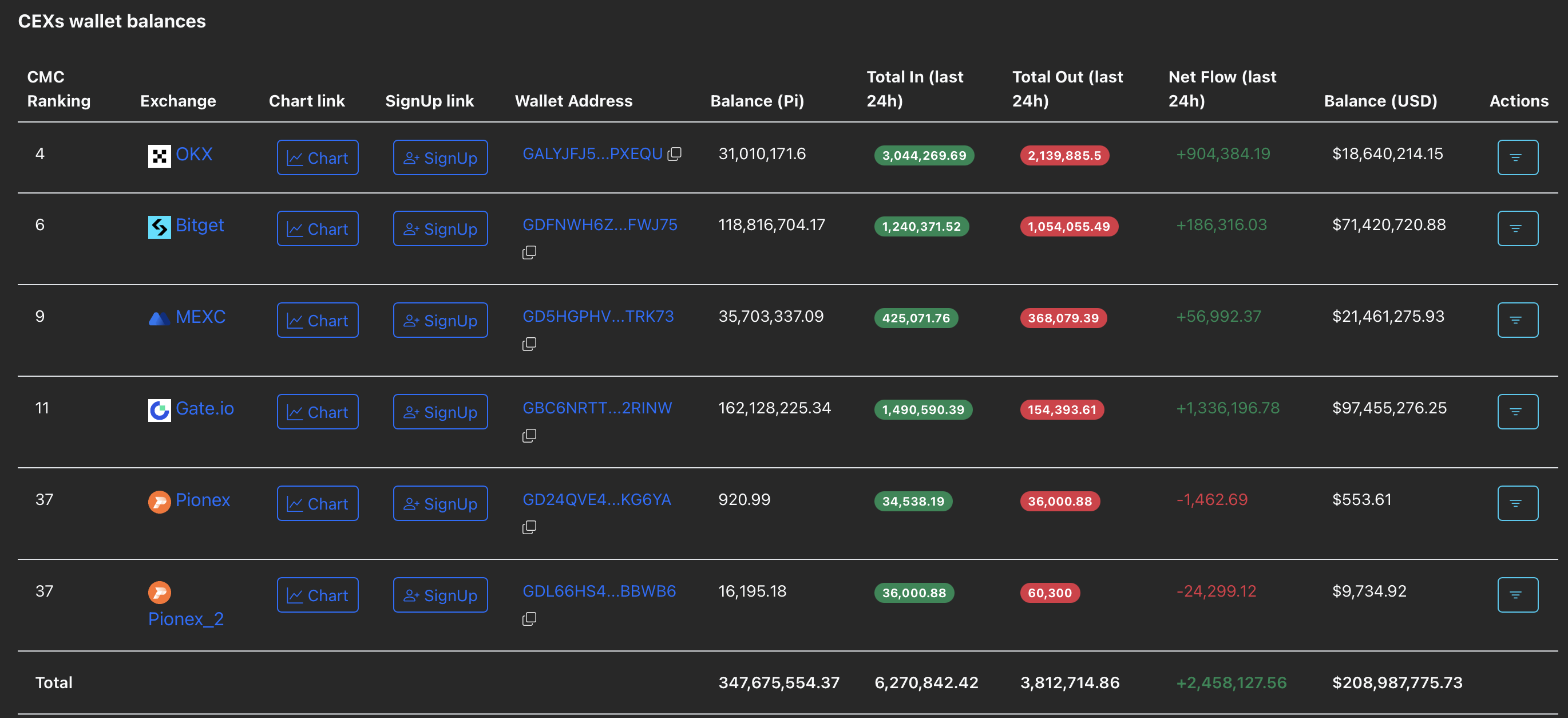

PiScan’s data shows a positive surge in netflow among CEXs with listed Pi tokens in the last 24 hours. A surge in CEX reserves signals an increase in potential supply that could drop the token price if it enters the market.

The data shows OKX exchange’s netflow 904,384 PI coins while Bitget’s netflow hits 186,316. Out of the total netflow of 2,458,127 PI among the five exchanges, 1,336,196 PI coins were deposited to Gate.io.

CEXs' Pi wallet balances. Source: PiScan

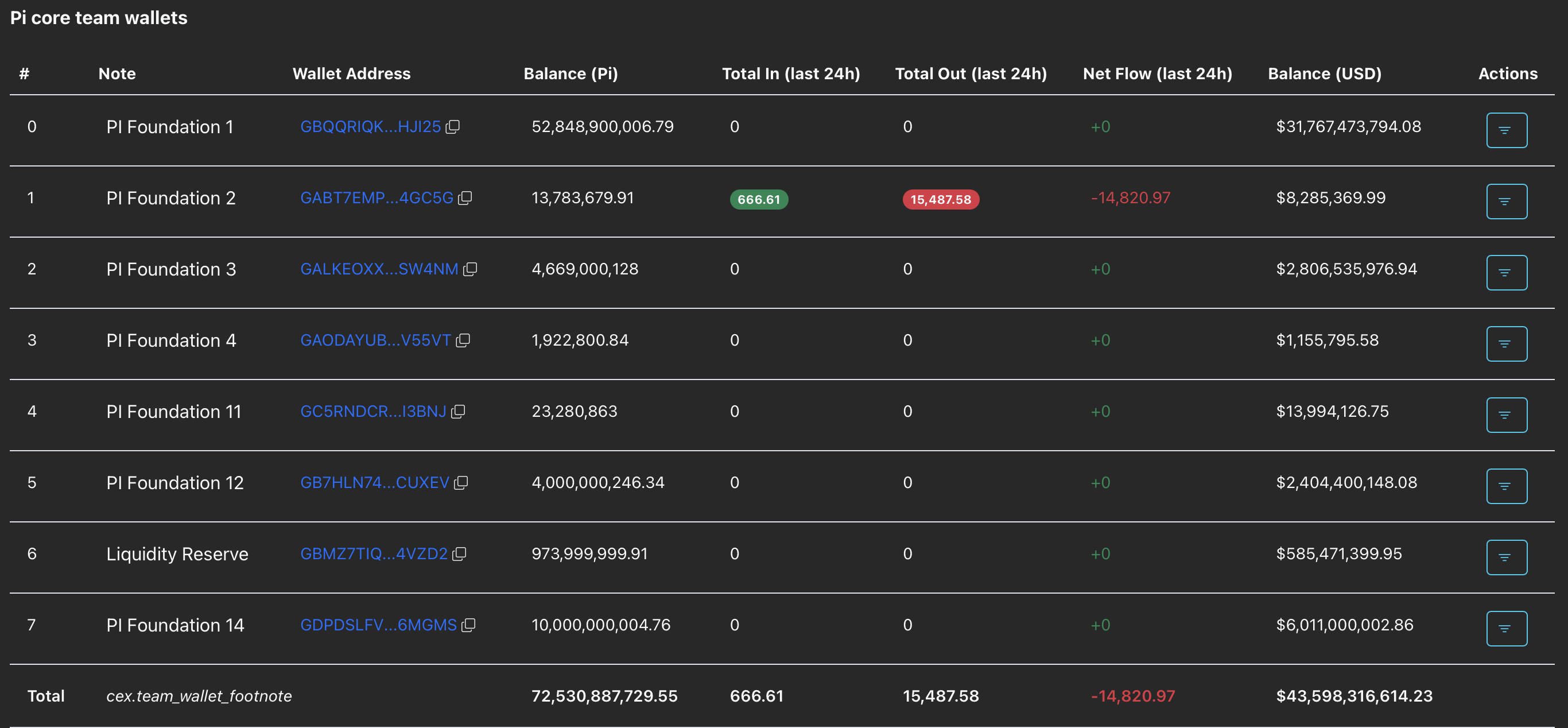

Amid rising CEX wallet balances, the Pi Foundation wallet #2 witnessed a net outflow of 14,820 tokens in the last 24 hours. With the rising supply on the verge of entering the spot floor and offloading moves from Pi Foundation wallets, there is a possibility of a correction in Pi Network price.

Pi core team wallets. Source: PiScan

Pi Network recovery at risk as bullish momentum fades

Pi Network recovered over 3.50% on Saturday but failed to surpass the 50-period Exponential Moving Average at $0.61 in the 4-hour chart. However, the altcoin crossed above the local resistance trendline formed by the May 21 and June 11 peaks.

At the time of writing, PI trades at $0.60, between the broken trendline and the 50-period EMA. A potential closing above the dynamic resistance could prolong the recovery to the 200-period EMA at $0.67, while a minor obstacle is present at $0.66 (June 7 high).

The Relative Strength Index (RSI) momentum indicator at 49 hovers sideways near the halfway line as it faces strong headwinds, aligning with the halt in the bullish recovery. Despite significant room for growth above the halfway line, a sudden pause in rising bullish momentum risks a potential reversal.

The Moving Average Convergence/Divergence (MACD) indicator approaches the zero line from deep negative territory. However, the recent decline in bullish green histogram bars warns of a potential bearish crossover with the signal line, a trend reversal signal.

PI/USDT daily price chart.

If Pi Network fails to hold the $0.57 support level, marked by the low on May 7, it could extend the declining trend towards the $0.50 psychological level.