Dogecoin Supply In Profit Hits 77.9%—How Do XRP, Bitcoin Compare?

On-chain data shows around 77.9% of all Dogecoin supply is in profit right now. Here’s how it stacks up against the likes of Bitcoin and XRP.

Dogecoin Compared Against The Rest In Total Supply In Profit

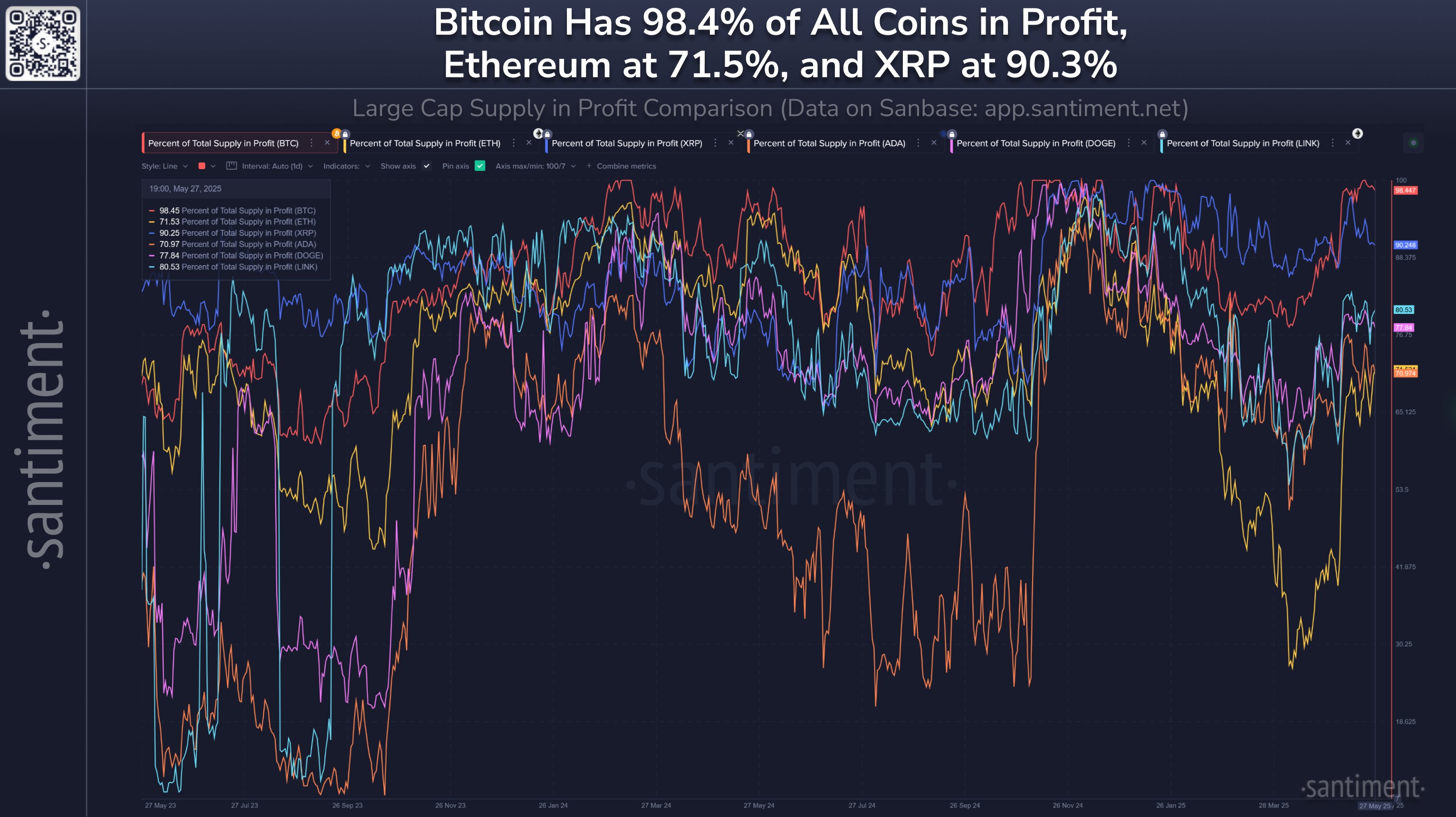

In a new post on X, the on-chain analytics firm Santiment has shared how some of the top coins in the cryptocurrency sector, like Bitcoin and Dogecoin, currently compare against each other in terms of the Percent of Total Supply in Profit indicator.

The “Percent of Total Supply in Profit” tells us, as its name already suggests, the percentage of a digital asset’s total supply in circulation that’s being held at some unrealized gain.

This indicator works by going through the on-chain history of each token on the network to see what price it was last moved at. If the previous transaction price is less than the current spot value for any coin, then that particular coin is assumed to be holding a profit right now.

The Percent of Total Supply in Profit counts up all tokens satisfying this condition and determines what part of the total supply they make up for. Now, here is a chart that shows how this figure is currently looking for six top coins: Bitcoin (BTC), Dogecoin (DOGE), Ethereum (ETH), XRP (XRP), Cardano (ADA), and Chainlink (LINK).

As displayed in the above graph, all of these cryptocurrencies, except for XRP, have witnessed a notable uptick in the percentage of Total Supply in Profit over the past month.

The king of the sector in terms of the indicator is Bitcoin, with around 98.4% of its supply being in the green. BTC has been in all-time high (ATH) exploration mode recently, so this extreme level isn’t a surprise, considering that 100% of the supply enters into a state of profit at the instant a new ATH is set.

Despite the fact that XRP hasn’t seen much growth in the metric recently, its profit-loss balance is still the second-best among these assets, with over 90% of the supply sitting on some gain.

Chainlink and Dogecoin rank third and fourth on the list, with the Percent of Total Supply in Profit standing at 80.5% and 77.9%, respectively. Ethereum, the second-largest coin by market cap, has performed relatively poorly on the indicator, with its value of 71.5% notably behind the others. That said, from a growth potential perspective, ETH’s profitability may not be as bad as it seems.

Generally, investors in profit are more likely to participate in selling, so whenever a significant part of the network is in the green, a mass selloff with the motive of profit realization can become probable. This can naturally facilitate the formation of tops.

Naturally, this doesn’t mean Bitcoin, with its extreme profitability, is sure to hit a top in the near future; its rally can continue so long as the demand side remains strong enough to absorb any profit-taking. But coins on the lower end, like Ethereum, Cardano, and Dogecoin, could have, in theory, more room to run, should conditions align.

DOGE Price

Dogecoin has been stuck in sideways movement recently as its price is still floating around the $0.22 mark.