Bitcoin Price Forecast: BTC gives up weekend gains, signaling potential bull trap as momentum weakens

- Bitcoin dips to around $103,000 on Monday, wiping out Sunday's gains and raising concerns of a short-term correction.

- Metaplanet adds 1,004 BTC to its treasury, while spot Bitcoin ETFs saw $603.74 million in net inflows last week.

- Technical indicators show weakening momentum, with rising bearish bets hinting at a possible bull trap and near-term correction.

Bitcoin (BTC) starts the week on a weaker note, falling by more than 3% to around $103,000 at the time of writing on Monday after briefly rallying over the weekend. The price action has raised concerns among traders about a potential bull trap, especially as momentum indicators show early signs of exhaustion. Despite continued positive corporate and institutional flows in the form of spot Bitcoin Exchange Traded Funds (ETFs) and Meta Planet’s accumulation, bearish sentiment appears to be gaining ground in the short term.

Bitcoin price drops to $103,000 as bearish bets increase

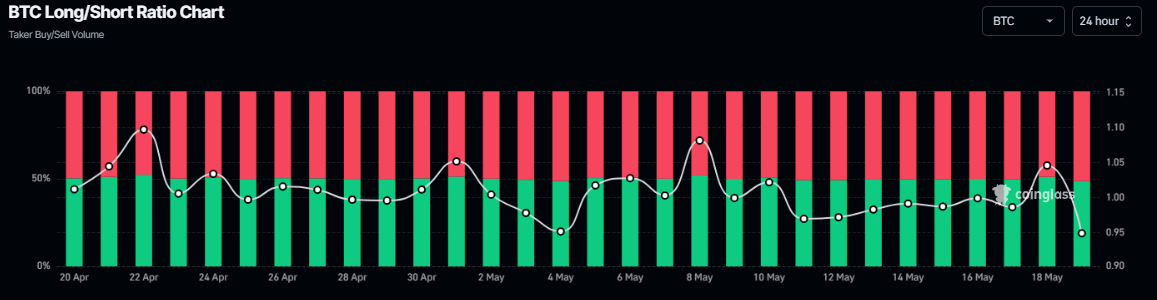

CoinGlass data shows that BTC’s long-to-short ratio falls to 0.94, the lowest level over a month. A ratio below one indicates that a larger number of traders are betting on the asset price to fall.

BTC long-to-short ratio chart. Source: CoinGlass

Metaplanet adds more Bitcoin, ETFs log inflows

Despite the increase in bearish bets, BTC corporate and institutional demand continues to strengthen. On Monday, Japanese investment firm Metaplanet announced that it had purchased an additional 1,004 BTC, increasing its total holdings to 7,800 BTC.

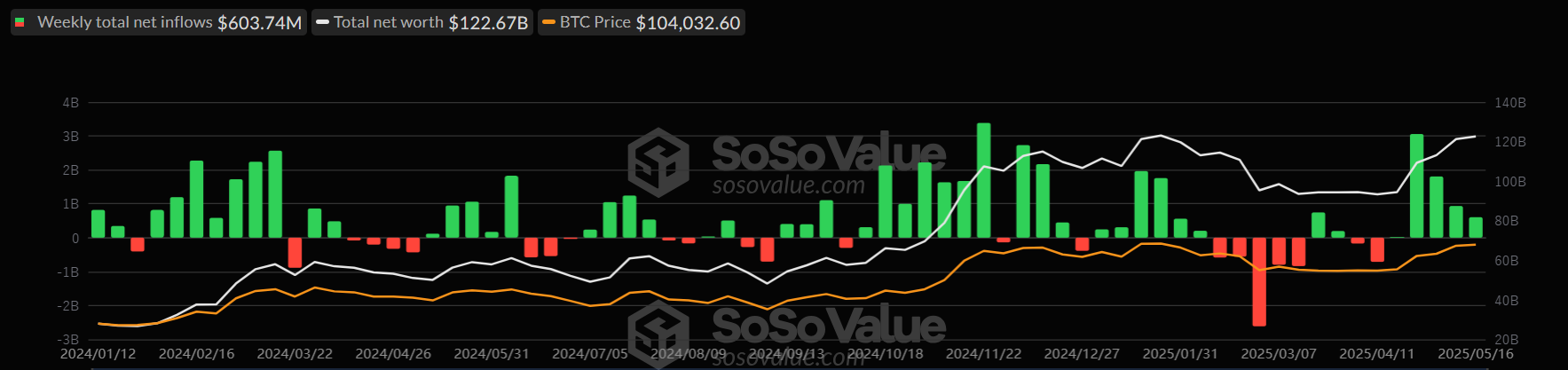

Additionally, according to SoSoValue data, US spot Bitcoin ETFs recorded a total inflow of $603.74 million last week, extending a five-week winning streak that began in mid-April. Bitcoin price should benefit if more corporate companies and institutional inflows continue and intensify. Still, the level of inflows registered last week is way below that seen in prior weeks:

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Bitcoin Price Forecast: Momentum indicators signal weakness

Bitcoin price rallied 3.23%, breaking above its key resistance level at $105,000 on Sunday. However, at the time of writing on Monday, it has failed to find support around this level and is trading down more than 3% to around $103,000.

The momentum indicators on the daily chart show signs of weakness. The Relative Strength Index (RSI) reads 60 and points downward after being rejected from its overbought levels of 70 on Sunday, indicating fading bullish momentum.

The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Sunday, with the MACD line crossing below the signal line, giving a sell signal and indicating the potential start of a downward trend.

If BTC continues its pullback, it could extend the decline to retest the psychological support level at $100,000.

BTC/USDT daily chart

However, if BTC rebounds and closes above $105,000, it could extend the rally toward the all-time high of $109,588 set on January 20.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.