Bitcoin Miners’ Selling Pressure Hits Lowest Level Since 2024 — What’s Happening?

After reaching a three-month high of $103,800 on Friday, May 9, the price of Bitcoin had a slow start to the weekend before resuming its run toward $014,000. While the premier cryptocurrency continues to hold above the $100,000 mark, market participants appear to trust the coin to make a play for fresh highs over the coming weeks.

Interestingly, the Bitcoin miners, who have become increasingly reactionary since the fourth halving in 2024, seem to also have renewed confidence in the price of BTC. The latest on-chain data shows that the miners have been holding onto their assets in recent weeks, coinciding with the coin’s latest price rally.

Are Bitcoin Miners Preparing For An Extended Rally?

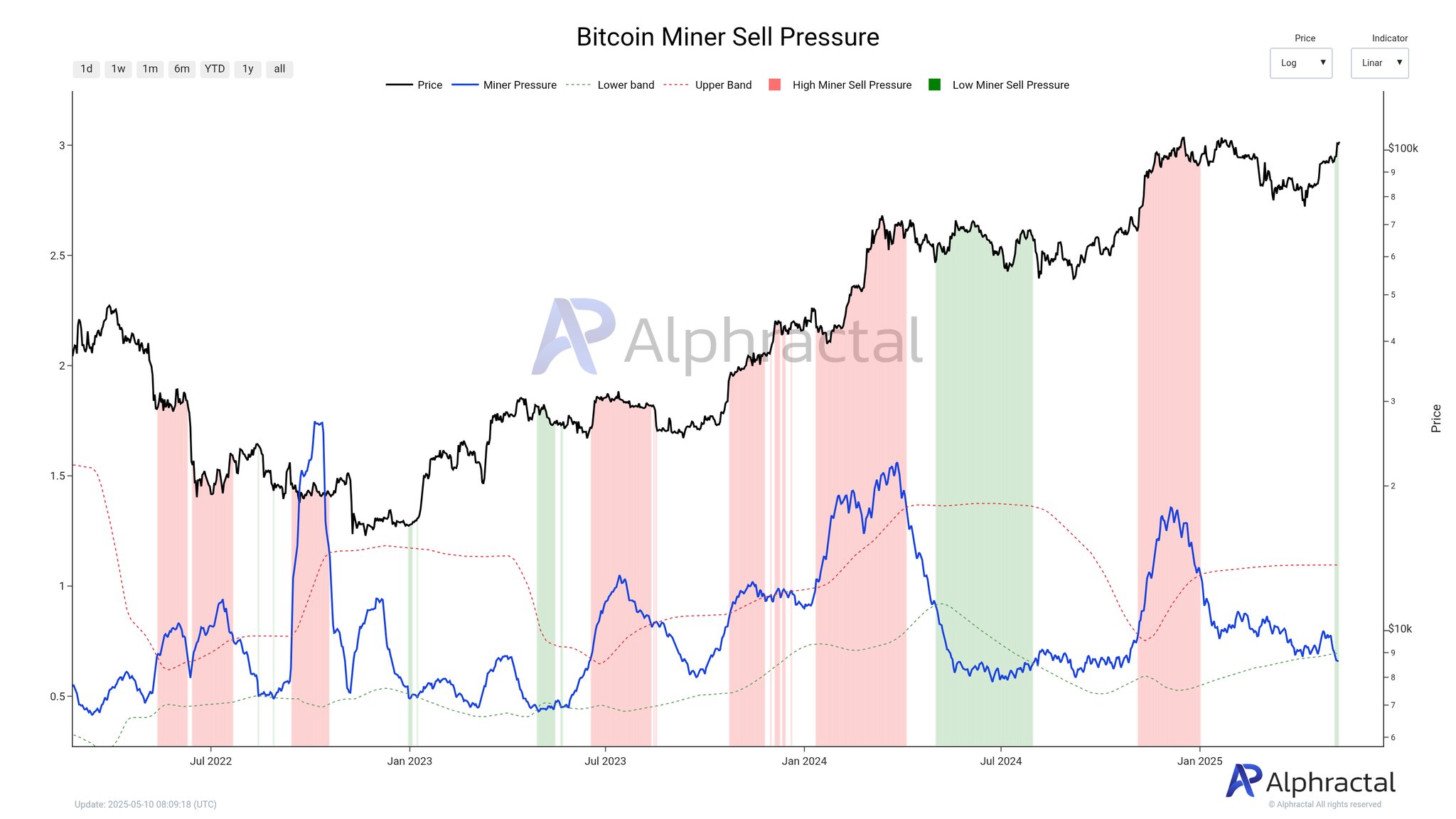

In a May 10 post on X, crypto analytics platform Alphractal revealed that Bitcoin miners are becoming less active in the market, accumulating their mining rewards rather than selling them for profit. The relevant indicator here is the Miner Sell Pressure metric, which measures the selling strength of Bitcoin miners over a given period.

This metric compares the total BTC outflows from miners over the past 30 days with the average amount of coins in their reserves within the same period. The Miner Sell Pressure indicator provides valuable insight into the behavior and sentiment of a relevant group of network participants.

In the highlighted chart, the red color represents high selling pressure amongst these Bitcoin miners and is often correlated with a sluggish market condition. The green color, on the other hand, reflects a low miner sell pressure, which could be a positive sign for the price of Bitcoin.

As shown in the chart above, the Miner Sell Pressure metric enters the red territory when the Miner Pressure moving average (blue line) crosses above the upper band (red line) — signaling intense bearish pressure from miners. Meanwhile, the Miner Pressure line crosses beneath the lower band (green line), suggesting low selling pressure from miners.

According to data provided by Alphractal, the Miner Pressure line recently crossed beneath the lower band, suggesting that the network miners have been holding on to their coins in recent weeks. The on-chain analytics firm added that this metric is at its lowest level since 2024, as miners seem to be waiting for the Bitcoin price to claim fresh highs.

While the Bitcoin market has somewhat matured such that miners’ selling doesn’t have that much significant impact on prices, an extended period of low selling pressure from the network participants could be naturally bullish for the premier cryptocurrency. Alphractal, however, noted that the market may see renewed selling interest as prices move in the coming weeks.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $104,250, reflecting an over 1% rise in the past 24 hours.