Ripple Price Prediction: XRP prepares bullish impulse aiming for $3

- XRP is knocking on the 50- and 100-day EMAs confluence resistance at $2.21 amid gains in the broader crypto market.

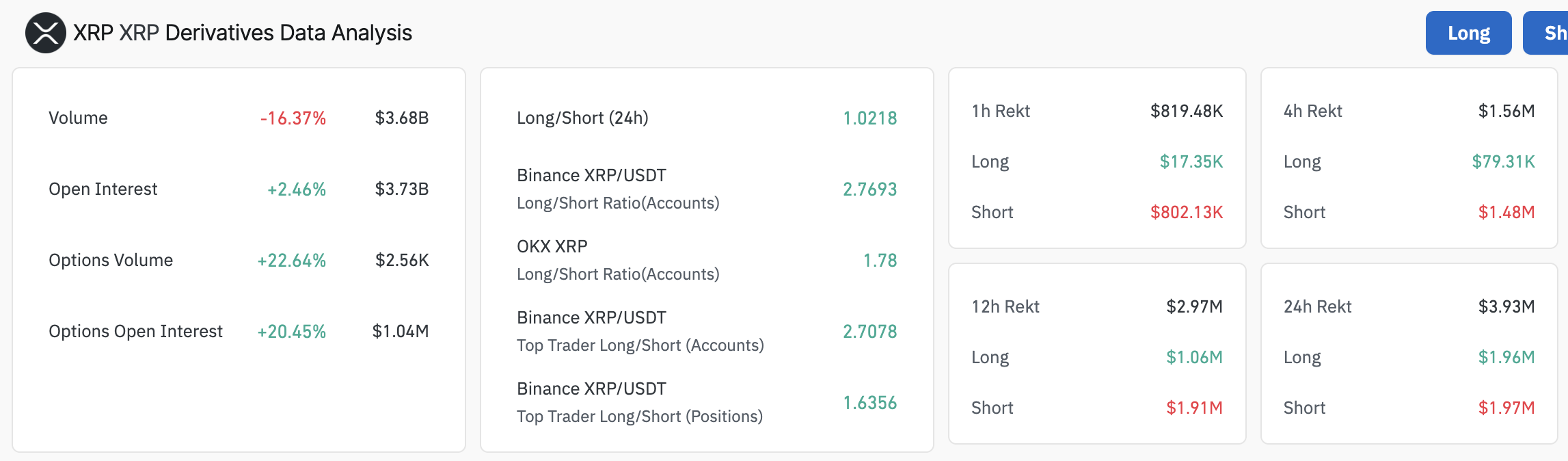

- The derivatives market Open Interest regains momentum as the long-to-short ratio leans bullish.

- Risk-on sentiment remains high as large volume holders increase exposure in XRP.

Ripple (XRP) price is gaining bullish momentum, increasing over 3% to trade at $2.19 at the time of writing on Thursday. The broader uptrend led by Bitcoin (BTC) as it closes the gap to $100,000 comes after the Federal Reserve (Fed) left interest rates unchanged at 4.24%-4.5%, citing market volatility and tariff policies championed by United States (US) President Donald Trump and their potential impact on the economy.

Cryptocurrencies wake up post-Fed interest rate decision

Powell emphasised the need for caution, adding that the central bank would "wait for more data on the economy's direction before changing interest rates." President Trump's tariff policies shook global markets in April, with the Fed Chair saying they "are highly likely to generate at least a temporary rise in inflation."

The crypto market stayed stable during Powell's Wednesday press conference but picked up steam in Thursday's Asian session.

CoinGecko reports the total crypto market cap rose 1.2% to $3.175 trillion, signaling a broader bullish trend. All top ten digital assets, including XRP, are up over the past 24 hours.

XRP bulls eye breakout above key trendline resistance

A 2.46% increase in Open Interest (OI) indicates renewed interest in XRP's uptrend as fresh capital enters the market. Similarly, options OI surged by 20.45% to $1 million in the last 24 hours, driving the bullish narrative amid increased speculative activity and trader engagement.

The long-to-short ratio of 1.0218 shows a bullish bias, meaning more traders are betting on XRP's price rising, reinforcing the optimistic sentiment.

XRP derivatives' market data | Source: CoinGlass

The heightened risk appetite is evident with the increase in whale holdings, with between 10 million and 100 million tokens. According to Santiment's Supply Distribution metric, this whale cohort has steadily been growing its share of the supply to account for 12.22% from 10.47% recorded on February 24. The 1.75% increase suggests confidence in XRP is growing as investors anticipate a larger breakout.

[07-1746682873439.24.39, 08 May, 2025].png)

Supply Distribution metric | Source: Santiment

XRP's price is reaching out for a potential breakout above a confluence resistance at $2.21, established by the 50-day and the 100-day Exponential Moving Average (EMA). A long-term descending trendline resistance from January is slightly above this key supply zone.

Traders might be holding off for the uptrend to confirm above this level, ensuring the bullish momentum is strong enough to reach the $3.00 mark, last seen in early March.

The Relative Strength Index (RSI) indicator's flip above the midline of 70 emphasises the short-term bullish outlook, which will likely hold XRP's price steady in upcoming sessions on Thursday.

XRP/USD daily chart

On the other hand, the SuperTrend indicator is stuck above the XRP price, creating headwinds. This trend following indicator uses the Average True Range (ATR) and a multiplier to gauge the general price direction. When the price crosses below the indicator line, changing the colour to red from green signals a downtrend in play.

XRP's position below the 50-day, the 100-day EMAs, and the extended trendline implies challenges to the uptrend and a potential rejection. A trend reversal would bring the 200-day EMA at $1.99 in focus, with intense declines likely to test the April 7 low at $1.62.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.