Why is the crypto market up today?

- Bitcoin broke above $93,000 for the first time since March, with altcoins Ethereum, XRP and Solana gaining 11%, 5% and 6%, respectively.

- The rally has sparked increased liquidations, with short traders suffering losses of over $500 million in the past 24 hours.

- The major US stock indexes saw gains of over 2.5% across the board.

- The rally stems from optimism surrounding Treasury Secretary Scott Bessent's statement that he expectsUS and China to reach a trade deal soon.

Bitcoin (BTC) rallied above $93,000 on Tuesday alongside the broader financial market following Treasury Secretary Scott Bessent's statement at a closed-door meeting that the trade feud between the US and China is unsustainable.

Bitcoin reclaims $93,000 as stocks rally following Scott Bessent's statement

The crypto market saw an uptick on Tuesday, rising over 5% as major assets took noted gains. Bitcoin rallied above $93,000 for the first time since March 6, with top altcoins Ethereum, XRP and Solana also gaining 11%, 5% and 6%, respectively.

The meme sector rallied alongside top cryptos, jumping over 15%. Other sectors including the AI and Real-world asset (RWA) sectors also posted gains.

Following the rise, traders experienced major losses, with over $581.46 million in futures liquidations in the past 24 hours, per Coinglass data. Short traders were hit the hardest, with over $504 million in liquidated positions in the past day as long-term holders began accumulating BTC.

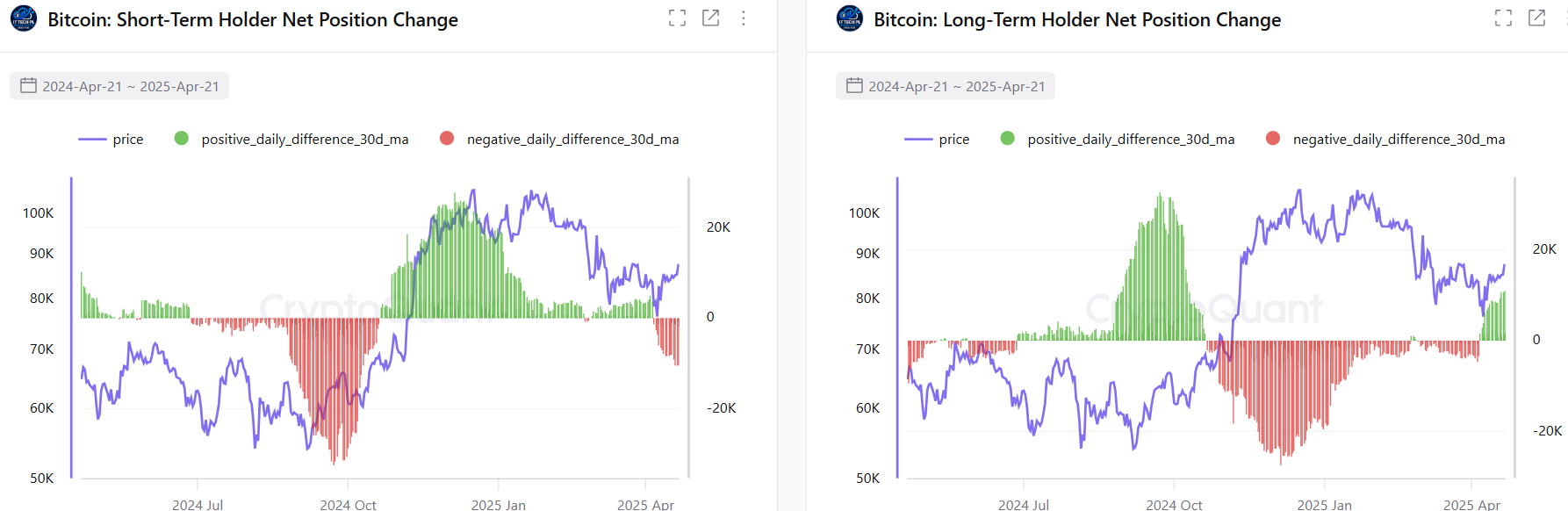

The Net Position Change for long-term holders shows that they are accumulating more BTC while short-term holders are selling. This behavior hints at a renewed desire for crypto assets among smart money investors.

"The Net Position Change for Long-Term Holders (LTH), those holding BTC for more than 155 days, has turned positive for the first time since the local peak [while] short-Term Holders (STH)—those holding BTC for less than 155 days—continue to offload their positions, with net outflows deep in negative territory," wrote an analyst on CryptoQuant's Quicktake page.

BTC LTH vs STH Net Position Change. Source: CryptoQuant

The switch in market sentiment stems from optimism surrounding Treasury Secretary Scott Bessent's statement concerning the US-China tariff face-off. Bessent said that a prolonged trade war between the two countries is "unsustainable" and that he expects the feud to de-escalate soon, according to Bloomberg.

Likewise, President Donald Trump allegedly told reporters at the Oval Office that he plans to make a deal with China to lower the tariffs. He further shared that the 145% tariff is very high and won't stand.

"It won't be that high. No, it won't be anywhere near that high, it will come down substantially, but it won't be zero," President Trump told reporters.

The news also sparked a rally in the stock market, with the S&P 500, Nasdaq, and Dow Jones rising over 2.5% across the board.

Bitcoin's earlier rally from Monday into the early hours of Tuesday amid a drop in stocks made several participants speculate that BTC might be decoupling from US stocks. However, the so-called ‘decoupling’ has been short-lived due to the similar rally in stocks on Tuesday. This highlights renewed optimism among traders and investors ahead of a potential end to the US-China trade war.