Crypto market sentiment split as Mantra OM crashes and XRP ETF nears: Santiment

The cryptocurrency market is witnessing a split in sentiment after two high-profile events – Mantra OM’s collapse and XRP’s ETF journey.

While the entire market has stabilized into a less volatile trend after weeks of turmoil surrounding tariff policies, traders are keenly observing the impact of Mantra’s OM token collapse along with positive news in the XRP’s ETF saga.

Mantra OM’s 90% crash created controversy

On April 13, 2025, the crypto market suffered a dramatic decline, taking down Mantra’s OM token from $6.35 to a low of $0.37 within a few short hours, causing an approximately 90% drop that brought down the project’s market cap from $6.11 billion to $683 million.

This brought back thoughts of numerous disasters for other investors, such as the fall of Terra LUNA and the FTX collapse, as stated in the Santiment report.

John Patrick Mullin, Mantra’s CEO, said that the crash was due to “reckless forced liquidations” executed by centralized exchanges during low-liquidity hours. Mullin maintained that neither Mantra staff nor large investors were at fault.

Despite this clarification, conspiracy theories, including allegations of insider trading, went viral.

On-chain data from Lookonchain revealed 43.6 million OM tokens worth $227 million were transferred to larger exchanges by 17 wallets before the crash. Reportedly, two of these wallets were owned by Laser Digital, a Mantra investor. The organization unambiguously denied it. Shorooq Partners had been another backer, and denied that they had sold tokens.

Social media reaction was quick and largely negative. The disappearance of Mantra’s Telegram channel within hours of the crash sparked rumors of an orchestrated exit, though Mullin said the disappearance was accidental.

As of April 15, OM had rebounded somewhat to $0.73, still below over 85% of pre-crash levels. Mullin said the team was in the process of developing a recovery plan. This includes potential token purchases and burns.

XRP gains traction in ETF race

Amid market uncertainty, XRP has positioned itself as a top contender for the next spot crypto ETF approval in the United States, according to Santiment data. The report highlights that XRP now holds the highest average 1% market depth among major altcoins on vetted exchanges.

On April 8, Teucrium launched the first US-based XRP exchange-traded fund under the ticker XXRP. While not a true spot ETF, this 2x leveraged fund aims to deliver twice the daily return of XRP using swaps and European exchange-traded products as references. Santiment notes that the ETF recorded over $5 million in volume on its launch day.

Santiment also reported that “XRP now leads the ETF filing race with 10 active applications, compared to five for Solana and three each for Litecoin and Dogecoin.” Major firms, including Grayscale, Bitwise, and VanEck, have all submitted applications. May 22 marks a critical deadline when the SEC is expected to respond to Grayscale’s XRP spot ETF application.

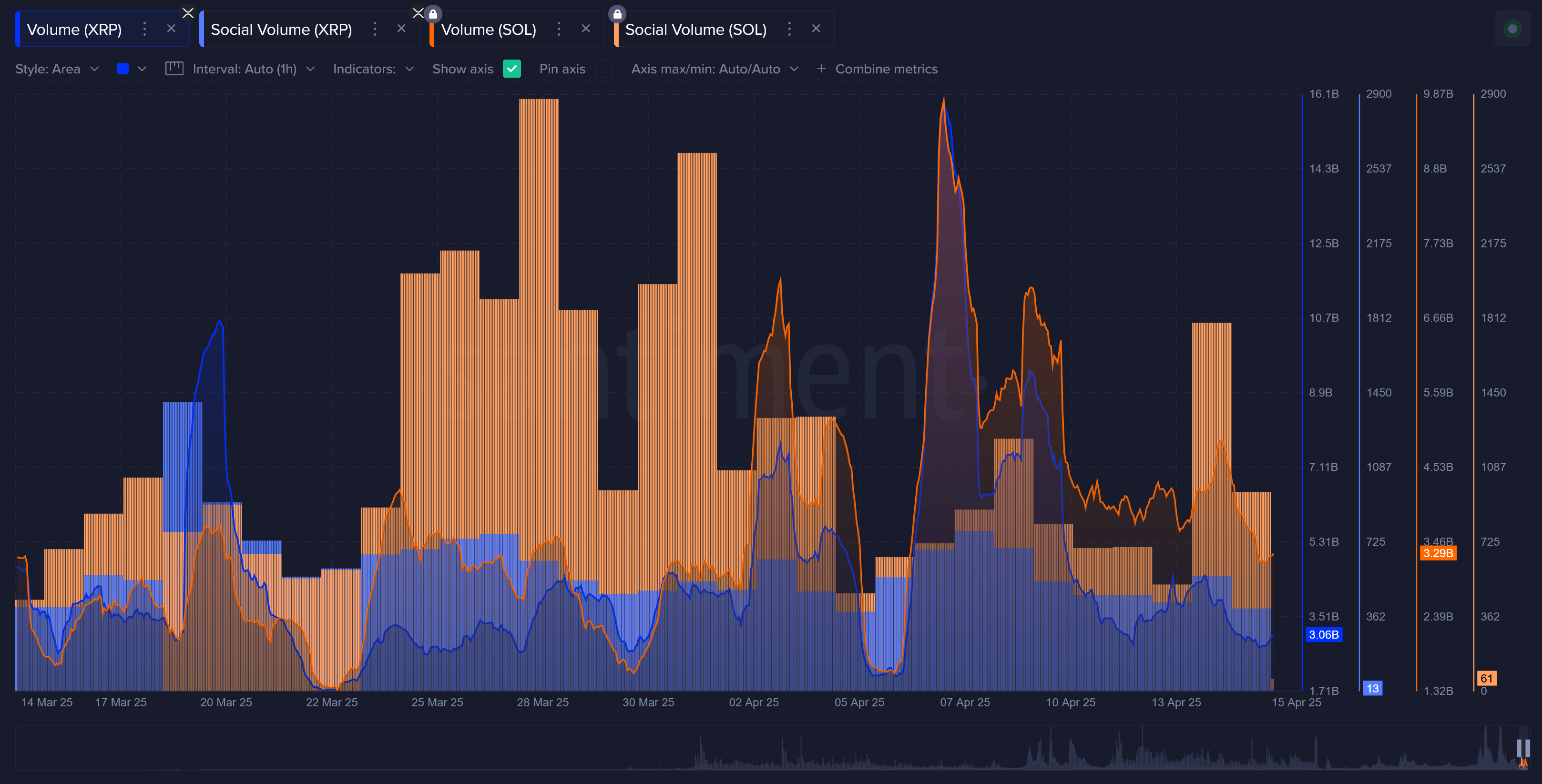

The Santiment report also compares XRP and Solana, noting that while Solana’s US market share has fallen to 16% from 30% in 2022, XRP’s share has been steadily climbing. However, the analysis indicates that “interest levels between the #3 and #5 market caps haven’t shown any major impact as yet, as XRP isn’t yet outpacing its near market cap competitor in either trading volume or social volume.”

Market sentiment remains polarized amid contrasting signals

Santiment describes the current market as highly polarized. The OM collapse also created new waves of doubt, just as confidence was starting to return to the wider market.

Mantra has stoked the existing crisis of confidence in the legitimacy of projects in the crypto ecosystem and potential market manipulation. Santiment’s preliminary evaluator analysis shows many traders who were just hoping to cool off recently are now assessing their risk exposures once again. XRP, with its ETF story, has provided a counterargument in sentiment.

The transition towards XRP as the third main cryptocurrency with spot ETF coverage has galvanizing speculation that other large cap cryptocurrencies could follow suit. The context for the overall market is still tough and Santiment noted that most assets are still holding values at current losses compared to their recent highs.

MVRV (Market Value to Realized Value) ratio of returns show that “most coins are in negative circle,” although this could still indicate recovery if only the overall macro paths suddenly improved. Market participants are now looking forward to the Federal Reserve’s next moves. The next FOMC meeting is May 7, which again will be significant.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now