Crypto Market Rigged? DeFiance Founder Blasts Exchanges Over Price Manipulation

The founder of a leading digital asset investment firm has raised significant concerns over the reliability of crypto token pricing, citing widespread manipulation between market makers and centralized exchanges (CEXs).

Arthur Cheong, CEO of DeFiance Capital, stated via social media platform X that the crypto market is suffering from a lack of transparency, with artificially sustained prices posing serious risks for investors.

Crypto Market Manipulation Allegations

According to Cheong, the coordination between crypto projects and market makers has created a “blackbox” scenario in which external observers, including retail and institutional investors, struggle to determine whether token prices reflect real supply and demand or are the product of manipulated mechanisms.

Cheong emphasized that such practices threaten to undermine market confidence and could ultimately render the broader crypto market “uninvestable.”

In his statement, Cheong criticized centralized exchanges for turning a blind eye to the problem, suggesting that the unchecked behavior is eroding trust across the altcoin market.

The biggest problem plaguing the liquid crypto market now is the complete blackbox of how projects and market makers can work together to create an artificial price that can sustain for a very long period.

You don’t know whether the price is a result of organic demand & supply…

— Arthur (@Arthur_0x) April 14, 2025

He highlighted the trend of tokens launched through Token Generation Events (TGEs) quickly losing value. In many cases, newly listed tokens have declined by 70% to 90% within a few months of their initial release. Cheong noted:

If the big players in the industry don’t step up to improve this, large part of the market will remain uninvestable for foreseeable future.

Community Response

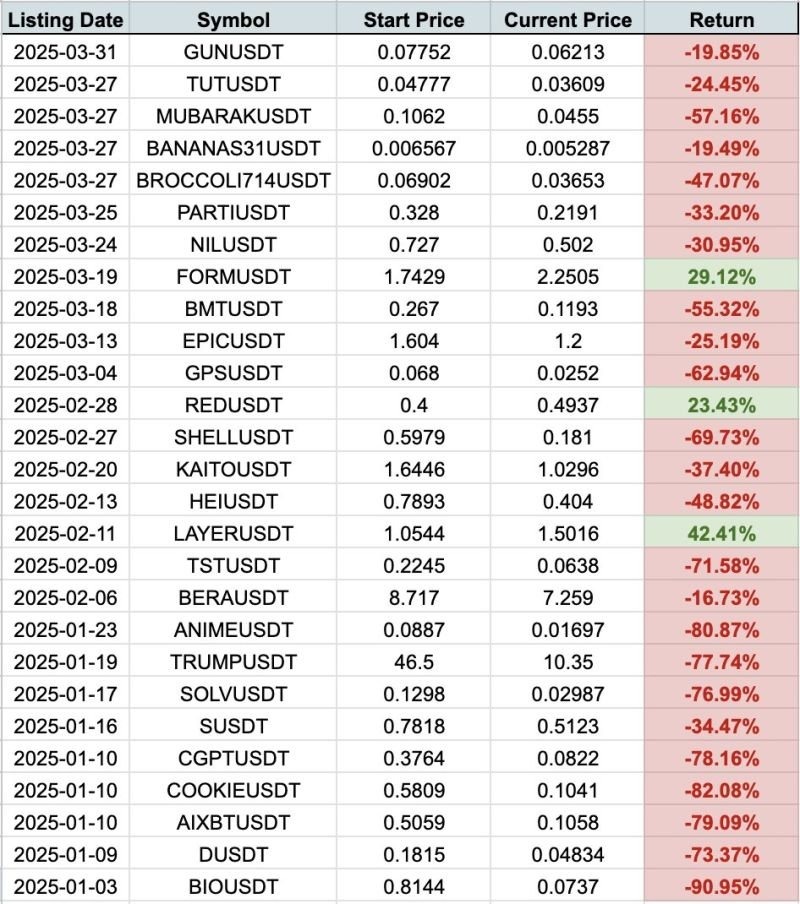

Supporting Cheong’s remarks, crypto analyst Miles Deutscher shared data indicating that only 3 out of 27 crypto tokens listed on Binance this year have managed to maintain positive price action.

The remaining 88% have experienced significant declines, with losses ranging from 19% to as much as 90%. Deutscher pointed to this trend as a contributing factor in the declining participation of retail investors.

This data including the statements by Cheong have sparked interesting reactions from the crypto community. Some users called out Binance and other exchanges to do the right thing and “demand more transparency and disclosure” from projects before listing.

CEXS should demand more transparency and disclosure before they list stuff. Hey @binance @coinbase maybe is crime szn with Trump. But the party will end sooner or later, and in EU it will get stricter so might as well start self-governing. You giving the industry a bad name.

— xKix – e/acc (Zack) (@0x_zak) April 14, 2025

Meanwhile, the other side of the community reactions believe that most cryptocurrencies are worthless from the start but with speculation backing their initial rise, they are doomed to fail in the end. X user known as Kun wrote:

It’s not an issue because if it was worth it you buy it If the value of a crypto business token relies on price that’s not investing but speculation only Most tokens are inherently worthless and people don’t know why they should own anything.

Featured image created DALL-E, Chart from TradingView