Tether mints another $1,000,000,000 USDT on Justin Sun’s Tron blockchain: TRX traders could profit

- Tether, the world's largest stablecoin issuer, mints another $1 billion worth of USDT on the Tron blockchain on Friday.

- Large stablecoin inflows during a market rally often indicate fresh buying pressure.

- As investors brace for US and China inflation reports, tokens like BNB, BGB and TRX could benefit from the volatile market swings.

Fresh $1B USDT Issuance signals liquidity surge on Tron network

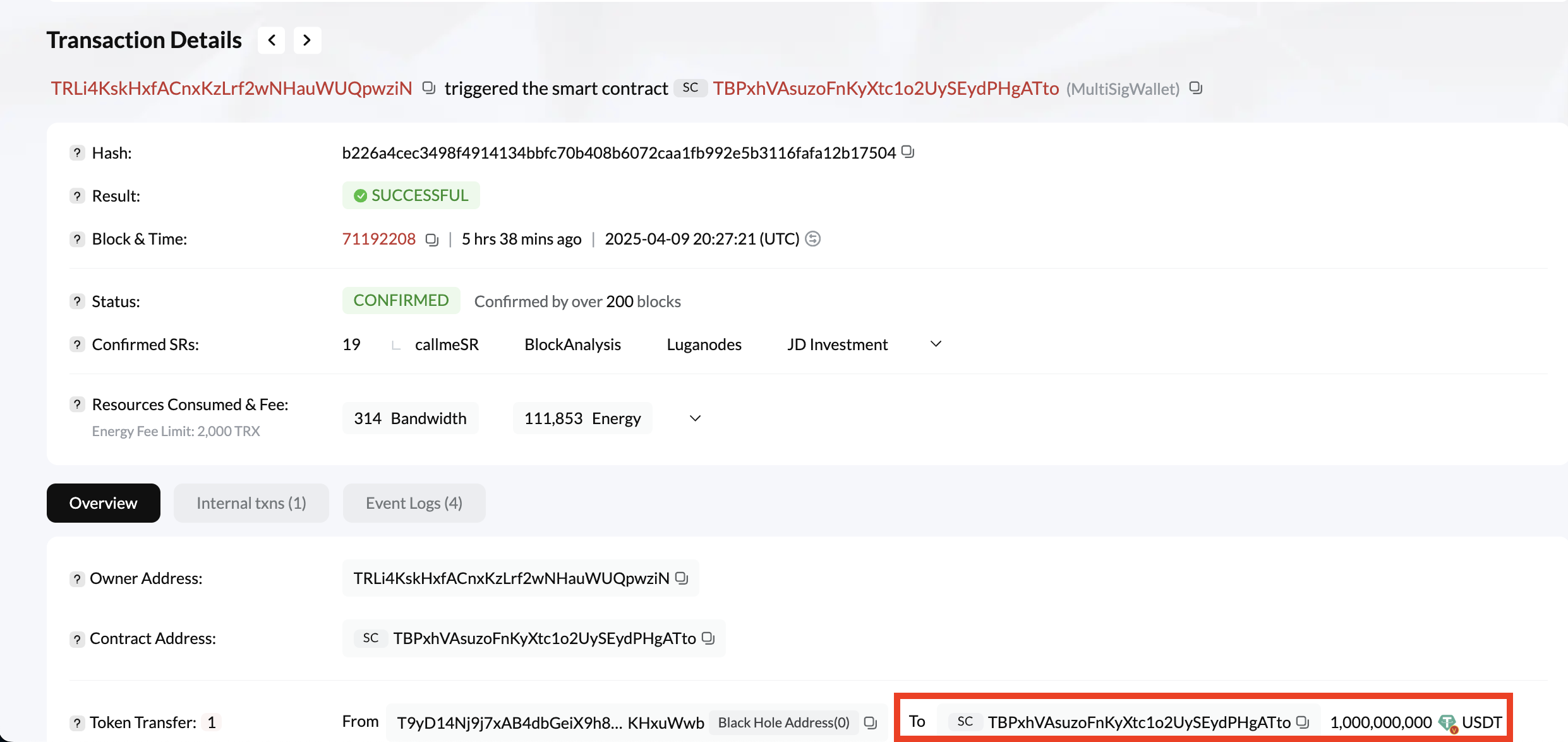

Tether, the world’s largest stablecoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain, according to Whale Alert data published Friday.

This issuance pushes Tether’s total USDT supply on Tron past $50 billion, reinforcing its dominance within the stablecoin sector.

However, timing of Tether’s latest mints—just ahead of crucial macroeconomic reports from both the U.S. and China—suggest it could be linked to traders looking to enter crypto positions to capitalize on potential short-term gains.

On the flip side, the $1 billion inflow could also provide firepower to scoop the dip if hawkish inflation indicators emerge from any or both of the world’s two largest economies on Thursday.

Notably the inflows coincided with Bitcoin price which briefly surpassed $83,600 after former U.S. President Donald Trump announced a rollback of the global tariffs. With CPI and PPI data looming, Tether’s $1 billion liquidity injection could provide directional momentum, depending on the outcome of each.

Tron On-chain metrics heat up as Tether mints another $1B in USDT

Tron’s blockchain fundamentals are flashing bullish signals, supported by a raft of intense on-chain activity amid the market turbulence.

On Wednesday, on-chain data from Tronscan shows that Tether’s the world’s largest stablecoin issuer executed another $1 billion USDT issuance on the network.

This aligns with the dominant narrative that investors begin to re-allocate capital towards crypto risk assets.

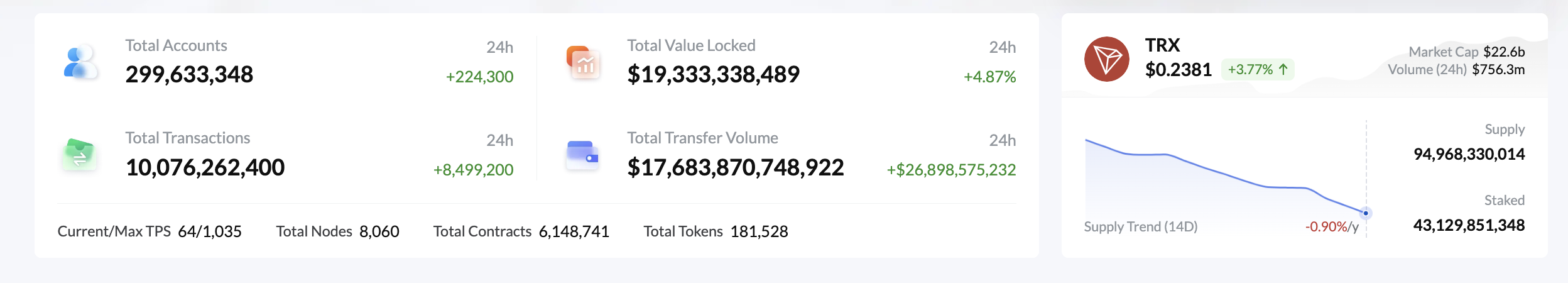

Validating this stance, Justin Sun’s Tron network expansion has accelerated significantly. According to real-time data from Tronscan, new TRX accounts surged by 224,300 in just 24 hours, bringing the cumulative count to 299.63 million. This uptick emphasizes rising user adoption and increased stablecoin activity as market turbulence heightens.

More importantly, Tron’s daily transaction count increased by 8.5 million, pushing the total number of all-time transactions past 10.07 billion. Simultaneously, the Total Value Locked (TVL) climbed 4.8% to $19.33 billion, reflecting a meaningful injection of new capital into the Tron DeFi ecosystem.

These headline metrics are further supported by deeper liquidity indicators. Over a 24-hour period, Tron’s transfer volume surged by $26.89 billion, lifting cumulative transfer volume to an impressive $17.68 trillion. This suggests capital is actively moving within the ecosystem—not just parked—which typically precedes demand pressure for TRX.

In essence, TRX supply-side dynamics paint a picture of tightening supply and enhanced investor sentiment after Trump’s decision to pause tariffs imposed on all US’ trade partners, except China.

TRX price primed for breakout amid liquidity wave

Historically, fresh stablecoin issuance—especially on Tron—has preceded surges in TRX and other related tokens. Much of the newly minted USDT fuels cross-border transfers, OTC desk settlements, and DeFi lending, all of which incur TRX gas fees.

Hence, periods of intense market volatility with traders rotating in and out of stablecoins often generate significant traction for the TRX token holder incentives, resulting in persistent buy pressure.

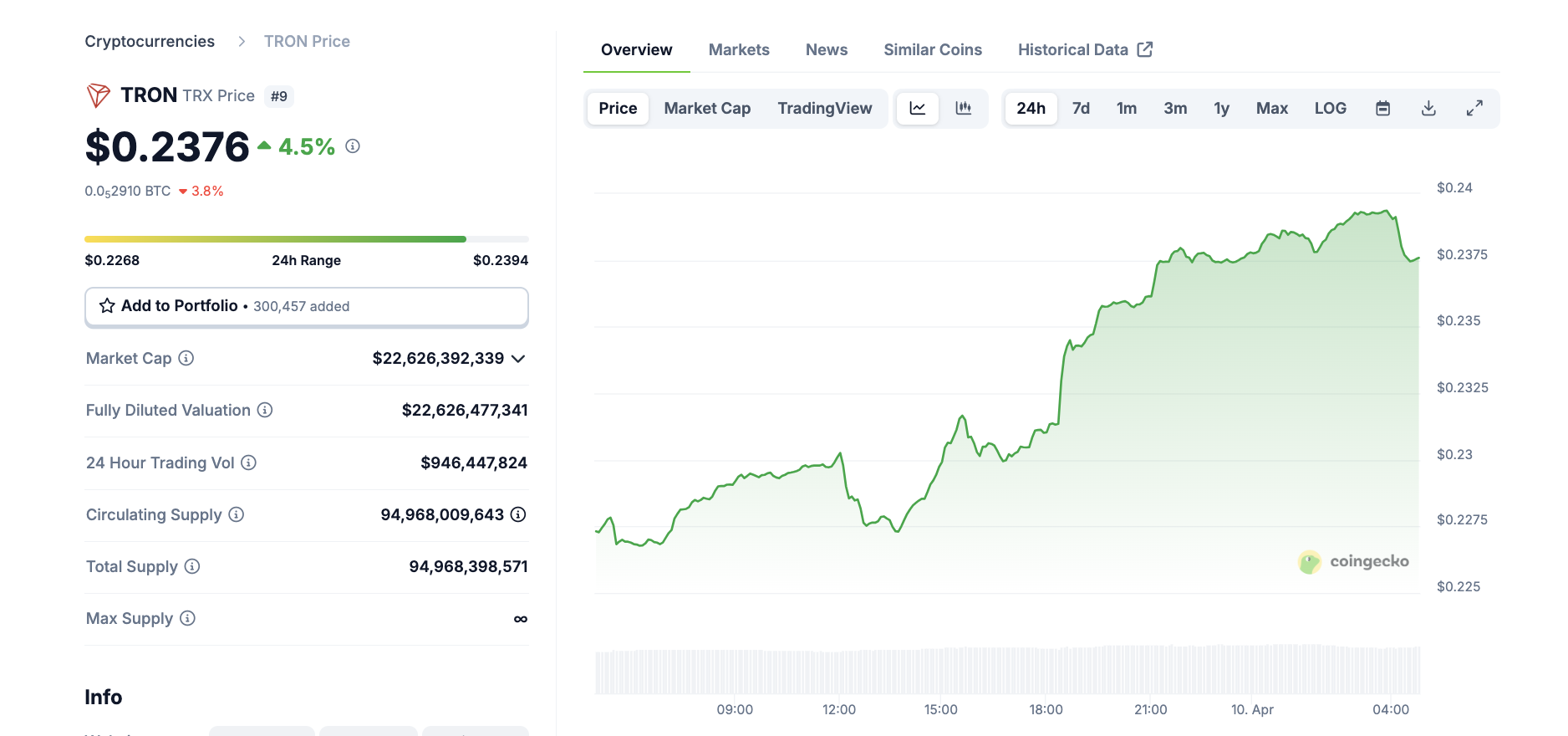

Tron (TRX) Price Action, April 10 | Source: Coingecko

With TRX price up 4.5% at press time on Thursday, trading at $0.2831 and 24-hour trading volume reaching $946 million, market sentiment is beginning to align with the on-chain strength.

Moreover, exchange balances for TRX have declined sharply in the past 48 hours, as investors migrate tokens to private wallets or stake them—another signal of reduced sell-side pressure and long positioning.

If upcoming macroeconomic data confirms dovish inflation trends, TRX may break through short-term resistance near $0.135, a level not seen in 30 days. This could see current TRX holders earn another 4.7% profit in the near term.