Toncoin Price Forecast: TON bulls target $4.6 mark as venture capital firms inject over $400 million

- Toncoin price hovers around $3.90 on Monday after rallying nearly 6% the previous week.

- TON Foundation announced on Thursday that it had raised over $400 million in Toncoin from venture capital firms in March.

- The technical outlook and open interest suggest a rally continuation, targeting $4.60.

Toncoin (TON) price hovers around $3.90 at the time of writing on Monday after rallying nearly 6% the previous week. TON Foundation announced on Thursday that it had raised over $400 million in Toncoin from venture capital firms in March. The technical outlook and open interest suggest a rally continuation, targeting $4.60.

TON announces $400 million investments for venture capital firms

The TON Foundation announced on Thursday that it had raised over $400 million in Toncoin from some prominent venture capital firms in March. Sequoia Capital, Benchmark, Ribbit Capital, Draper Associates, Vy Capital, Kingsway, CoinFund, Hypersphere, and others were among the participants.

“The scale of the round and the names involved make it one of the most significant institutional allocations in the crypto space in recent years,” says Ton’s blog post.

Over the past two years, crypto venture activity has cooled significantly. A funding round of this size and participation signals renewed institutional interest — especially since it was conducted in Toncoin tokens rather than equity, reflecting direct conviction in the token as a unit of value and providing investors with exposure to the network’s economy without the delays of legal structures or intermediaries. Thus bringing capital closer to real usage and shortening the gap between funding and utility, bolstering Toncoin’s bullish outlook.

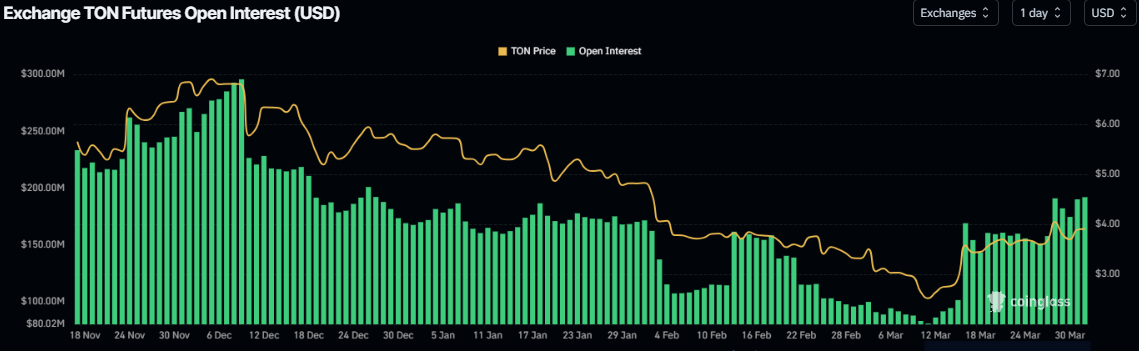

Another bullish sign is that TON’s Open Interest (OI) reaches a new yearly high. According to Coinglass’s data, the futures’ OI in TON at exchanges rose from $151.28 on March 26 to $192.20 million on Monday, the highest level this year. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the TON price.

TON’s Open Interest chart. Source: Coinglass

Toncoin’s technical outlook suggests a rally toward the $4.60 mark

Toncoin price broke above a descending trendline (drawn by connecting multiple highs since early December) in mid-March and consolidated the following days. After announcing $400 million in Toncoin from some prominent venture capital firms on Thursday, TON rallied over 10% that day, correcting the positive news-led move on Friday and Saturday. As of Sunday, it found support around the daily level at $3.68 and rallied 5.22%. At the time of writing on Monday, it hovers around $3.90.

If the daily support around $3.68 holds as support, TON could extend the rally to retest its net daily resistance at $4.62.

The Relative Strength Index (RSI) on the daily chart reads 60, above its neutral level of 50, and points upward, indicating increasing bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bullish crossover last week, giving a buy signal and suggesting a continuation of the upward trend.

TON/USDT daily chart

However, if TON closes below the daily support at $3.68, it could extend the decline to retest its March 16 low of $3.32.