Pi Network Price Forecast: PI token risks new record low amid bearish outlook

- Pi Network’s PI token edges lower to its record low of $0.3220 within a falling channel pattern.

- Rising CEXs' wallet balances indicate large PI deposits as risk-off sentiment intensifies.

- The technical outlook remains bearish, suggesting a potential new record low.

Pi Network (PI) recovers by 1% so far on Wednesday, following two consecutive days of losses that accounted for nearly 10%. The declining PI token price trend within a falling channel pattern risks further losses to a potentially new record low as large deposits to centralized exchanges (CEXs) boost selling pressure.

Large deposits to CEXs signal increased selling pressure

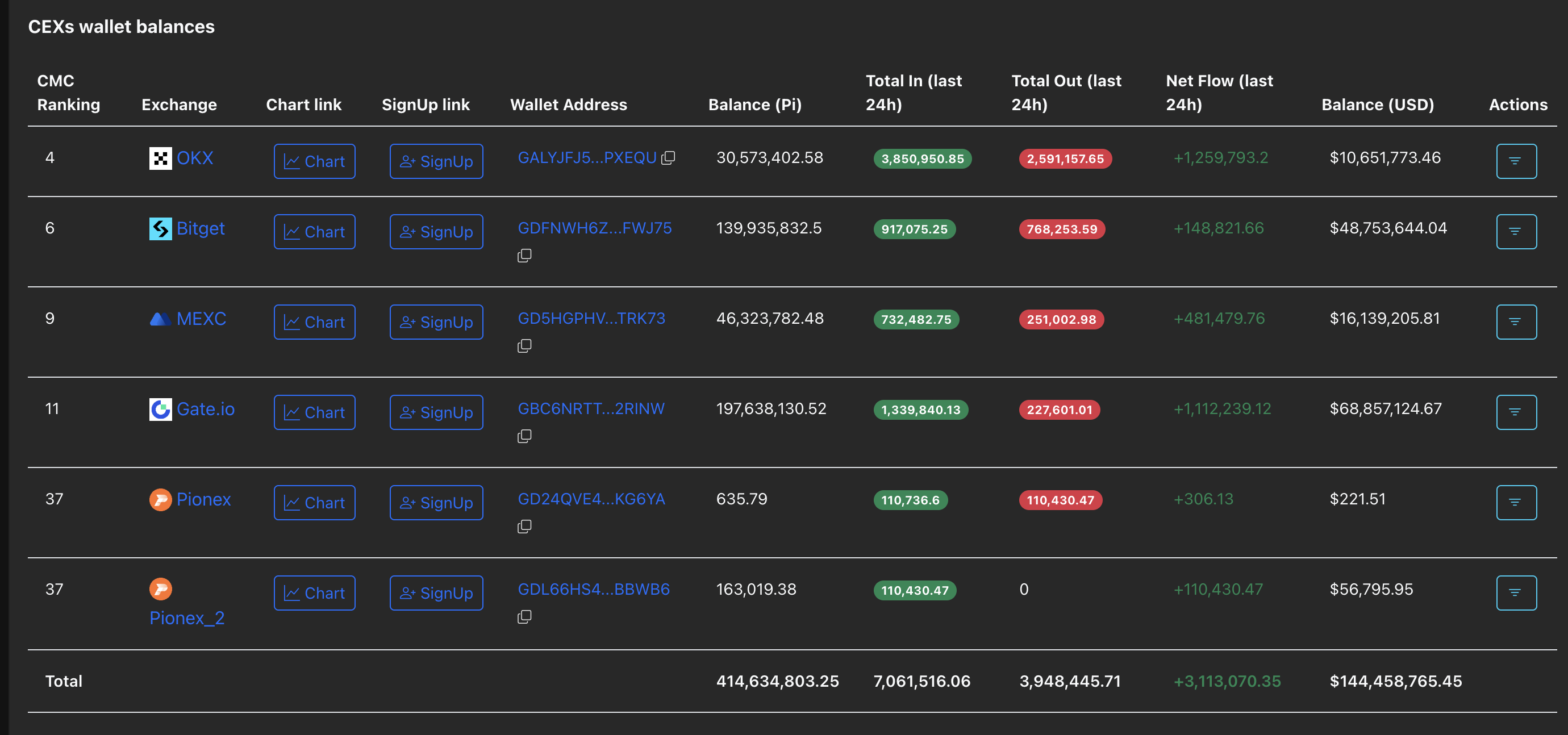

PiScan data shows that the 7.06 million PI token inflows to the CEXs' wallet balances outpaced the 3.94 million PI outflow, resulting in a net inflow of 3.11 million PI tokens, which is worth nearly $1.08 million at the current price. The 3.11 million net PI token inflow results in a 0.75% increase in the CEXs' wallet balances, rising to 414.63 million PI tokens.

CEXs Wallet Balances. Source: Coinglass

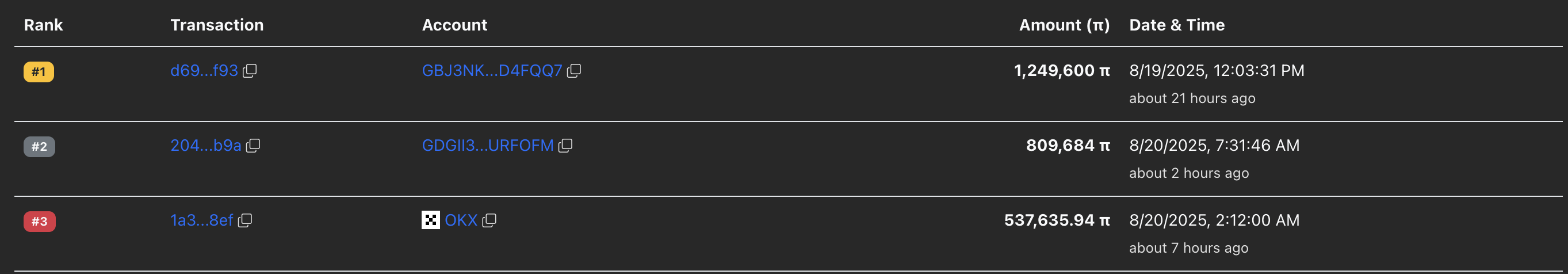

It is worth noting that two out of the three largest transactions on the Pi Network over the last 24 hours are large deposits to the OKX exchange. The transactions refer to 1.24 million and 809,684 PI tokens. Typically, an increase in exchange reserves driven by large deposits signals a risk-off sentiment among investors, fueling the correction phase.

Large transactions. Source: Coinglass

Pi Network risks further losses in a falling channel

PI trades at $0.3481 at press time on Wednesday, with bulls attempting to halt the third consecutive bearish candle on the daily chart. Still, price action on the same chart highlights a pullback phase in a falling channel pattern, with bears targeting $0.3220, the all-time low recorded on August 1.

A decisive push below this level could retest the falling channel’s lower boundary level near $0.2700 for a fresh record low.

The Relative Strength Index (RSI) reads 42 on the daily chart as it hovers above the oversold boundary line. This suggests a bearish momentum, with further room for correction.

The Moving Average Convergence Divergence (MACD) crosses below its signal line, signalling a bearish turnaround in trend momentum.

PI/USDT daily price chart.

Looking up, the PI token should reclaim the $0.4000 level to retest the overhead trendline at $0.4342.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.