Chainlink Price Forecast: LINK rebounds as Bitget integrates Chainlink Proof of Reserve for BGBTC

- Chainlink price recovers nearly 4% on Wednesday after correcting 8.6% the previous day.

- Bitget exchange announces the adoption of Chainlink Proof of Reserve on Ethereum for BGBTC.

- Bullish momentum builds as rising open interest and expanding adoption strengthen LINK’s outlook.

Chainlink (LINK) recovers by 4%, trading above $24 at the time of writing on Wednesday, after an 8.6% pullback on the previous day. The rebound was supported by Bitget’s announcement of adopting Chainlink’s Proof of Reserve on Ethereum (ETH) for its wrapped Bitcoin asset (BGBTC), reinforcing the oracle network’s growing role in enhancing transparency. Adding to this optimism, Chainlink’s expanding partnerships and adoption highlight its broader use cases, strengthening the bullish outlook for LINK.

Chainlink’s growing adoption hints at a bullish picture

Bitget, a cryptocurrency exchange, announced on Tuesday the adoption of Chainlink Proof of Reserve on Ethereum to provide real-time transparency for BGBTC. The adoption by Bitget utilizes decentralized oracle networks to verify the reserve balances backing tokenized assets autonomously, ensuring that BGBTC’s backing is independently audited without relying on manual disclosures.

“Transparency is essential in the digital asset industry,” said Gracy Chen, CEO of Bitget. Chen continued: “By adopting Chainlink’s industry-leading Proof of Reserve, we’re giving our users and institutional partners the assurance they deserve, knowing that BGBTC is always verifiably backed. This is another step in our mission to deliver secure, transparent, and innovative products for the Web3 space.”

Apart from the announcement, Chainlink’s expanding partnerships and increasing adoption highlight the network’s broader use cases and strengthen its long-term growth potential. On Wednesday, Lendr.fi, a Liquid-Staked Real World Asset Tokens Web3 company, has adopted the Cross-Chain Token (CCT) standard, enabling its native token, RWAL, to be natively transferable across chains via Chainlink CCIP.

Earlier this week, DeFi protocol Pendle_fi adopted the Chainlink data standard on Arbitrum and Base to power its newly launched futures platform, Boros. Last week, Chainlink announced a partnership with ICE Markets to bring high-quality derived forex and precious metals data onchain, and accelerate mainstream adoption of onchain finance.

Derivatives data hints at an upward trend ahead

Futures’ Open Interest (OI) in Chainlink at exchanges, which has been constantly rising since early August, rose to an all-time high of $1.75 billion on Tuesday and currently stands at $1.48 billion. Rising OI represents new or additional money entering the market and new buying, which could fuel the current LINK price rally.

LINK Open Interest chart. Source: Coinglass

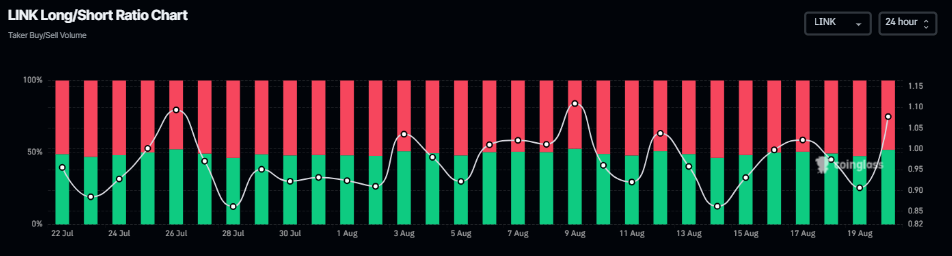

Chainlink’s Coinglass long-to-short ratio data indicate that the bullish bet among traders is also rising, nearing its monthly high, which reflects bullish sentiment in the markets.

LINK long-to-short ratio chart. Source: Coinglass

Chainlink Price Forecast: LINK bulls aim for higher leg

Chainlink price surged to reach the January 31 high of $26.37 on Monday, and declined 8.61% the next day. At the time of writing on Wednesday, it recovers over 4%, trading at $24.63.

If LINK continues its recovery, it could extend the rally toward its key resistance at $26.37. A successful close above this level could extend the gains toward the December 13 high of $30.94.

The Relative Strength Index (RSI) stands at 63 and points upward on the daily chart, indicating bullish momentum. Meanwhile, the Moving Average Convergence (MACD) bullish crossover since August 8 still holds, suggesting continuation of the upward trend, but the fading green histogram bars hint at vanishing bullish strength.

LINK/USDT daily chart

However, if LINK faces a correction, it could extend the decline toward its daily support at $22.05.