GBP/USD dips after UK Retail Sales slump, Dollar finds footing on trade jitters

- GBP/USD trades at 1.3456, down 0.07%, after UK Retail Sales plunge 2.7% MoM in May.

- DXY holds near weekly highs as US mulls revoking chip waivers for China-linked allies.

- Traders eye next week’s UK GDP and US Core PCE data amid mixed Fed signals.

The Pound Sterling registers minimal losses during the North American session, after UK Retail Sales data disappointed investors, while the Greenback recovers some ground. Currently, the GBP/USD is trading at 1.3456, down 0.07%.

Sterling slips as UK data disappoints and risk sentiment sours on US chip waiver threat and Fed inflation concerns

Market mood turned mildly sour as newswires revealed that the “US may revoke waivers for allies with semiconductor plants in China,” as Bloomberg reported. This would typically underpin the buck, which, according to the US Dollar Index (DXY), trades with minimal losses of 0.10% at 98.62, but is set for weekly gains of over 0.57%.

Data in the United States (US) reveals that the economy is slowing down, as indicated by the latest Philadelphia Fed Manufacturing Index in June, which dropped to -4, unchanged from May but worse than the estimated -1 contraction.

In the meantime, the Fed's monetary policy report recently revealed that there are early signs that tariffs are contributing to higher inflation. However, their full impact has yet to be reflected in the data. The report added that the current policy is well-positioned and that financial stability is resilient amid high uncertainty.

The report contrasted with comments of Fed Governor Christopher Waller, who said the Fed could cut interest rates as soon as July.

In the UK, Retail Sales registered its worst monthly drop since 2023, plunging -2.7% MoM in May, exceeding forecasts of -0.5% contraction and April’s 1.7% growth. The report followed the Bank of England's (BoE) decision to hold rates unchanged, in what was perceived as a dovish hold, on a 6-3 vote split.

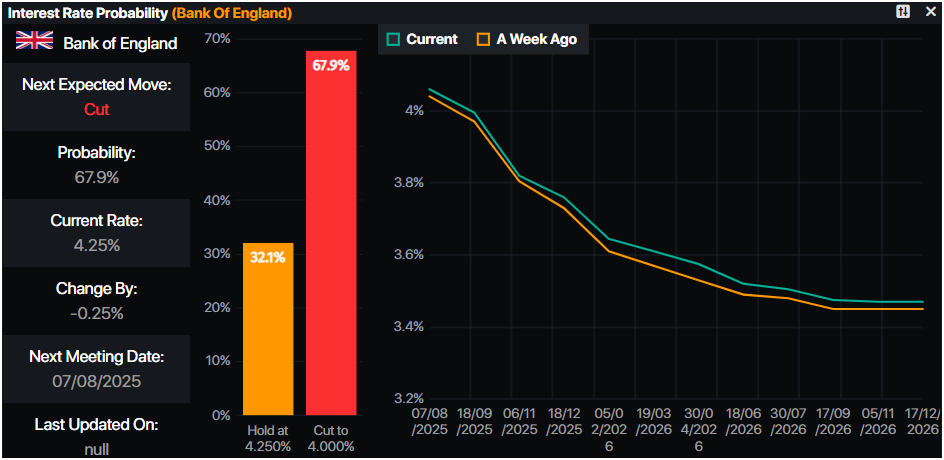

Markets had priced in a near 60% chance that the BoE would reduce rates at August’s meeting.

Source: Prime Market Terminal

Next week, the UK–US economic calendar

The UK docket will feature speeches by BoE members, S&P Global Flash PMIs, and Gross Domestic Product (GDP) figures for Q1 2025. Across the pond, the US schedule will feature Flash PMIs, housing data, Consumer Confidence, Fed speeches, first-quarter GDP numbers, Durable Goods Orders, and the release of the latest Core PCE inflation figures.

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains upward biased but remains capped by 1.3500 and the 20-day SMA at 1.3515. Although momentum shifted bullish as shown by the Relative Strength Index (RSI), a daily close below the June 19 high of 1.3469 opens the door for further downside.

Key support lies at 1.3450, 1.3400 shy of the 50-day SMA. On the other hand, bulls would target 1.3550 if they reclaim 1.3500 and the 20-day SMA. This would pave the way for retesting the yearly high at 1.3631.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.17% | 0.73% | 0.92% | 1.10% | 0.37% | 0.79% | 0.70% | |

| EUR | -0.17% | 0.44% | 0.74% | 0.95% | 0.33% | 0.63% | 0.54% | |

| GBP | -0.73% | -0.44% | 0.31% | 0.50% | -0.11% | 0.18% | 0.09% | |

| JPY | -0.92% | -0.74% | -0.31% | 0.17% | -0.85% | -0.50% | -0.63% | |

| CAD | -1.10% | -0.95% | -0.50% | -0.17% | -0.65% | -0.31% | -0.40% | |

| AUD | -0.37% | -0.33% | 0.11% | 0.85% | 0.65% | 0.29% | 0.20% | |

| NZD | -0.79% | -0.63% | -0.18% | 0.50% | 0.31% | -0.29% | -0.09% | |

| CHF | -0.70% | -0.54% | -0.09% | 0.63% | 0.40% | -0.20% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).