An on-chain analyst has explained how Bitcoin could be in the middle of a decision point based on its supply cost basis distribution.

Bitcoin Is Currently Retesting A Major Supply Cluster

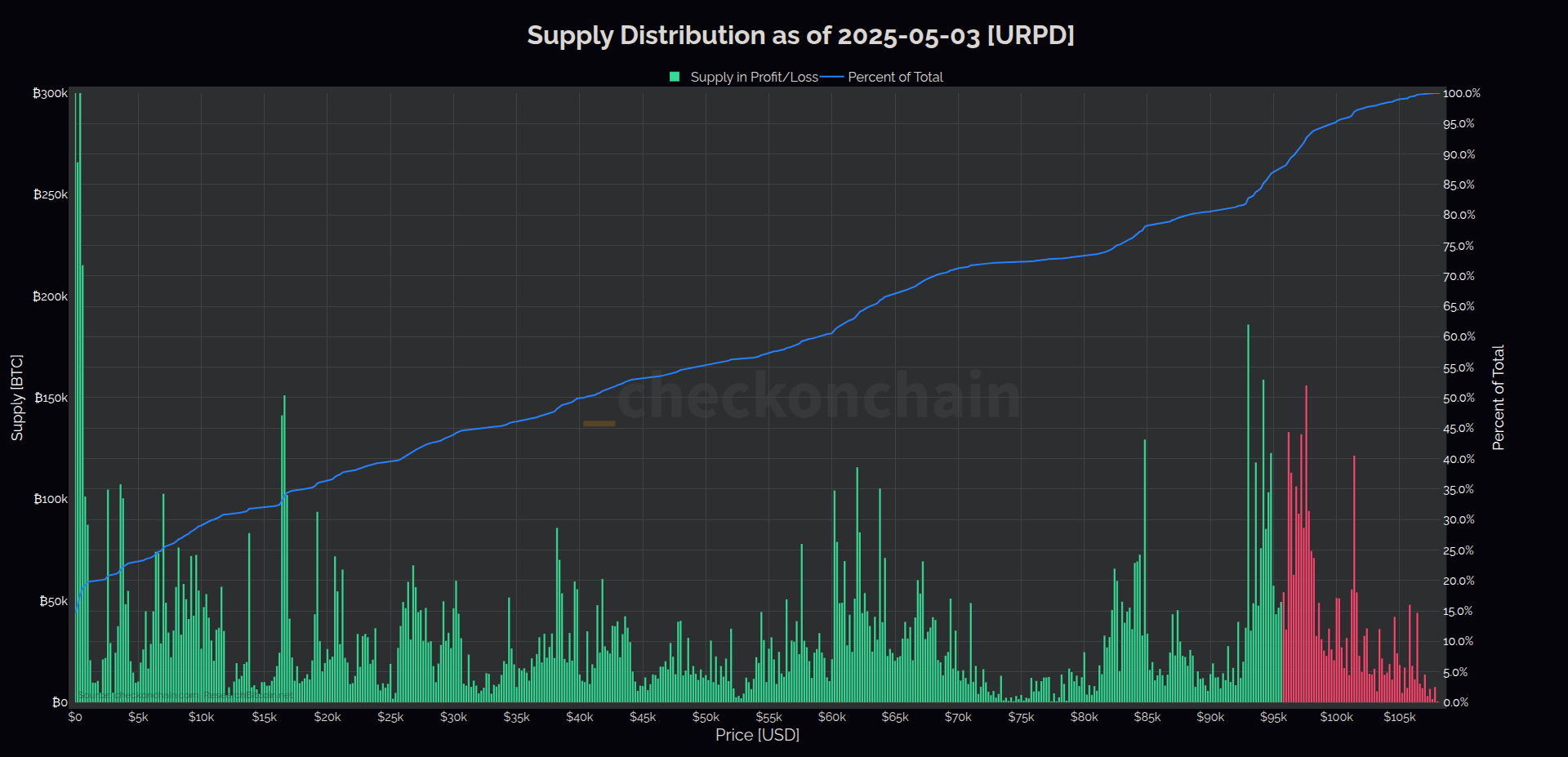

In a new post on X, analyst Checkmate has talked about how Bitcoin is looking based on its UTXO Realized Price Distribution (URPD). The URPD is an on-chain indicator that tells us about what part of the BTC supply was last purchased at the different price levels that the cryptocurrency has visited in its history.

Below is the chart for the metric that the analyst shared in the post.

As is visible in the graph, a notable part of the Bitcoin supply was purchased around the price range that BTC has been trading inside recently. In particular, there seem to be two massive supply clusters at these levels.

When Checkmate shared the chart yesterday, the cryptocurrency’s price was trading right between the two supply walls. That is, investors who bought in the lower of the walls were in the green and those who did at the upper one were underwater.

The analyst called the asset’s location as being “right in the middle of a decision point.” This is because of the fact that any large move up or down from that point would have an effect on the profit-loss status of a large amount of addresses.

In on-chain analysis, large supply walls under the spot BTC price are assumed to be locations of probable support, as the investors who bought there might defend their break-even mark during a retest.

Similarly, the levels above can act as resistance, as those holders might take the opportunity to sell the cryptocurrency and get out with the whole of their investment back.

Since the post, Bitcoin has seen a small pullback, so the asset is now leaning toward the green supply zone. It’s possible that this area would help keep BTC from falling under, given the large amount of supply that was purchased inside it.

Naturally, where it goes next could end up having a major effect on the market sentiment. As Checkmate puts it, “all it will take is one big red or green candle from here to convince people of a lower high, or bull continuation, respectively.”

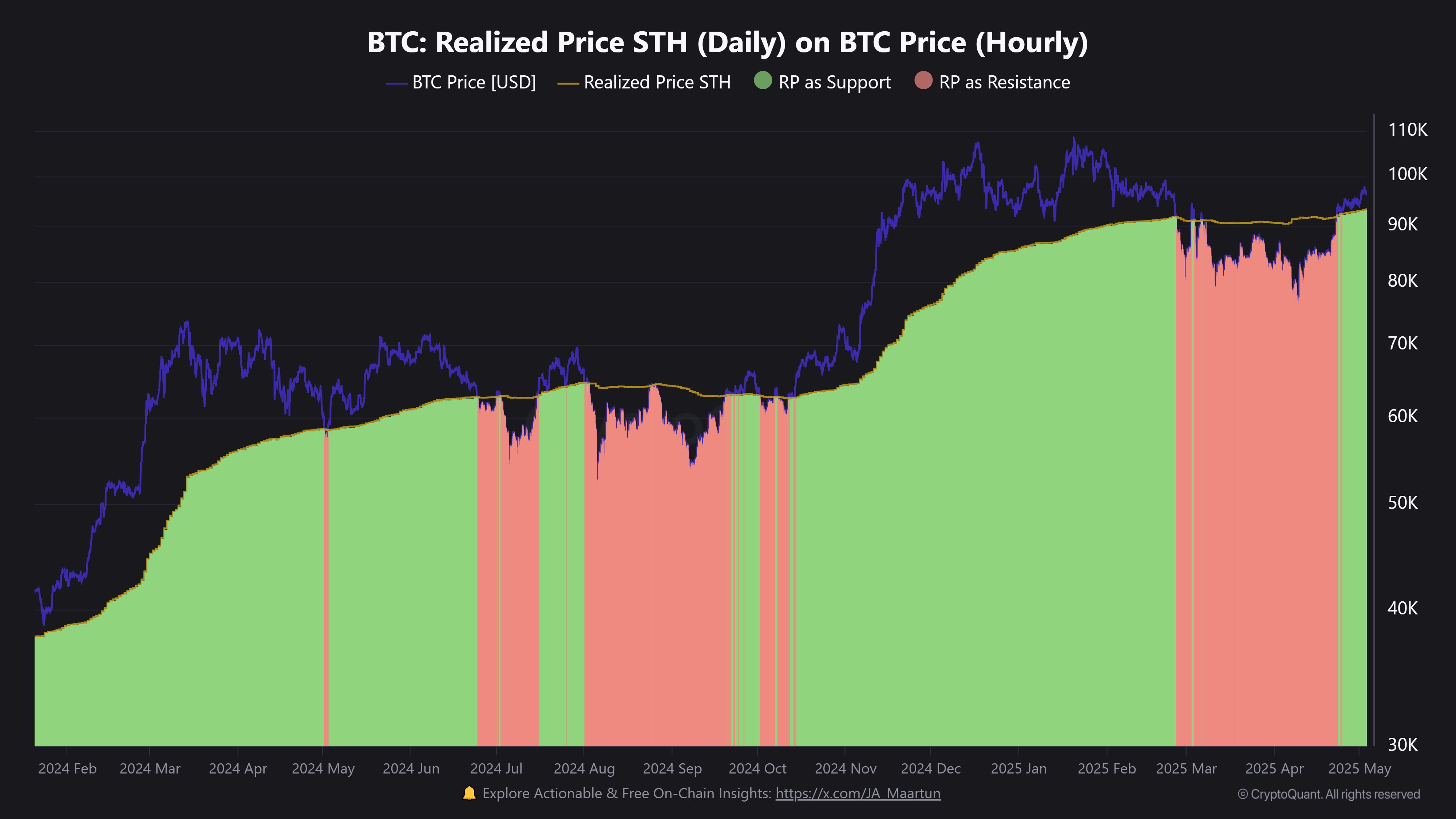

Bitcoin is currently also near a macro on-chain support level: the short-term holder Realized Price. As CryptoQuant community analyst Maartunn has explained in an X post, this level is situated at $93,364.

The short-term holder Realized Price refers to the average cost basis of the Bitcoin holders who purchased their coins within the past 155 days. This level has historically served as a boundary between bullish and bearish trends for BTC.

BTC Price

At the time of writing, Bitcoin is floating around $94,000, down 1.5% in the last 24 hours.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.