[IN-DEPTH ANALYSIS] Costco: Balancing Stability with Growth Opportunity

Investment Thesis

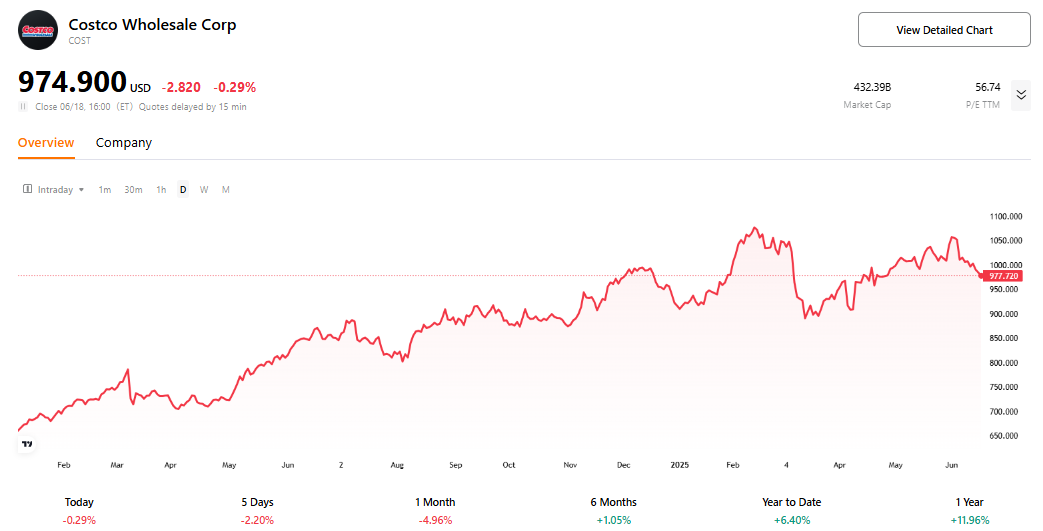

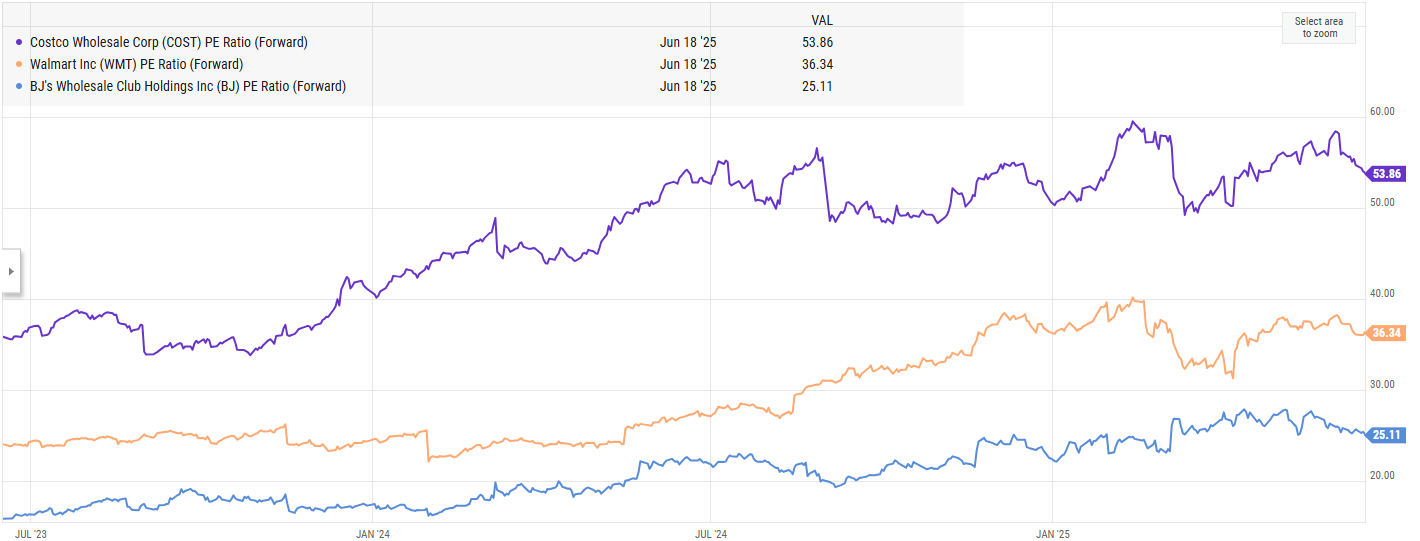

Costco has built a competitive moat through its unique membership-based warehouse business model, featuring low prices, high volumes, and a synergy between private-label and curated products. Its solid fundamentals, including high renewal rates, consistent comparable sales growth, nearly $15 billion in cash reserves, and a low-leverage financial structure, have demonstrated strong resilience during macroeconomic fluctuations.Despite short-term challenges such as high inflation, tariff policies, and the e-commerce transformation, Costco's flexible supply chain, global expansion potential, and digital investments ensure its long-term growth momentum remains robust. Although its current P/E ratio of 54 is high, the 90% renewal rate and 60% market share justify its premium valuation. The target price is set at $977.4.

Source: TradingKey

Company Overview

Costco is a retail enterprise centered on membership-based warehouse clubs, founded in 1976 with its headquarters in Washington State, USA. Its unique business model is based on charging membership fees, offering bulk goods and discount services to members, covering multiple categories such as food, daily necessities, electronic products, and home furnishings. As of 2025, Costco operates approximately 905 warehouse stores worldwide, with 624 located in the United States, covering markets in North America, Europe, Asia, and more.

Market Advantages of Warehouse Membership Retail and Costco’s Competitive Landscape

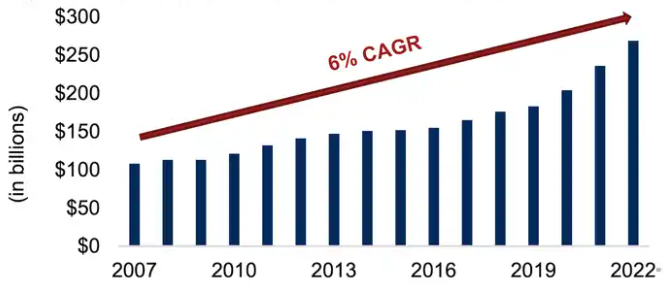

Wholesale membership retail is renowned for its low costs and high cost-effectiveness, and is regarded as an alternative to traditional supermarkets. Its advantages are not only reflected in the cost savings brought by bulk purchases, but also in the convenience of one-stop shopping and value-added services such as exclusive discounts and in-store rewards for members. In recent years, influenced by the pandemic and inflation, consumers' shopping habits have undergone significant changes, tending towards more cost-effective options. This has led to record-high renewal rates for almost all membership stores, and the market size has expanded at an accelerated pace in the post-pandemic era.

Source: CFRA Research, “Club Stores: Prepare for a New Era of Expansion” report, Arun Sundaram.

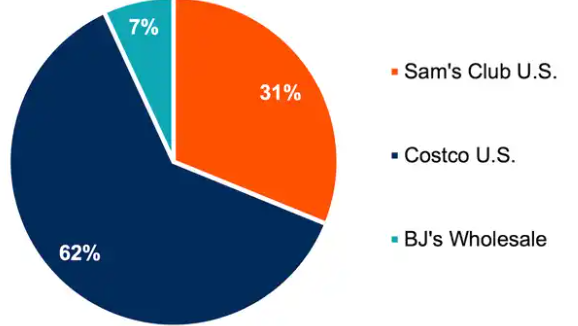

Costco's main competitors include Sam's Club and BJ's Wholesale Club, both of which also adopt a membership system and bulk sales model, with a highly overlapping target customer base. In addition, large retailers like Target and e-commerce giant Amazon also pose a certain degree of competition, but their business models are more inclined towards traditional retail or online shopping, and the competition with Costco's warehouse membership system is relatively indirect. According to CFRA Research, Costco holds a dominant position in the US warehouse membership retail market, with a market share of over 60%. This advantage is attributed to its unique business model, including a curated product assortment, efficient supply chain management, and continuous optimization of member value.

Source:CFRA Research, “Club Stores: Prepare for a New Era of Expansion” report, Arun Sundaram.

Costco’s Business Model: Simplicity Meets Sophistication

Costco's business model appears to be very simple: it charges an annual membership fee, sells large packages of goods at low prices, and achieves profitability through high sales volume. However, behind this seemingly straightforward model lies a crafted strategy, integrating low profit margins, private labels, curated product selection, and the membership system, to create a unique competitive advantage.

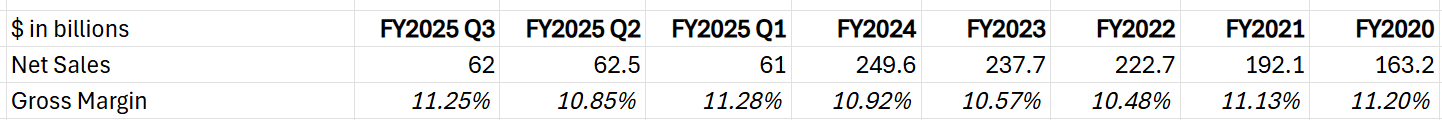

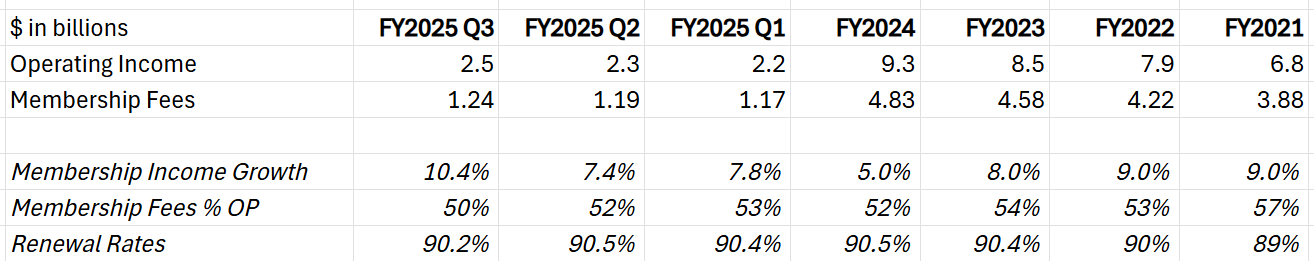

Low Profit Margins and Synergy with Private Labels: The gross profit margin of Costco's products is approximately 11%, significantly lower than that of traditional retailers. It achieves profitability through a cycle of low prices and high volumes - low prices attract customers, high sales enhance purchasing power, and further reduce costs. This isn’t mere “low-margin, high-turnover” tactics, but rather achieves differentiation through its own brand Kirkland Signature. By providing products of comparable quality to well-known brands but at lower prices, Costco enhances its uniqueness. Moreover, the profit margin of private labels is usually higher than that of ordinary products, effectively compensating for the low gross profit. Kirkland Signature products account for approximately 33% of total sales, and their sales even exceed those of Lowe's and P&G, and grow faster than the overall business, providing strong support for profitability.

Source: Costco, TradingKey

Curated Selection Boosts Efficiency: Costco offers only about 4,000 selected products (SKU), far fewer than the tens of thousands offered by traditional retailers. This "limited selection" strategy simplifies inventory management and logistics, accelerates inventory turnover (about 12 times per year, higher than competitors), significantly reduces storage and operational costs. At the same time, selected products avoid the "choice paradox" for consumers, helping them quickly access to high-quality, low-priced goods, thereby enhancing shopping satisfaction.

Source: Costco, TradingKey

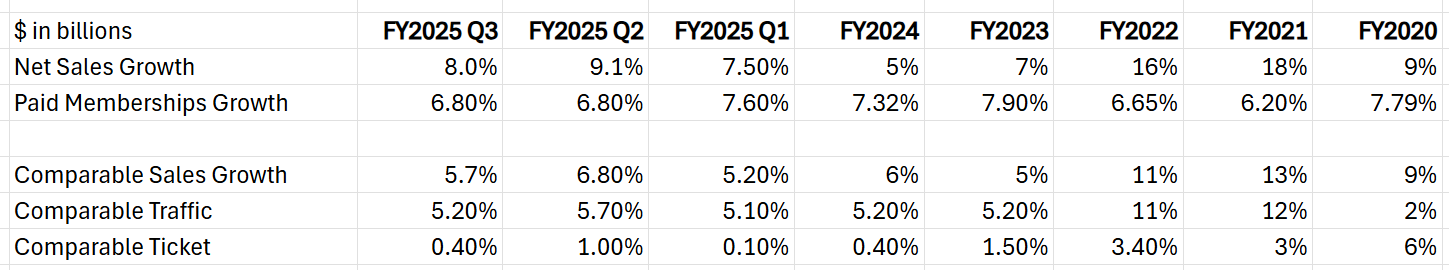

Membership Model Ensures Stable Revenue: Costco has attracted a stable customer base through its unique operation model, and has built a stable revenue foundation by charging annual membership fees to its members (basic membership $60, premium membership $120). In the fiscal year 2024, Costco's membership fee income exceeded $4.8 billion, contributing the majority of its operating profits. Additionally, the membership fee threshold filters out high-income groups with strong consumption capabilities and high loyalty, not only helping to retain customers but also encouraging repeat purchases, thereby strengthening the economic value of the membership system.

Source: Costco, TradingKey

Why Did Costco's Stock Decline Despite Strong Earnings?

Although the company's third-quarter earning report for the fiscal year 2025 showed impressive results, with earnings per share at $4.28 (vs. $4.24 expected) and revenue at $63.21 billion (vs. $63.19 billion expected), both exceeding market expectations, the stock price nevertheless declined. We attribute this to the following reasons:

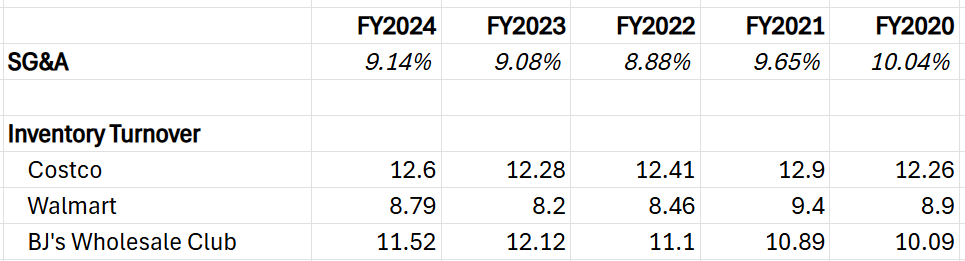

Slowing Core Metrics: Although the overall financial data is positive, Costco's key operational indicators indicate signs of sluggish growth. The net sales growth rate, comparable sales growth rate, and paid membership growth rate all show a trend of deceleration, especially the comparable sales growth has significantly weakened. The data indicates that growth mainly relies on comparable customer traffic rather than higher average ticket sizes, and the low average ticket sizes growth has dragged down the overall performance. Investors may therefore express concerns about Costco's long-term growth momentum.

Source: Costco, TradingKey

Tariff Policy Pressures Operations: Trump's tariff policies pose challenges to Costco's supply chain and cost management. The management disclosed that to avoid the additional costs brought by tariffs, Costco transported some goods in advance, resulting in inventory buildup and increased logistics complexity, and consequently, operational costs rose. Investors may be concerned that the uncertainty of tariff policies will continue to affect operational efficiency and even erode profitability.

Macroeconomic Pressures Consumption: In an environment of high inflation, consumers' purchasing power has declined, which has restricted the growth of Costco's sales. The US consumer confidence has dropped to a three-year low, and the willingness to purchase non-essential items has significantly weakened. As a membership-based retailer, Costco relies on a low-price strategy to attract customers, but the inflationary pressure has led consumers to reduce bulk purchases and consumption of high-priced goods. The latest data shows that comparable sales growth slowed in May, and the performance of categories other than food and daily necessities was particularly weak.

Will Costco’s Stock Plummet?

The answer is negative. From a fundamental perspective, the company operates stably and its business continues to progress. Its comparable sales have maintained growth, membership revenue has steadily increased, the renewal rate remains high, demonstrating the high loyalty of members. These core indicators all indicate that Costco's business model remains strong, providing a solid foundation for its market performance.

Resilient Model Gains Institutional Support: Although the weak macroeconomic conditions may have some impact on Costco, its non-cyclical industry positioning and membership-based business model provide strong support. In 2024, institutional investors reduced their allocation to non-cyclical industries due to an increase in risk appetite. However, since the beginning of 2025, the intensification of macroeconomic uncertainty has led to a decline in institutional risk appetite, and the non-cyclical industries with strong defensive capabilities have regained favor. According to TradingKey's Star Investors data, the proportion of institutional holdings (72.25%) and the number of holding institutions of Costco have continued to rise in recent quarters, attracting well-known institutions such as Vanguard, BlackRock, State Street, and Geode Capital Management. This trend highlights the confidence of institutions in Costco's stable business model and long-term growth potential, strengthening its investment value.

Get started

The Impact of Tariffs is Limited: Future tariff policies may increase the costs for the retail industry, but the impact on Costco is relatively manageable. The proportion of imported goods in Costco's U.S. business is only about 33%, and the imports from China, Mexico, and Canada account for less than 15%. Moreover, Costco only sells approximately 4,000 SKUs, with a streamlined product range. Combined with its strong purchasing capabilities and rapid inventory turnover rate, it enables it to flexibly replace goods affected by tariffs. Costco's low-price strategy further enhances its competitiveness. In the future, it may continue to attract consumers and increase market share by maintaining low prices and widening the price gap with competitors.

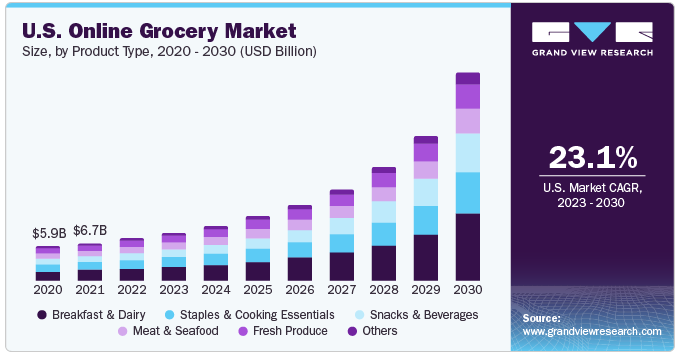

E-commerce Business Progresses Steadily: The pandemic has accelerated the shift of American consumers to online grocery shopping. The online grocery market is expected to grow at a compound annual growth rate (CAGR) of 23.1% from 2023 to 2030. Costco's e-commerce business started relatively late. In the past few quarters, the growth rate of its e-commerce sales was 16%, which was lower than the industry average. However, the company is actively investing in distribution infrastructure to enhance its online capabilities. Recently, Costco collaborated with Affirm to launch a "buy now, pay later" program, providing more flexibility for members to purchase high-priced goods, further stimulating online consumption. With the enhancement of e-commerce capabilities, Costco is expected to occupy a larger share in the rapidly growing online market.

Source: grandviewresearch

Robust Financial Position: Costco boasts a healthy balance sheet, with nearly $15 billion in cash on hand and an annual free cash flow of over $6 billion, providing it with ample financial flexibility. The debt-to-equity ratio is only 30%, significantly lower than the industry average, indicating low leverage and strong risk-resistance capabilities. This healthy financial condition enables Costco to maintain strategic initiative in uncertain environments, whether it is responding to external shocks or increasing investment.

Valuation Analysis: Is the High Premium Justified?

Driven by strong membership growth, continuous comparable sales growth and a solid financial foundation, Costco's current forward P/E ratio is 54 times, approaching historical highs, with a PEG ratio exceeding 5, far higher than that of its competitors, indicating little room for error in its valuation. However, its operational resilience, global business expansion and the stability brought by the 90% high renewal rate of the membership system support the rationality of the valuation premium. If international market expansion and digital transformation continue to progress, long-term growth potential is expected and the high valuation may be maintained. Nevertheless, considering the macroeconomic and competitive pressures in the coming year, a 45 times P/E ratio seems to be a relatively reasonable valuation level, meaning the target price is $977.4.

Source: YCHARTS

Risks

Although Costco has a solid fundamental foundation, it still faces several risks. Firstly, a valuation correction may occur. If the market no longer supports its "quality first" strategy, the current price-to-earnings ratio of over 50 times may be reduced. Secondly, signs of a slowdown in comparable sales growth have emerged. If it continues to maintain low single-digit growth rates, the market may question the rationality of its high valuation. Additionally, international expansion challenges are also a major risk. Especially in new markets like China, any strategic mistakes could lead to high costs. Finally, a downturn in the macroeconomy may affect consumer demand. Even though Costco's non-cyclical nature offers resilience, it is difficult for it to be completely immune. These risks need to be closely monitored, but Costco's stable business model and financial strength provide it with a buffer to cope with challenges.