Microsoft’s Market Cap Reaches $3.48 Trillion—Is the AI Dividend Still Driving Global Leadership?

TradingKey - Microsoft’s stock hit a new all-time high on June 5, 2025, closing at USD 467.68 per share.

This performance has been driven by sustained expansion in its cloud computing and artificial intelligence businesses, particularly the commercial progress of the Copilot AI agent, which has drawn increasing market attention.

Analysts at Jefferies pointed out that Microsoft plans to launch reasoning-capable Copilot agents—dubbed the “Researcher” and “Analyst” editions—within the year. These advanced tools are expected to accelerate deep integration of AI among enterprise users, thereby driving synergistic growth across Azure cloud services and cybersecurity offerings.

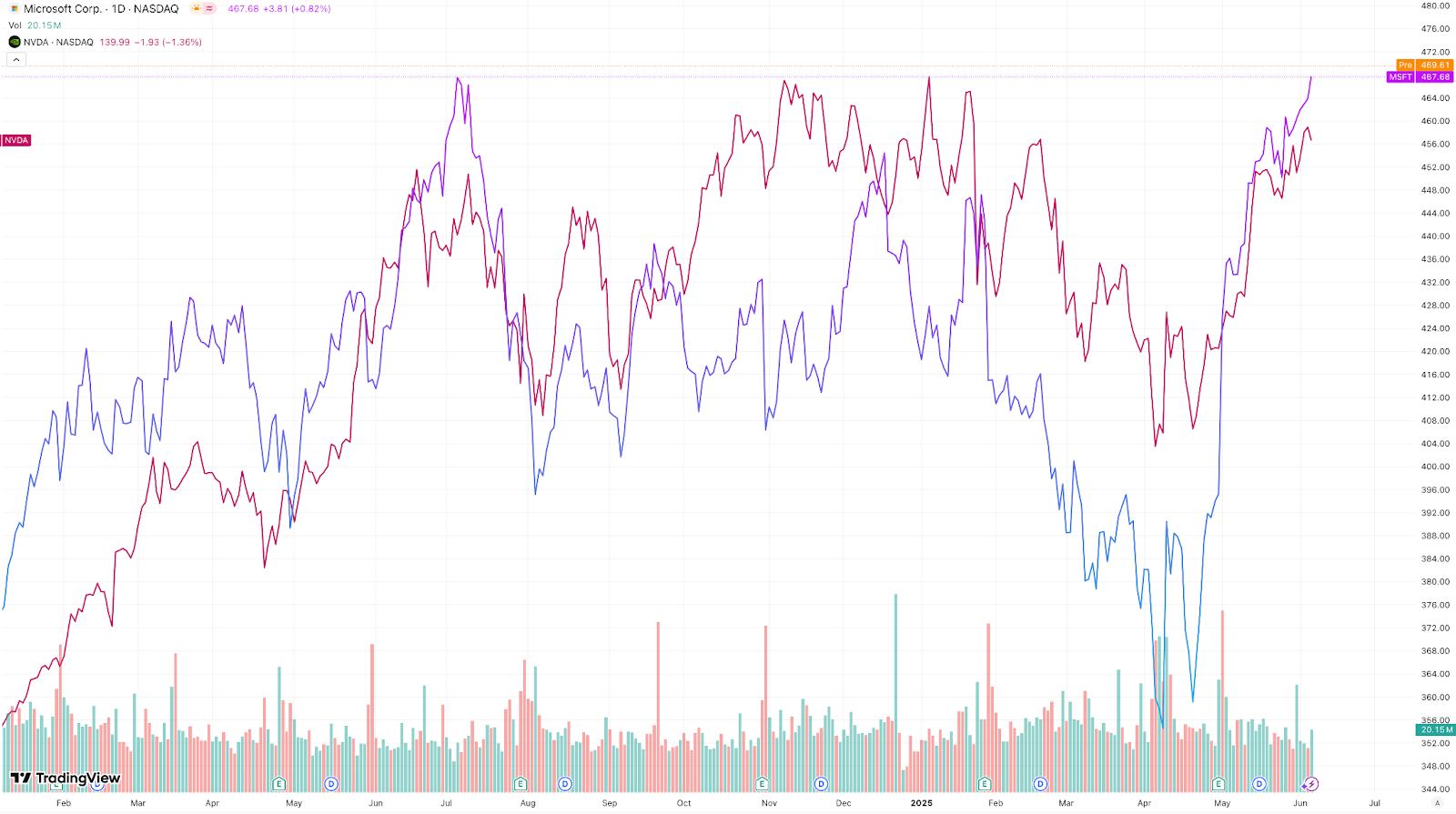

In contrast, performance among other tech giants has become increasingly divergent. While NVIDIA’s shares remain strong, they closed approximately 6% below their January peak. Apple has been weighed down by uncertainty surrounding U.S.-China tariff policies, with year-to-date losses nearing 20%, and a drawdown of over 22% from its historical high.

Market focus is increasingly concentrated on Microsoft and NVIDIA. Both companies have seen their market caps fluctuate near record levels, with Microsoft leveraging its lead in enterprise AI deployment to maintain stability, while NVIDIA benefits from surging demand for AI chips, pushing gross margins back above 70%.

【Microsoft & NVIDIA Daily Chart, Source: TradingView】

Notably, Microsoft’s new high reflects capital markets’ aggressive bet on the “AI dividend.” Despite macroeconomic challenges such as persistent inflation and rising debt burdens, the growing certainty around enterprise AI adoption has become a critical pillar supporting valuations across the tech sector.

Microsoft’s current success not only underscores how technological transformation is reshaping corporate valuation models, but also highlights a broader reallocation of global capital toward AI industry leaders.