Bitcoin Price Forecast: BTC consolidates ahead of MicroStrategy Q1 earnings, strategic Bitcoin reserve deadline

- Bitcoin price is extending its consolidation streak, trading around $95,000 on Wednesday, as traders await a decisive breakout.

- MicroStrategy’s Q1 earnings release and the approaching deadline for the Strategic Bitcoin Reserve have the potential to move BTC price.

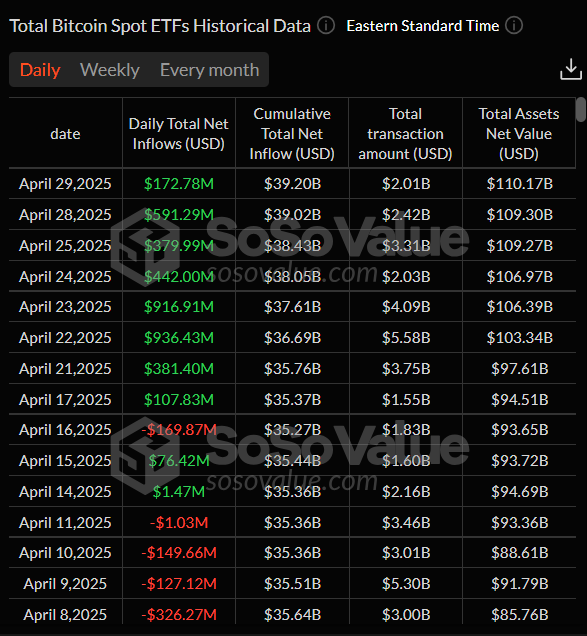

- US spot Bitcoin ETFs recorded an inflow of $172.78 million on Tuesday, continuing the trend of inflows since April 17.

Bitcoin (BTC) is extending its consolidation streak to five consecutive days, trading around $95,000 on Wednesday, as investors await a decisive breakout. A K33 report highlights two key events to watch this week: MicroStrategy’s Q1 earnings release and the approaching deadline for the Strategic Bitcoin Reserve.

Institutional demand for Bitcoin remains strong, supporting a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded an inflow of $172.78 million on Tuesday, continuing the positive trend seen since April 17.

Bitcoin traders await MicroStrategy's Q1 earnings

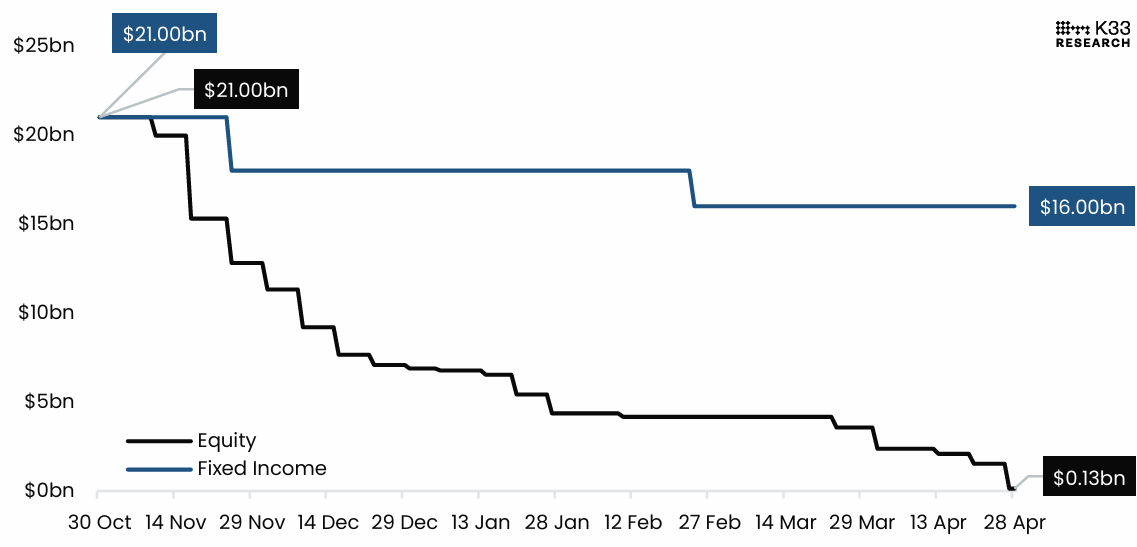

The K33 report speculates that positive news will emerge from MicroStrategy’s Q1 earnings presentation on Thursday, as the company nearly depleted its $21 billion at-the-market (ATM) shelf offering this week. The analyst explains that the massive $21 billion ATM announced by MSTR on October 30, 2024, is now practically emptied after another BTC purchase on Monday.

Six months after this announcement, $128.7 million remains of the original $21 billion ATM offering. Nonetheless, other funding sources, such as convertibles and perpetual preferred stock offerings Strife (STRF), have moved slower. MicroStrategy Executive Chairman “Michael Saylor seems more than determined to deploy as much capital as frequently and aggressively as possible to grow the company’s BTC treasury,” the analyst says.

Given the continued solid MSTR premiums, the analyst views a new ATM announcement as a likely scenario during the earnings call – similar to the 21/21 plan announcement during Q3 earnings. Such an announcement would likely benefit the BTC price.

Strategy’s 21/21 progression chart. Source: K33 Research

The second event to watch this week is the 60-day deadline of Trump’s executive order regarding the Strategic Bitcoin Reserve, set for May 5. The order from March 6 gave the US Treasury a 60-day deadline to deliver an evaluation of the legal and investment considerations for establishing and managing the Strategic Bitcoin Reserve. Official communication ahead of this deadline has been very limited, with little discussion of the matter among the public. However, the analyst expects this to change as the date approaches.

Institutional demand continues the trend of inflows

Bitcoin institutional demand remained strong so far this week. According to the data from SoSoValue shown below, US spot Bitcoin ETFs recorded an inflow of $172.78 million on Tuesday, continuing the trend of inflows since April 17. If these inflows intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC traders await decisive breakout

Bitcoin price broke above its 200-day Exponential Moving Average (EMA) at $85,000 early last week, rallying 11.14% through Friday. However, BTC failed to close above its March high of $95,000 and has hovered around this level in the last four days.

If BTC breaks and closes above $95,000 on a daily basis, it could extend the rally to retest its next daily resistance at $97,000. A successful close above this level could extend additional gains to retest its psychological resistance at $100,000.

The Relative Strength Index (RSI) on the daily chart holds at 66, suggesting bullish momentum, and still has room for further gains before hitting overbought conditions.

BTC/USDT daily chart

However, if BTC fails to close above the $95,000 resistance level and faces a pullback, it could extend the decline to find support around the $90,000 psychological level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.