Bitcoin traders celebrate 3.125 BTC halving anniversary with $90K price prediction

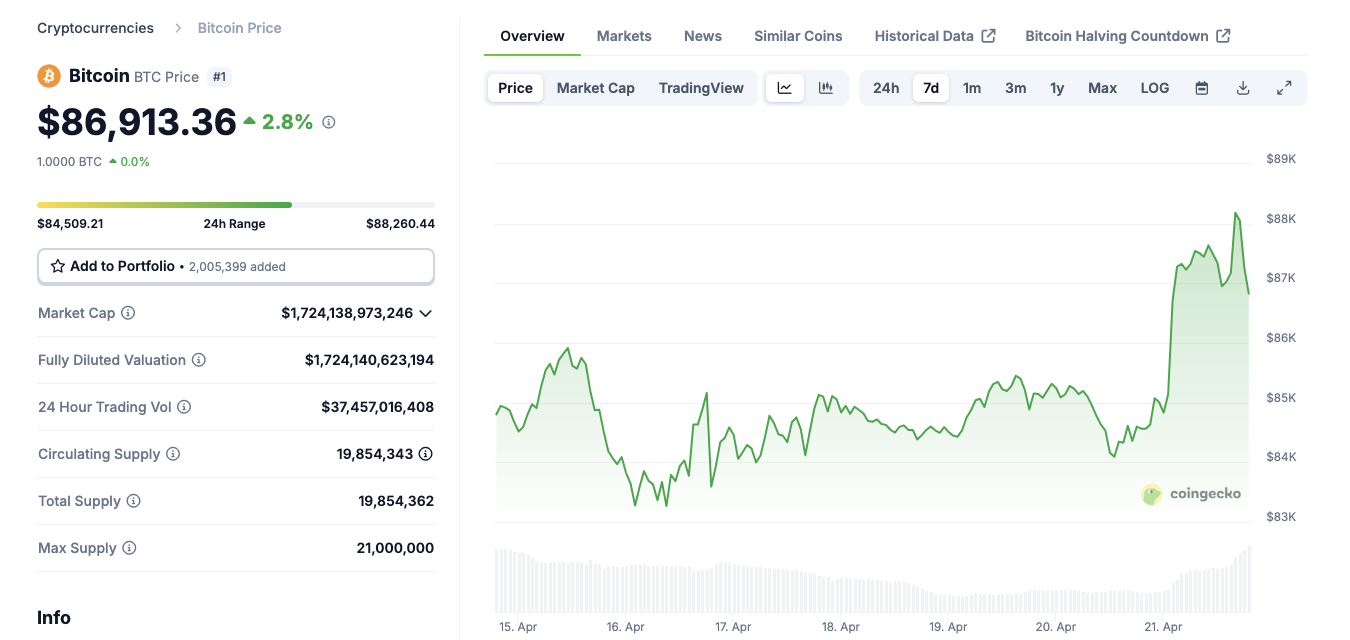

- Bitcoin price breaks above $88,200 on Monday, as markets react to declining investor confidence in USD-denominated assets.

- The Bitcoin community commemorates the anniversary of the latest halving event, which slashed issuance from 6.25 BTC to 3.125 BTC.

- The US Dollar Index plunged to 98.30 on Monday, posting its largest single-day loss in April.

Bitcoin price surges past $88,000 on Monday as traders mark the 3.125 BTC halving anniversary amid a rapid shift in investor focus away from USD-based investments.

Bitcoin price breaks above $88,200 as investor sentiment weakens for USD assets

Bitcoin climbed above the $88,200 level on Monday, signaling renewed bullish momentum in the digital asset market. The move comes as investor appetite for USD-denominated assets shows signs of softening amid inflation concerns, rate cut uncertainty and fiscal instability.

Market participants reacted swiftly to the shift in sentiment, turning to BTC as a potential hedge amid mounting skepticism over traditional monetary policy tools.

This marks Bitcoin’s strongest daily candle in over two weeks and positions it firmly above the short-term $90,000 resistance zone that capped gains earlier in mid-April.

Bitcoin price action today, April 21, 2025 | Source: Coingecko

Notably, BTC trading volume rose alongside price action, with total crypto market capitalization adding over $50 billion in the last 24 hours to cross the $2.8 trillion mark on Monday.

Meanwhile, as BTC price surged to a new monthly timeframe peak on Monday, the US Dollar Index (DXY) logged its sharpest single-day decline in April, signaling a shift in capital allocation away from dollar-backed assets.

US Dollar Index (DXY) | Source: YahooFinance

The DXY, which measures the US Dollar’s strength against a basket of major currencies and reflects broader demand for USD-denominated instruments—including Treasury bonds and money market securities—serves as a key gauge of investor sentiment.

A drop in the index typically indicates weakening confidence in US fiscal stability. If investors keep rotating funds into Bitcoin, more upside could follow as the week unfolds.

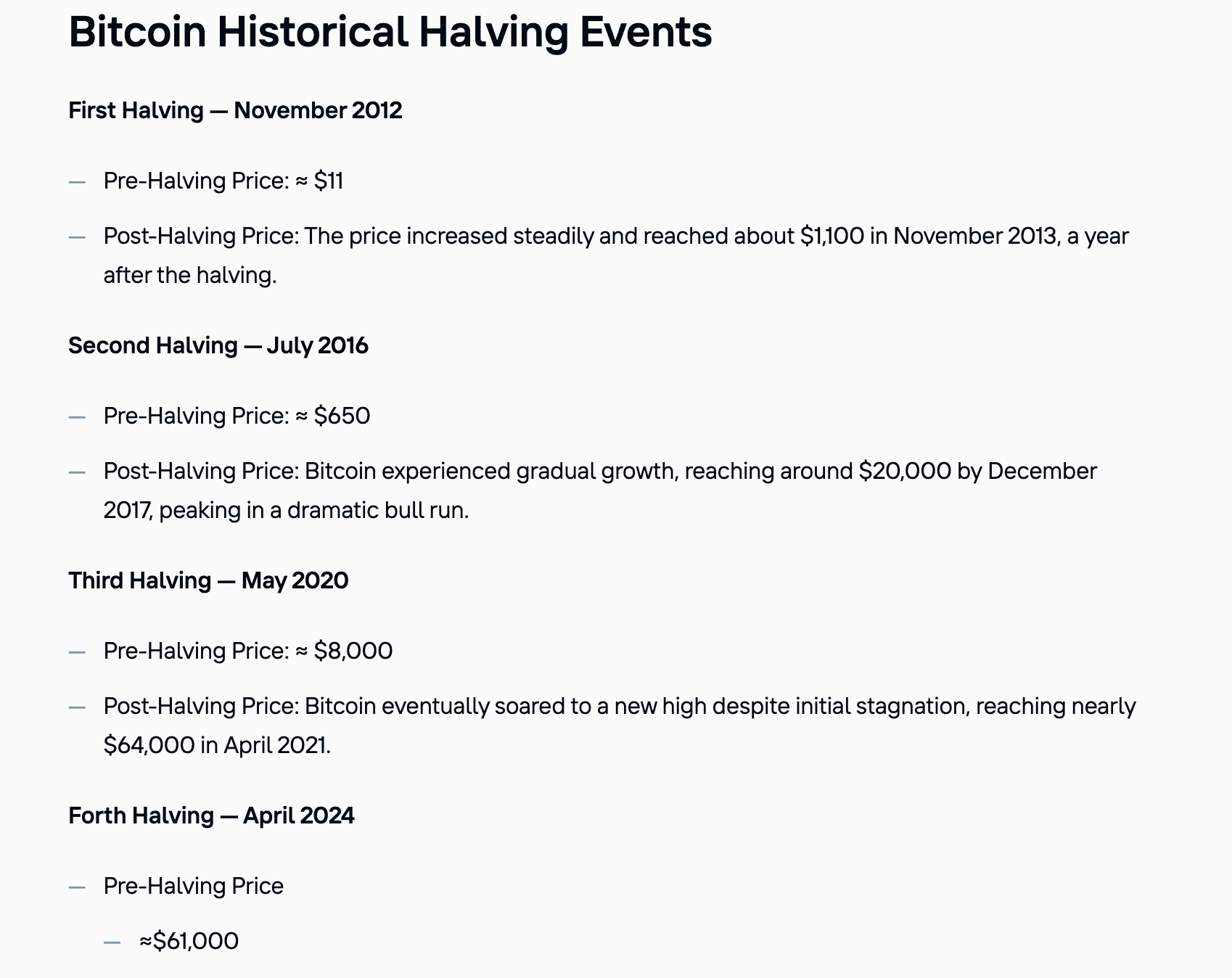

Bitcoin community marks 3.125 BTC halving anniversary

The Bitcoin community is celebrating the anniversary of the most recent halving event, which took place on April 20, 2024. That event cut Bitcoin’s block reward from 6.25 BTC to 3.125 BTC, reducing the rate of new supply issuance and reinforcing the asset’s deflationary design.

As speculations and discourse around the halving event generated hype, BTC price has surged from above $88,260 for the first time in 45 days, dating back to March 7, and now closing in on the $90,000 milestone.

Historically, halvings have been key catalysts for long-term bullish cycles, and this latest rally is being interpreted as a continuation of that trend. The rally aligns with a growing market narrative around Bitcoin scarcity, especially as exchange reserves continue to dwindle and long-term holders refuse to sell. With daily issuance now under 450 BTC, many analysts believe supply pressure is increasingly outpaced by institutional demand.

Community sentiment across social media remains overwhelmingly positive, with major influencers and developers highlighting the symbolic and economic significance of the 3.125 BTC threshold.

According to the current market data compiled by Alternative.me, investor sentiment around BTC Fear and Greed Index remains in the “fear” zone, signalling that the rally could be in early phases.

While macroeconomic conditions remain uncertain and centralized financial systems face scrutiny, the halving anniversary and thinning supply have sparked increased demand from large investors, looking to park displaced capital from wobbling USD-denominated investments.

Bitcoin Price Prediction: $90K breakout ahead bulls regain momentum

Bitcoin price forecast remains bullish as BTC trades at $86,814, building on a clean 4.93% breakout from the consolidation range. The green candle following the green arrow marked a bullish engulfing signal near the 13-period Super SMA (red line), reclaiming short-term momentum.

On the 12-hour chart, BTC price is now decisively above all three SMAs (5, 8, and 13), which are tightly aligned and now upward sloping—typically a signal of trend confirmation and upward volatility.

The Relative Strength Index (RSI) at 60.52 supports further upside, braking above its moving average (yellow line), confirming strengthening momentum without signaling overbought conditions. This momentum shift follows a bearish rejection (red arrow) earlier last week, where BTC faced resistance near the $86K level. The successful retest of the SMAs acted as a dynamic support zone, enabling a surge in volume (15.71K) that validates the recent move.

While the bullish case targets $88,500 short-term, a drop below $85,300 would negate this setup. For now, momentum favors buyers, with technical structure supporting continuation.