Ethereum Price Forecast: ETH defies Powell’s hawkish tone as Israel-Iran ceasefire fuels bullish sentiment

Ethereum price today: $2,440

- Ethereum maintained gains as optimism from the Israel-Iran ceasefire outweighed Fed Chair Jerome Powell's hawkish tone before Congress.

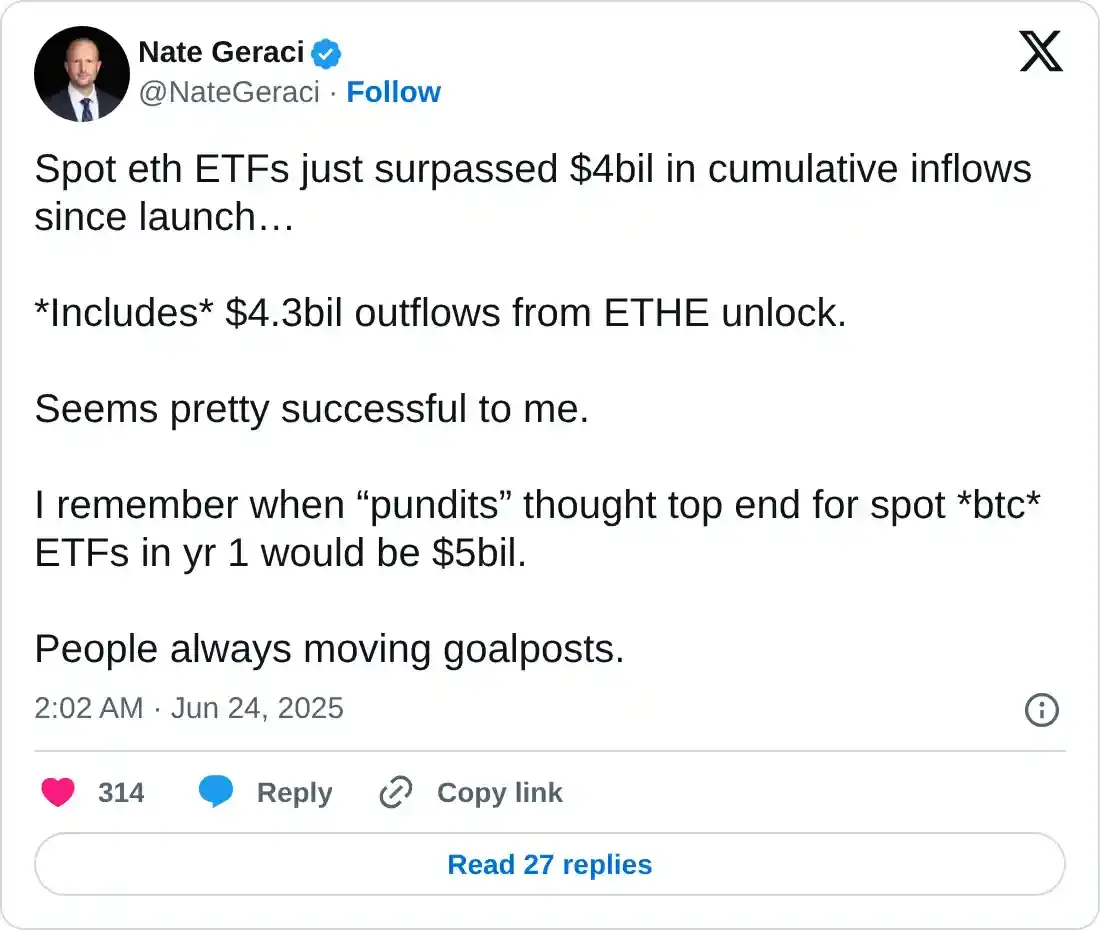

- Ethereum ETFs record net inflows of $100 million on Monday, pushing their cumulative inflows above $4 billion.

- ETH eyes a break above the 200-day SMA resistance after flipping the upper boundary of a descending channel.

Ethereum (ETH) held its ground on Tuesday, trading above $2,400 at the time of writing and up 3% despite hawkish tone from Federal Reserve (Fed) Chair Jerome Powell in his testimony before the House Financial Services Committee. The rise comes as ETH continues to ride the wave of bullish sentiment spurred by President Donald Trump's announcement of the Israel-Iran ceasefire and US spot Ethereum exchange-traded funds (ETF) return to inflows.

ETH holds steady amid Powell's ‘watch-and-wait’ comments

Powell maintained that the Fed is in a “watch-and-wait mode” before deciding on rate cuts, especially due to the potential effects of Trump's tariffs on inflation.

"I think we'll start to see more tariff inflation starting in June [...] The Fed is just trying to be careful and cautious with inflation. It's uncertainty about the size and potential persistence of inflation from tariffs," said Powell.

"We would expect to see meaningful inflation effects in June, July or August. If we don't see that, that would lead to cutting earlier. Right now, we're in watch and wait mode," he added.

A similar hawkish tone was echoed by other Fed officials, including New York Fed President John Williams, who highlighted that "it's appropriate to maintain current policy stance," emphasizing that "tariffs may be adding a quarter of a percentage point to inflation right now."

Despite the Fed's hawkish comments, Ethereum continued riding on the waves of a fragile ceasefire deal between Israel and Iran, climbing above $2,400 on Tuesday.

Notably, US spot Ethereum ETFs recorded $100 million in net inflows on the cusp of the ceasefire announcement on Monday — more than their total inflows throughout last week — representing a return of institutional demand.

As a result, the products surpassed $4 billion in cumulative inflows just a month before their one-year milestone of launch. The strong inflows come amid an exodus of $4.3 billion in Grayscale's ETHE, which features a higher-fee structure.

"From a technical point of view, bulls are trying to build momentum due to the presence of the resilient and robust institutional demand, but the overhead resistance is capping upside attempts," said Ray Youssef, CEO of NoOnes and Paxful co-founder, in a note to FXStreet.

The recent rise shouldn't be treated as a "clear breakout [but] more like the market exhaling after a period of sustained tension and volatility,” he added. “The evolving trade tariffs narrative and risks tied to the Middle Eastern conflict will continue to cloud risk sentiment. It's a cocktail of macro uncertainty that makes short-term market moves extremely data-sensitive and unusually technical."

This aligns with the quick rise after ETH briefly declined below $2,200, just a few dollars shy of its average cost basis at $2,273, per CryptoQuant’s data. Investors quickly pushed prices above this level to boost their holdings back into profit, making it a critical price point as market sentiment evolves.

Ethereum Price Forecast: ETH breaks descending channel resistance

Ethereum experienced $61.13 million in futures liquidations over the past 24 hours, with liquidated long and short positions reaching $28.83 million and $32.3 million, respectively, according to Coinglass data.

ETH has broken above the upper boundary of a descending channel and the 50-day Exponential Moving Average (EMA) on Monday. The rise comes after bouncing off the lower boundary of a symmetrical triangle and the $2,110 support, strengthened by the 100-day Simple Moving Average (SMA).

ETH/USDT daily chart

If ETH holds the upper boundary of the descending channel as support and goes on to clear the $2,500 resistance and the 200-day SMA, it could test the upper boundary of the symmetrical triangle. However, a rejection near $2,500 could send the top altcoin back to the triangle's lower boundary.

Meanwhile, the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are eyeing moves above their neutral levels. A firm crossover will accelerate the bullish momentum.

A daily candlestick close below $2,100 will invalidate the thesis and potentially send ETH to $1,750.