Top Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe risk further losses as Bitcoin clings to $100K

- Dogecoin edges higher on Monday after hitting the lowest price in two months during the three-day crash.

- Shiba Inu holds onto a crucial psychological support level after recording a new year-to-date low, suggesting increased selling pressure.

- Pepe ticks lower on Monday, erasing the early May gains and losing a crucial support zone.

Meme coins, such as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE), are in a free fall as the risk-off sentiment sweeps the broader cryptocurrency market. The meme coins DOGE and SHIB hit new swing lows while PEPE breaks under a crucial support zone, putting the segment leaders at risk of further losses as selling pressure grows.

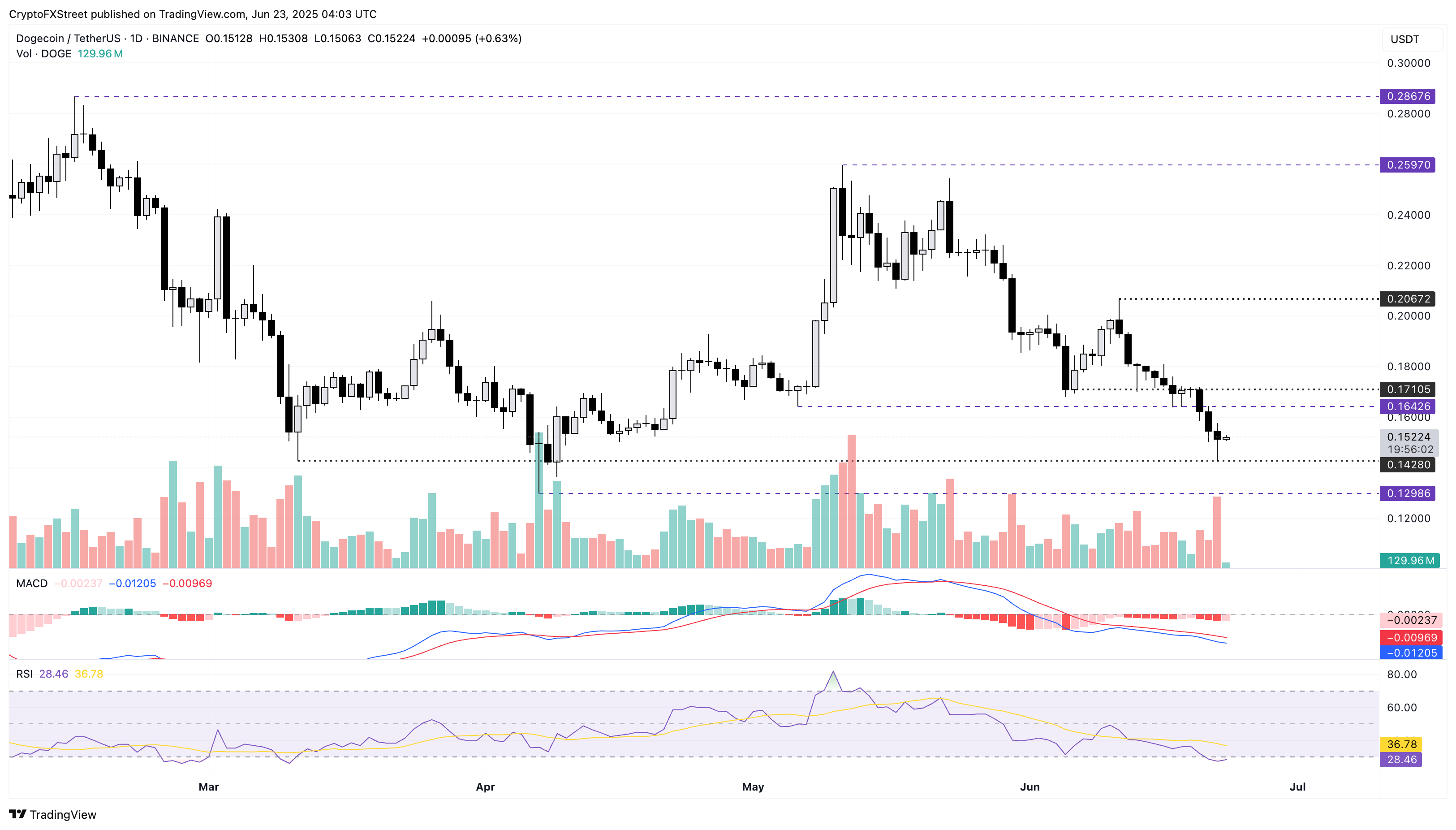

Dogecoin risks an extended correction under $0.15

Dogecoin marked its fifth consecutive bearish closing week, experiencing a 13.81% decline last week. At the time of writing, DOGE edges higher by over 0.50% at press time on Monday as selling pressure cools down momentarily.

On Sunday, Dogecoin reached its lowest trading price in two months, with a 24-hour low of $0.1427, before recovering to close the day at $0.1512. As the declining trend gains traction, Dogecoin puts pressure on the $0.1428 support level marked by the low on March 11.

A closing below $0.1428 could extend Dogecoin’s decline towards the year-to-date low of $0.1298.

The Moving Average Convergence/Divergence (MACD) indicator declines in the negative direction alongside its signal line, suggesting a growth in bearish momentum.

The Relative Strength Index (RSI) at 28 enters the oversold zone, signaling an intense selling pressure. However, the oversold conditions brew reversal possibilities, suggesting a potential bounce back if the broader market sell-off cools down.

DOGE/USDT daily price chart.

If the meme coin closes above $0.1710, it could reverse the downfall and target the $0.20 psychological mark.

Shiba Inu risks losing a psychological support level

Shiba Inu edges higher by less than 1%, holding at the $0.000010 psychological support after printing four consecutive bearish candles last week. However, with the 24-hour low of $0.00001004 on Sunday, SHIB marks the lowest year-to-date price.

A close below the $0.000010 round figure could trigger a freefall in Shiba Inu, as the psychological level has remained intact since late February 2024. In such a scenario, the meme coin could extend its decline to the $0.00000883 level marked by the January 2024 lowest daily close.

The MACD indicator dives deeper into the negative territory with its signal line suggesting a rise in selling pressure. The RSI at 28 indicates oversold conditions, as sellers dominate the trend, while a faint signal suggests a potential reversal may be around the corner.

SHIB/USDT daily price chart.

A reversal pushing a clean daily close above $0.00001150 will undermine the weekend crash, potentially extending the uptrend towards $0.00001337 monthly high.

Pepe fails to hold above a crucial demand zone

Pepe edges lower by over 0.50% at press time on Monday, extending the 14% pullback over the last four bearish days. The meme coin breaks under the $0.00000900 support zone, erasing most of the bullish gains recorded in early May.

With last week’s low of $0.00000830, PEPE recorded the lowest monthly price, fueling the risk of the $0.00000794 level retest marked by the lowest daily close in May.

The MACD indicator flashes similar signals as it does for the other two meme coins, declining further into negative territory, which suggests a surge in selling momentum. The RSI at 31 hovers above the oversold boundary after a swift reversal from the halfway level, suggesting a spike in bearish momentum.

PEPE/USDT daily price chart.

However, if PEPE reclaims the $0.00000830 support-turned-resistance zone, it could prolong the uptrend towards the $0.000010 round figure, acting as a key psychological level.