Bitcoin Risks Dropping Below $100,000 as Daily Liquidations Near $1 Billion

Bitcoin’s price slipped to $101,579 today, down 3.5% in 24 hours and 4.5% over the past week, as nearly $1 billion in leveraged crypto positions were liquidated across major exchanges.

The decline coincides with an intensifying political feud between Elon Musk and US President Donald Trump—an unusual but material factor spooking markets and triggering investor exits.

Nearly $1 Billion Liquidated as Market Reacts to Political Volatility

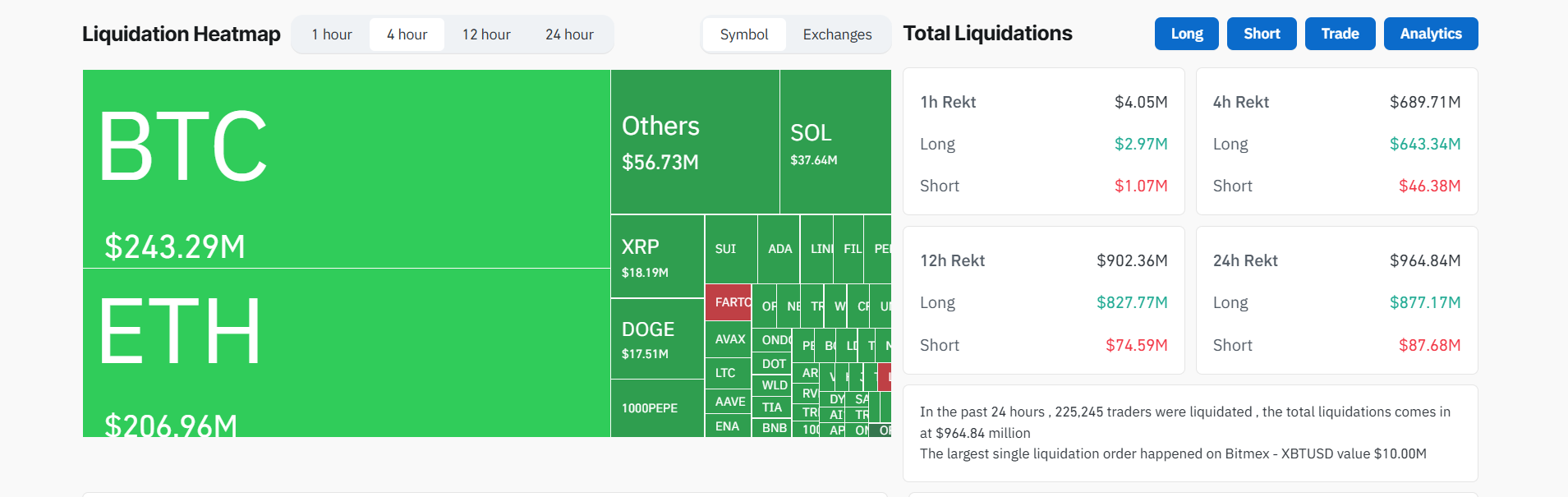

According to liquidation data, a total of $964.84 million in positions were liquidated over the past 24 hours, with $877.17 million of those being long positions.

Bitcoin accounted for $243.29 million of the total, followed closely by Ethereum at $206.96 million. Over 225,000 traders were liquidated during the same period.

The abrupt unwinding of leverage highlights growing unease among market participants—many of whom are reacting to broader macro risks and the unexpected ripple effects of domestic US politics on digital asset markets.

Crypto Liquidations Heatmap. Source: Coinglass

Crypto Liquidations Heatmap. Source: Coinglass

Trump-Musk Feud Sparks Volatility

The drop in Bitcoin’s price aligns with the public fallout between Elon Musk and President Trump, which escalated this week after Musk publicly criticized Trump’s $1.6 trillion “One Big Beautiful Bill Act.”

Also, Musk accused the bill of ballooning the national deficit and cutting critical electric vehicle subsidies that directly affect Tesla.

In response, Trump threatened to cut off all federal contracts with Musk’s companies—including Tesla, SpaceX, and Starlink—triggering a 15% drop in Tesla’s stock price.

Musk then retaliated with calls for Trump’s impeachment. He also alluded to Trump’s alleged ties to unreleased Epstein files.

Meanwhile, multiple sources have confirmed that top White House aides held emergency meetings today to assess the potential economic fallout.

The high-profile conflict is now seen as a potential destabilizer for tech equities and digital assets alike. Crypto traders are apparently rushing to reduce exposure.

Overall, despite a broader risk-on environment driven by the anticipation of rate cuts later in 2025 and growing institutional participation in crypto, this political drama is clouding sentiment.

Will Bitcoin Hold the $100,000 Line?

Technically, Bitcoin now sits just above a key psychological support level at $100,000.

A decisive breakdown below this level could trigger a fresh round of algorithmic selling and liquidation events. Especially with long overleveraged positions dominating the books.

If long liquidations continue at this pace, Bitcoin could test the $95,000–$98,000 range before finding meaningful support.

The Musk-Trump fallout reflects the increasing entanglement of crypto markets with global politics and legacy finance.Traders are now learning that Bitcoin’s volatility isn’t just a function of on-chain metrics or macroeconomic indicators. Billionaire feuds and legislative threats can also trigger volatility.

Until tensions ease or markets find a new catalyst, Bitcoin’s short-term outlook remains fragile.