SOL gains 5% as Solana treasuries surpass $1.7B following rising institutional demand

- The number of Solana-focused treasuries has climbed to thirteen, with combined holdings now exceeding $1.7 billion in SOL.

- Digital asset treasuries focused on Solana, led by Sharps Technology, have amassed 1.44% of SOL's total supply.

- SOL is up 5% in the past 24 hours, as it eyes the $224 resistance.

Solana (SOL) gained 5% on Wednesday as corporate treasuries expanded their holdings to 8.27 million SOL, valued at $1.72 billion.

Solana rises as corporate treasuries stack over 8 million SOL

Institutional demand for Solana has climbed in recent months, with the number of corporate SOL treasuries reaching thirteen, according to data from the Strategic SOL Reserve website.

The data suggests that Solana treasury companies have scooped a combined 8.27 million SOL, worth $1.72 billion in the past few months. Their total holdings now constitute 1.44% of Solana's total supply.

Sharps Technology leads the pack with a stash of 2.14 million SOL. The company announced plans to raise $400 million for a Solana treasury on Monday via a private investment in public equity (PIPE) transaction.

Upexi and DeFi Development Corporation came next, holding 2 million SOL and 1.42 million SOL, respectively.

The Solana treasury trend accelerated in April after DeFi Development Corp rebranded from Janovar following a change in its leadership. Since then, the firm, alongside other public companies, has steadily expanded its holdings.

Apart from the thirteen corporate entities listed on the Strategic SOL Reserve website, other companies have shown interest in building Solana-focused treasuries.

Pantera Capital is reportedly seeking to raise $1.25 billion to convert a Nasdaq-listed firm into 'Solana Co.,' a vehicle designed to amass SOL as a treasury asset.

Likewise, Galaxy Digital, Multicoin Capital, and Jump Crypto are allegedly planning a $1 billion offering to establish a Solana treasury, with Cantor Fitzgerald serving as lead banker.

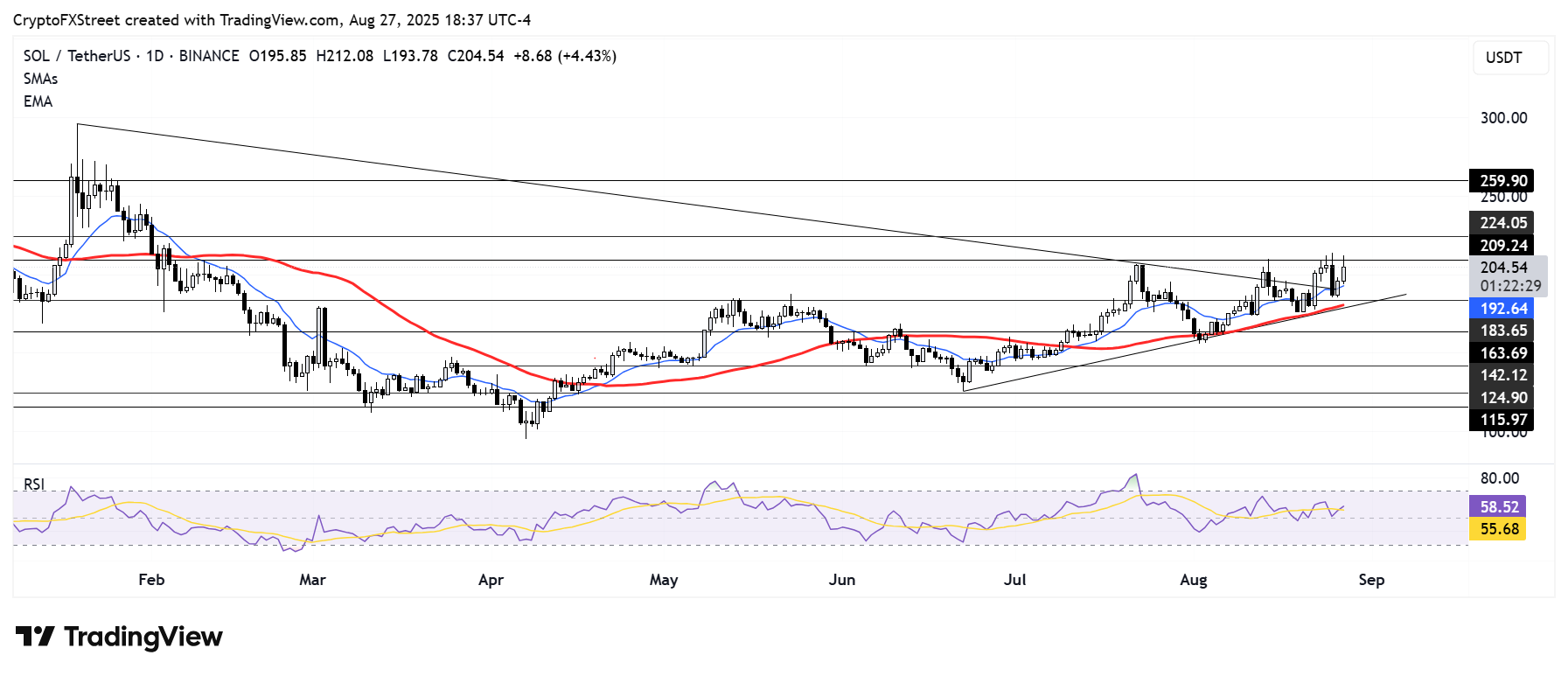

SOL is up 5% in the past 24 hours, trading at around $205 at the time of publication. The fourth-largest altcoin is testing the $209 resistance as it eyes a potential move toward $224.

SOL/USDT daily chart

On the downside, SOL just moved above a symmetrical triangle with its lower boundary and 50-day Simple Moving Average (SMA) serving as support near the $180 level.

The Relative Strength Index (RSI) is above its neutral level, continuing its range-bound movement between its midline and overbought boundary over the past three weeks. This indicates a choppy market with a slight bullish tilt.