Ethereum ETFs Post First Weekly Outflows After 3 Months

US-listed Ethereum exchange-traded funds (ETFs) have logged their first week of outflows in 15 weeks, marking a pause in what had been a steady run of institutional inflows.

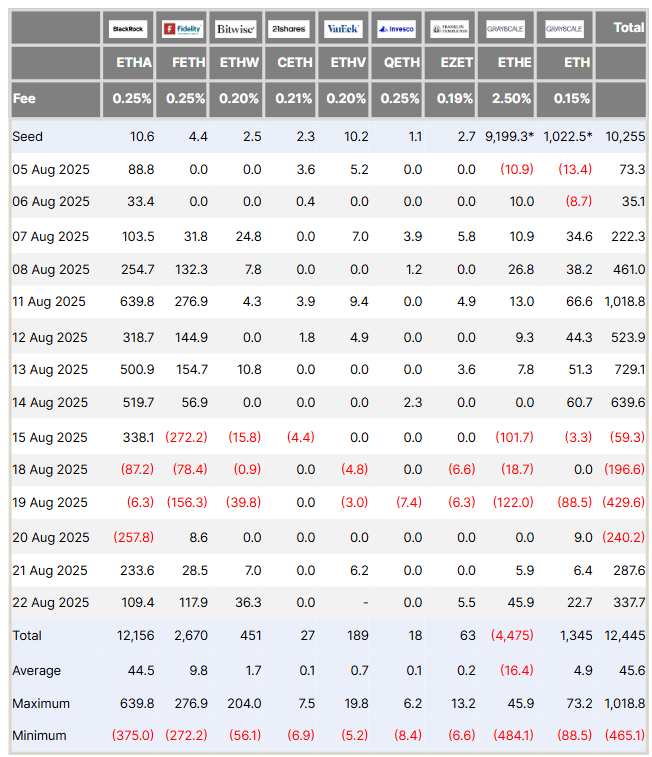

Data from Farside Investors shows that investors pulled $241 million from the products during the week of August 22, even as a late-week rebound in demand softened the overall impact.

Ethereum ETFs Suffer Rare Setback of $241 Million Outflow

The week began with heavy selling pressure, with the nine funds registering a combined $866.4 million outflow between Monday and Wednesday.

Notably, Tuesday alone accounted for $429 million in redemptions, the second-largest daily outflow since the products went live.

By Thursday, however, sentiment began to shift. The funds recorded two consecutive days of inflows totaling $625.3 million.

While this reversal reduced the scale of the withdrawals, it was not enough to erase the earlier damage. The result was a net weekly outflow of roughly $241 million.

Ethereum ETFs Daily Flows in August. Source: Farside Investors

Ethereum ETFs Daily Flows in August. Source: Farside Investors

This shift tracked broader macro signals and Ethereum’s market moves. The early-week selloff stemmed from concerns about US inflation data, which heightened speculation over the Federal Reserve’s next policy decision and triggered expectations of a short-term price correction in ETH.

Later in the week, Fed Chair Jerome Powell delivered a more dovish message, calming fears of prolonged tightening. Ethereum responded with a rally to a fresh all-time high, which in turn spurred the late-week inflows.

Despite the setback, Ethereum ETFs continue to show stronger relative performance compared with their Bitcoin counterparts.

Last week, Bitcoin ETFs saw more than $1.1 billion in outflows, underlining the diverging investor appetite for the two leading crypto products.

Nate Geraci, president of investment advisory firm The ETF Store, pointed to the broader trend.

Since the start of August, spot Ethereum ETFs have attracted $2.8 billion in inflows, while spot Bitcoin ETFs have registered $1.2 billion in outflows. Looking back to July, Ethereum has pulled in $8.2 billion, compared with $4.8 billion for Bitcoin.

This pattern reflects a notable shift in institutional positioning. Investors appear increasingly willing to rotate into Ethereum products, even as broader market volatility continues to influence weekly flows.