Crypto market trades green as Bitcoin blasts past $111,000, enters price discovery mode

Bitcoin surges past $111,000 on Thursday, entering uncharted territory and triggering broad market optimism.

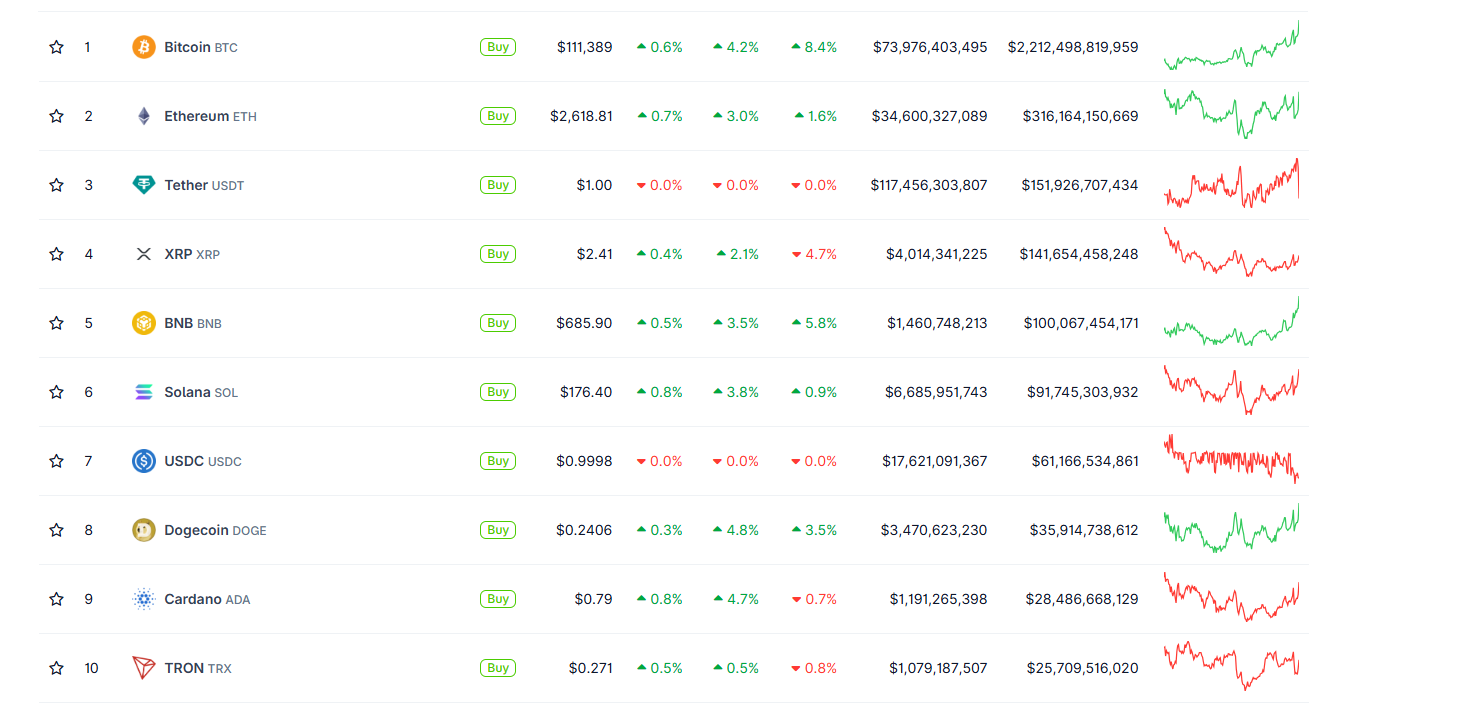

The crypto market trades in the green on Thursday, with major altcoins like ETH, ADA, and SOL following BTC’s lead.

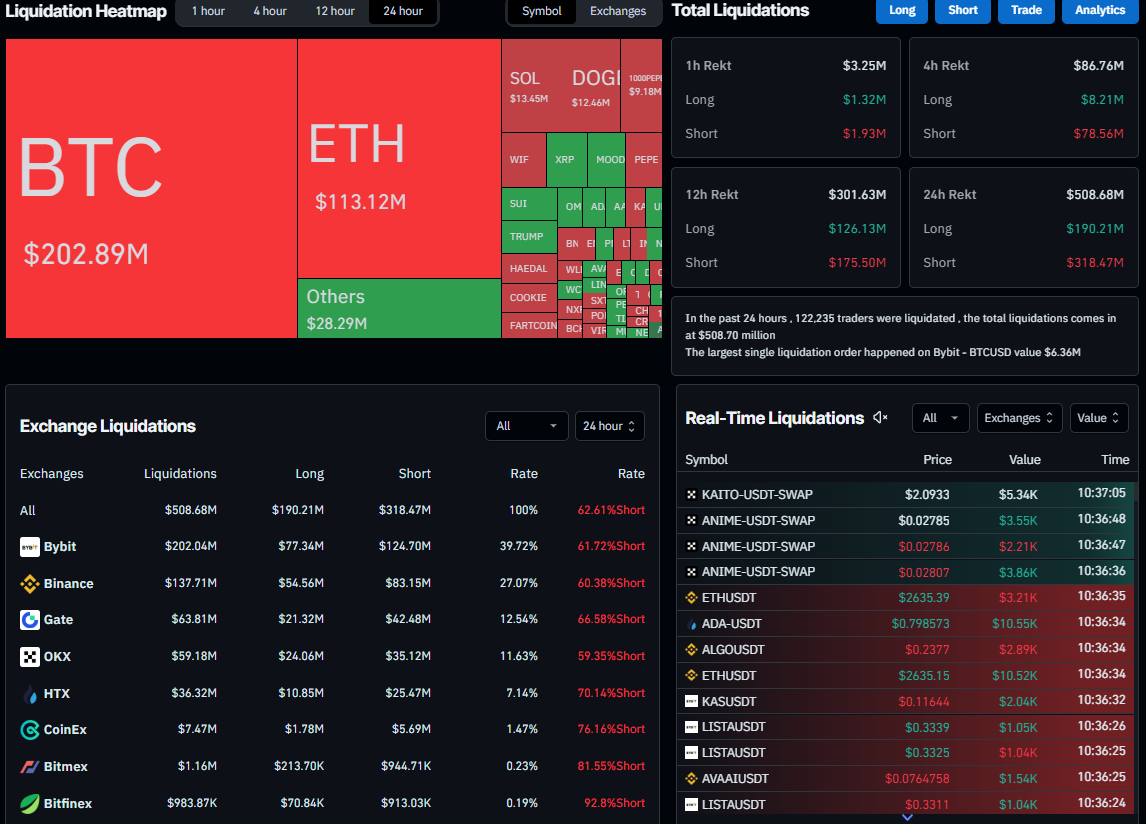

CoinGlass data shows that over $500 million in leveraged positions were liquidated across crypto markets in the past 24 hours.

Bitcoin (BTC) soars above $111,000 on Thursday, entering uncharted territory and fueling a broad rally across the cryptocurrency market. With BTC now in price discovery mode, major altcoins like Ethereum (ETH), Cardano (ADA), and Solana (SOL) followed suit, pushing the overall market into the green. According to data from CoinGlass, the sharp move triggered over $500 million in liquidations of leveraged positions across crypto markets in the past 24 hours, underscoring the intensity of the breakout.

Why is the crypto market rallying today?

The crypto market trades in the green on Thursday, with the largest cryptocurrency by market cap surpassing $111,000 following the breakout of its all-time high on Wednesday.

The main reason for the market rally is Bitcoin’s entering uncharted territory and triggering broad market optimism. Bitcoin’s technical outlook on the daily chart suggests a rally continuation, targeting its key psychological resistance at $120,000, supported by recent developments in the bond market, discussed in the previous report.

BTC/USDT daily chart

Major altcoins like ETH, ADA, and SOL followed BTC’s lead and traded in green, as shown by the CoinGecko chart below.

CoinGlass Liquidation Heatmap data shows that the rally in the crypto market had triggered a wave of liquidation, with over $500 million in leveraged positions wiped out in the last 24 hours. Notably, 62.61% were short positions, underscoring the market’s overly bearish positioning, which can further fuel the rally through short squeezes. The largest single liquidation occurred on Bybit, where a BTCUSD position worth $6.36 million got liquidated.

Liquidation Heatmap chart. Source: Coinglass

What’s next for crypto?

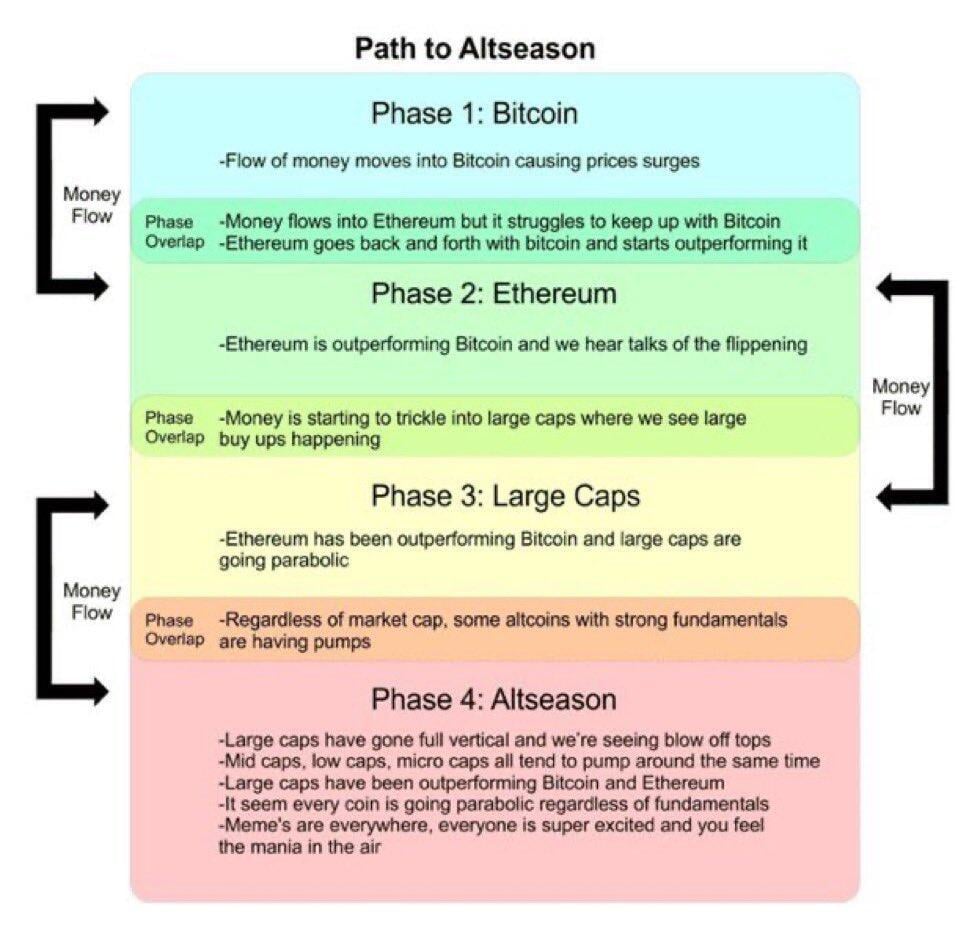

As explained in the graph below, traders should watch for the capital rotation. Given Bitcoin’s all-time high, the market is likely in Phase 1 (the flow of money into BTC causing a price surge) or transitioning into Phase 2. Ethereum may start to outperform Bitcoin soon, and large-cap altcoins could begin seeing inflows.

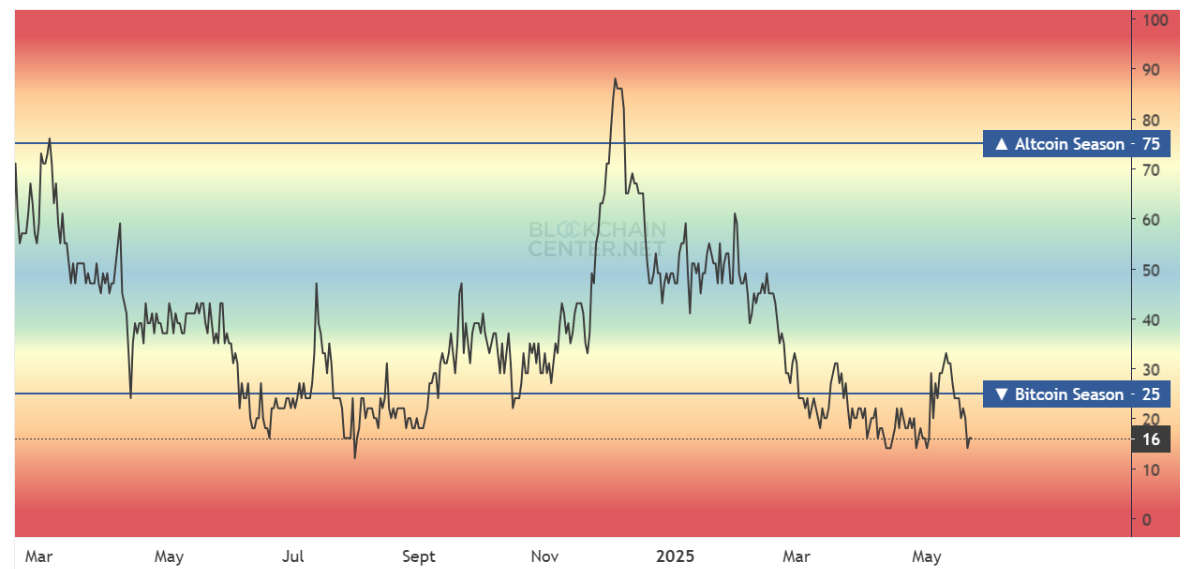

The Altseason (Phase 4) typically comes after these earlier phases, as Blockchaincenter.net’s Altcoin Season index currently reads 16. The metric indicates that altcoins have more room for growth, and investors still prefer to invest their money in Bitcoin or hold it rather than transferring it to altcoins, suggesting the market is likely in Phase 1.

Altcoin Season index. Source: Blockchaincenter.net

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.