Bitcoin Price Forecast: BTC steadies around $104,000 as consolidation likely to persist amid market uncertainty

- Bitcoin trades near $104,000 on Wednesday after being rejected at a key resistance level the previous day.

- The likely end of the US government shutdown and return of key economic data could spark short-term BTC volatility.

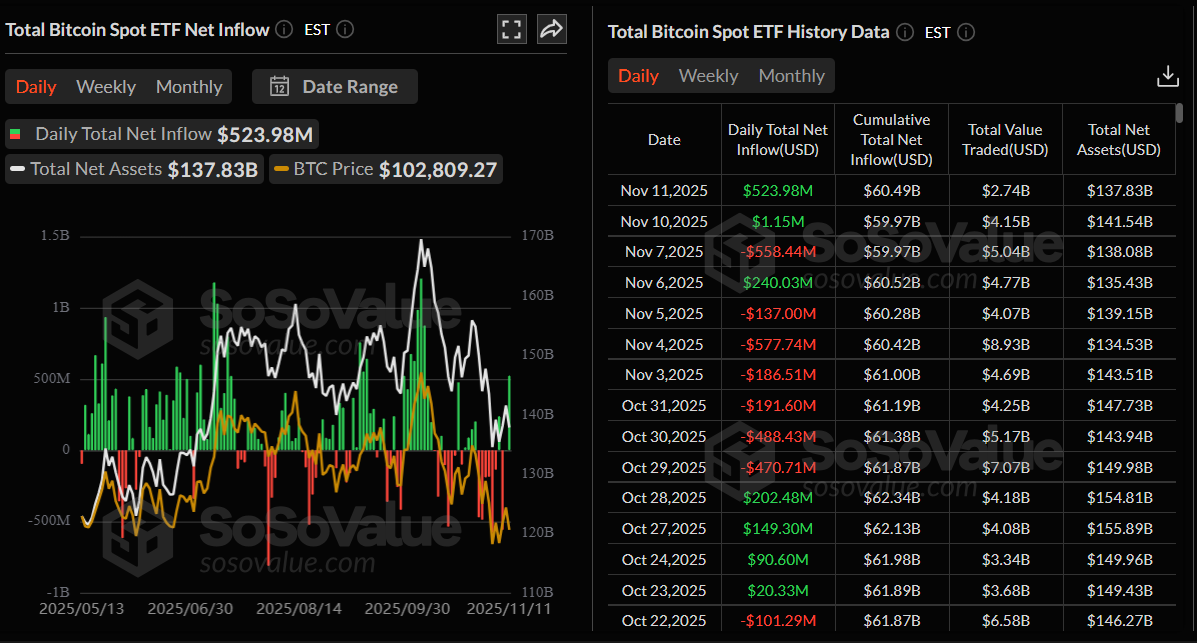

- US-listed spot Bitcoin ETFs saw a $523.98 million inflow on Tuesday, reflecting renewed institutional demand.

Bitcoin (BTC) price steadies around $104,000 at the time of writing on Wednesday after being rejected from a key resistance level, suggesting a consolidation may continue in the near term. The likely end of the US government shutdown and the return of key economic data could bring fresh volatility to the largest cryptocurrency by market capitalization. Meanwhile, US-listed spot Bitcoin Exchange Traded Funds (ETFs) saw a $523.98 million inflow on Tuesday, signaling improving institutional appetite.

Bitcoin could experience volatility if the US government resumes operations

With the US government shutdown nearing its end, the return of key economic data could trigger a repricing of Federal Reserve (Fed) expectations and fuel short-term volatility in Bitcoin. However, in the absence of a clear and sustained macro catalyst, current market conditions suggest that BTC is likely to remain sideways in the near term.

A K33 Research report highlighted that the bill still requires approval from the House of Representatives and President Trump’s signature before the shutdown can officially end.

The analyst continued: "A resolution would immediately ease liquidity pressures and allow frozen federal operations to resume. Key agencies, such as the Bureau of Labor Statistics and the Bureau of Economic Analysis, are expected to resume publishing official data once funding is restored. The market will be closely watching for the release of delayed employment, inflation, and other macroeconomic indicators, though agencies may stagger or partially release this data due to the backlog."

Additionally, the QCP Capital noted that while the bill to end the US government shutdown moves to the House for approval, its passage would only offer a short-term reprieve, averting holiday disruptions but leaving the risk of another fiscal standoff early next year.

“It is a textbook case of ‘kick-the-can’ policymaking that removes immediate tail risks but doesn’t resolve the structural issue. Markets will stay headline-sensitive to procedural snags or delays in the House vote,” said QCP’s analyst.

Bitcoin’s institutional demand returns

Institutional demand for Bitcoin shows some signs of recovery. According to SoSoValue data, US-listed spot Bitcoin ETFs recorded inflows of $523.98 million on Tuesday, after a mild $1.15 million inflow the previous day, ending the recent streak of withdrawals totaling $1.22 billion the previous week. If this trend of inflows intensifies, it could provide the momentum needed for Bitcoin to extend its ongoing price recovery.

Bitcoin Price Forecast: BTC faces correction from key resistance level

Bitcoin price rose slightly and retested the key resistance at $106,453 —the 38.2% Fibonacci retracement (drawn from the April 7 low of $74,508 to the all-time high of $126,299 set on October 6, at $100,353) — on Monday and declined 2.78% the next day. At the time of writing on Wednesday, BTC recovers slightly, trading above $104,700.

If BTC continues its recovery and closes above the 38.2% Fibonacci retracement at $106,453 on a daily basis, it could extend the rally toward the 50-day Exponential Moving Average (EMA) at $109,755.

The Relative Strength Index (RSI) reads 44, approaching the neutral 50 level and suggesting fading bearish momentum. For the recovery rally to be sustained, the RSI must move above the neutral level. Additionally, the Moving Average Convergence Divergence (MACD) lines are converging, with decreasing red histogram bars below the neutral level and suggesting an impending bullish crossover.

On the other hand, if BTC continues its correction, it could extend the decline toward the key support at $100,353.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.