EN

US Jobs Report Week Is Here

Countdown to market volatility

Trade Now

Create an Account

-

Sign up with Google

-

Facebook

-

Apple

Register via other methods

Email

Phone Number

By proceeding, you confirm that you are 18 or older, consented to Mitrade to disclose your personal data for identity verification using an independent third-party service, and agreed to our Privacy Policy

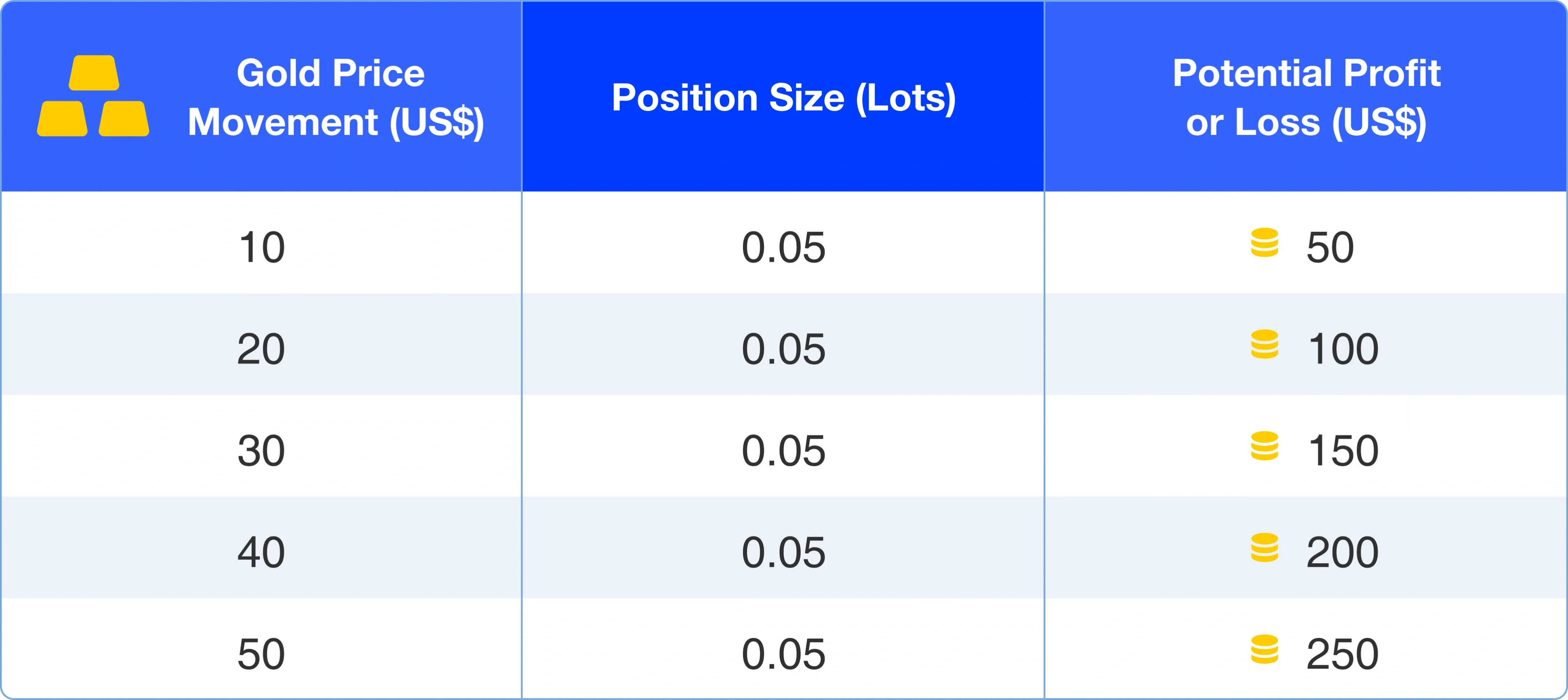

Potential Profit and Loss Simulation for NFP Moves

As an example, during the August 1, 2025 NFP report, when the data came in weaker than expected, gold prices rose by nearly $50 within 30 minutes.

Such rapid moves may lead to gains or losses, depending on the trader’s positions and the market conditions at the time.

*All figures are for illustrative purposes only. Potential profit or loss is calculated as: P/L=Price Change × Lots × Contract Size. These figures are theoretical estimates and do not account for spreads, slippage, or fees.

Why the NFP Report Matters?

The Non-Farm Payroll (NFP) report provides key insights into the strength of the US labor market. This means that NFP-driven volatility may present potential trading scenarios within a short time after the release.

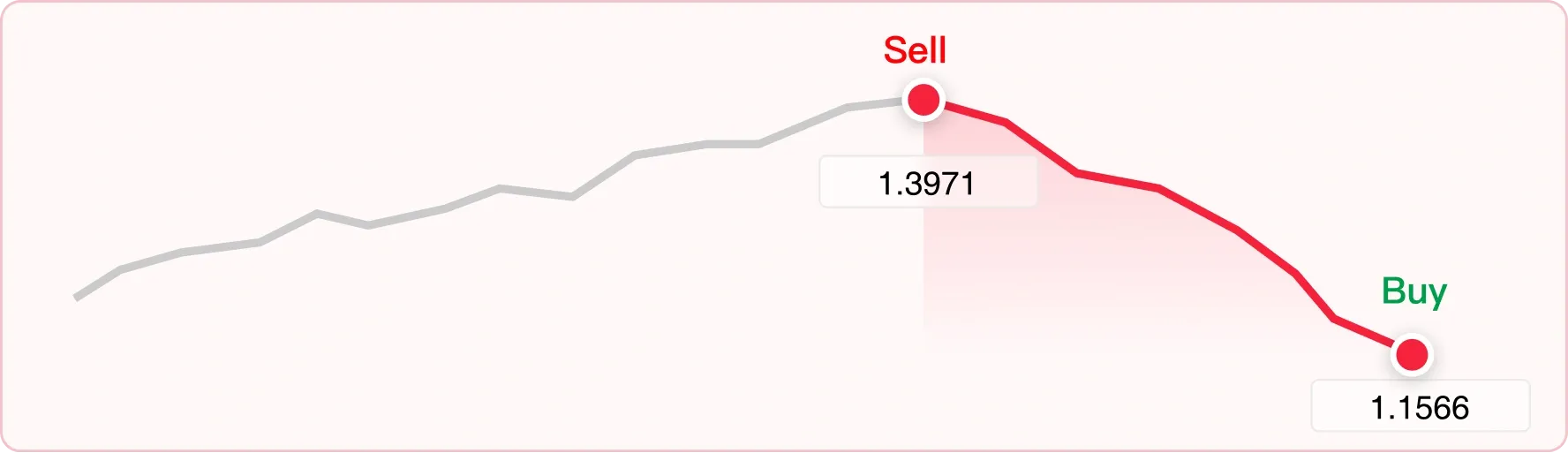

Above-expectation figures often indicate a robust US economy, which can strengthen the dollar and put downward pressure on gold prices.

Conversely, weaker-than-expected data may weaken the dollar and push gold prices higher.

*Charts are for illustrative purposes only. Past performance is not indicative of future performance.

Your Advantages for NFP Trading

Adjustable Leverage*

Select leverage from 1x to 30x to suit your trading strategy.

Flexible Trading Options

Go long or short on Gold, USD pairs, and other available instruments.

Real-Time Market Alerts

Receive instant notifications on NFP releases, anytime, anywhere.

*Leverage can magnify profits and losses. Please trade responsibly.

Open Your Account in just 3 Steps.

1.Register for an account

2.Verify your identity

3.Deposit and start trading

1.Register for an account

2.Verify your identity

3.Deposit and start trading