The Best Stocks to Buy With $10,000 Right Now

Key Points

The AI buildout is bullish for hardware stocks.

Amazon and Microsoft rarely sell off to these levels.

- 10 stocks we like better than Taiwan Semiconductor Manufacturing ›

The tech market has hit a bit of a lull. While the S&P 500 (SNPINDEX: ^GSPC) is right at all-time highs, many of the biggest tech stocks are down significantly from their highs. This retreat opens up a prime buying opportunity, as the market's current bearish outlook on tech could easily pivot into a bullish one and send these stocks to new highs.

I've got five stocks that all look like fantastic buying opportunities, and each is down significantly from its recent high -- except for one. If you've got $10,0000, or really any amount of cash, now could be an excellent time to buy some of the best tech stocks on the market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Taiwan Semiconductor Manufacturing

Any major tech discussion should always include Taiwan Semiconductor Manufacturing (NYSE: TSM). Taiwan Semiconductor acts as the primary chip fabricator for nearly every cutting-edge tech company, and without it, artificial intelligence (AI), self-driving, and many other leading technologies wouldn't be possible. As long as AI spending continues to rise, Taiwan Semiconductor will be an excellent stock to own.

Currently, Taiwan Semiconductor is at an all-time high, which shows that the market understands the company's position in the tech world. Management believes that it will grow at nearly a 30% pace this year, showcasing the huge and growing demand for chips. I think Taiwan Semiconductor plays an important role, and every portfolio should have some exposure to it.

Nvidia

Nvidia (NASDAQ: NVDA) has been a popular AI stock pick for a while now, and it's all because its graphics processing units (GPUs) are the primary computing units deployed in AI data centers. While there are other options rising up, none have been able to steal any of Nvidia's market share because the AI computing realm is desperate for as much computing capacity as possible. Wall Street analysts expect its growth to reaccelerate during fiscal year 2027 (ending January 2027), with 65% revenue growth expected versus 57% for this year.

Despite that, Nvidia is down nearly 10% from its all-time high, opening up a rare buying opportunity for one of the best stocks in the market.

Broadcom

Broadcom (NASDAQ: AVGO) is challenging Nvidia in the computing space by taking a different approach to computing. Instead of designing another GPU-like chip that excels in any computing application it's deployed in, it's taking a specialized approach and designing chips for each workload they see. These chips are designed in collaboration with an end-user, so there isn't a broad market for them. However, they are becoming quite popular as they can deliver better performance than Nvidia's GPUs when the workload is optimized for the chip.

Similar to Nvidia, analysts expect massive growth for Broadcom during 2026. They expect about 51% revenue growth, yet the stock is down nearly 20% from its all-time high. If you missed out on Broadcom's run during 2025, now is the time to remedy that mistake.

Microsoft

Microsoft (NASDAQ: MSFT) has had about as bad a start to 2026 as you could imagine. It had a poorly received earnings report for the fiscal second quarter of 2026 (ended Dec. 31), and the stock hasn't stopped selling off since. It's currently down around 25% from its all-time high, and there really isn't a good reason for it to be that cheap.

Microsoft posted a solid quarter, with revenue rising 17% and net income rising 23% on a non-GAAP (adjusted) basis -- its GAAP earnings were skewed by its OpenAI investment rising. Microsoft is still the same stalwart it was over the past few years, so taking advantage of the market's odd pessimism is a great move to make.

Amazon

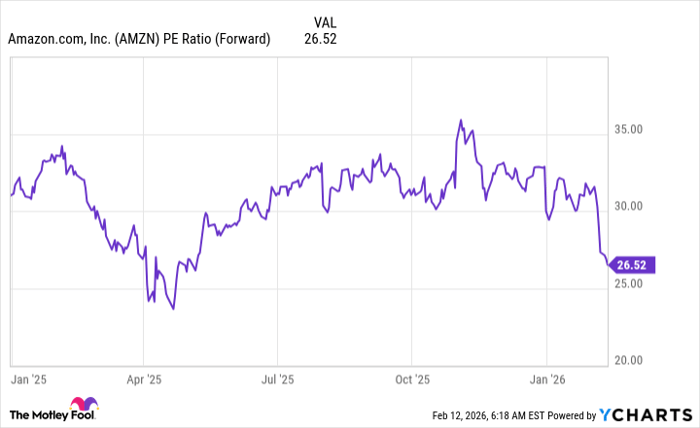

Similarly, Amazon (NASDAQ: AMZN) has also had a poor start to 2026, after its Q4 earnings report caused the stock to tumble. It's down around 20% from its all-time highs and has been a losing investment since 2025 began. And that's despite delivering solid results over the past year. One of the biggest issues with Amazon's stock was that it carried a premium valuation compared with the rest of big tech without as quick growth. That premium has disappeared over the past few months, and now Amazon trades for 26.5 times forward earnings.

AMZN PE Ratio (Forward) data by YCharts

That's nearing the level it traded at during the tariff sell-off in April 2025. Buying opportunities like this don't come around often for Amazon, or any of the others on this list, and now is a great time to scoop up shares. While Taiwan Semiconductor may not be far off its all-time high like these other four, I think it's uniquely positioned to capitalize on massive AI spend, and today's price makes perfect sense for TSMC's stock, too.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 20, 2026.

Keithen Drury has positions in Broadcom, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.