This Growth Stock Continues to Crush the Market

Key Points

Making high-performance microchips requires highly specialized equipment.

There’s a reason, however, one company dominates this aspect of the chip market.

ASML is that company, but the stock regularly takes shareholders on a roller-coaster ride.

- 10 stocks we like better than ASML ›

As the clichéd warning reminds us, past performance is no guarantee of future results. In other words, just because a stock is beating the market now doesn't mean it will continue doing so in the future.

Still, a track record of strong gains doesn't necessarily hurt the bullish argument. There's a reason that a stock is performing so well, after all, and great companies tend to remain great.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With that as the backdrop, the fact that shares of Netherlands-based ASML Holding (NASDAQ: ASML) continue to not just outperform the S&P 500 but outright trounce it makes it worth a look -- and consider adding to your portfolio.

Image source: Getty Images.

What's ASML, and why should you own it?

It's not a household name. However, there's a very good chance you benefit from ASML's know-how every single day of your life. You may even be benefiting from it right now!

ASML makes equipment used to manufacture microchips. In fact, it makes the vast majority of the machines used to manufacture the high-performance chips used in smartphones, computers, and yes, artificial intelligence data centers.

It's called lithography, or in ASML's case, extreme ultraviolet (or EUV) lithography. That's just the use of intricate patterns of light to "spray" circuitry onto a silicon wafer, turning it into a true microchip.

As it stands right now, ASML's newest equipment can make a semiconductor with circuitry as narrow as 8 nanometers. That's tiny. One nanometer is one-billionth of a meter, which of course you can't see with your naked eye. But this degree of resolution is necessary to achieve the sort of speed and power efficiency demanded by modern-day technological applications.

That's why Global Market Insights believes the EUV lithography equipment industry is poised to grow at an average annualized pace of nearly 14% through 2034, led by ASML.

ASML's wares in and of themselves aren't the reason this volatile stock remains a buy after any decent pullback, however. Rather, it's the patent-protected hold it has on the market. The company boasts more than 30,000 worldwide patents, more than half of which are active. While it regularly faces unlicensed use of its know-how, its legal defenses are typically successful. That's how and why its revenue has more than tripled over the past 10 years, and is likely to keep growing at a comparable pace well into the future.

Again, Global Market Insights expects the EUV lithography machinery business to more than triple in size during the decade ahead.

Have patience

The bigger-picture tailwind and technological backstory are compelling enough. Buying and holding this stock, however, can be something of an adventure. This company's strong growth and close connection to the artificial intelligence industry keeps things more than a little volatile, and its growth rate can fluctuate quite a bit from one year to the next. This isn't apt to change anytime soon either.

This volatility can work in your favor by virtue of pulling the stock well back from its peaks like it did in 2022 and then again in 2024. It just takes patience to wait for those predictable pullbacks to fully play out.

To this end, as much as you might want to, now arguably isn't the time to step in. ASML shares just reached another record high, but like so many other stocks right now, this one is hesitating. It's conceivable this ticker could merely drift higher during December -- as most stocks do -- before the weight of the run-up from the early April low finally starts to set in.

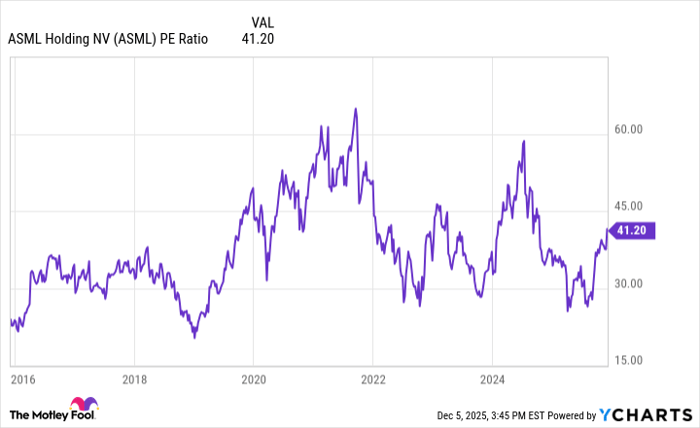

The deck is slightly stacked against ASML shares at this time in another way too. That's its valuation. Priced at more than 40 times next year's projected per-share earnings of $25.92, this ticker may be valued at just a little beyond its sustainable limit. For reference, ASML's stock was priced at less than 30 times its trailing price/earnings ratio at 2022's and 2024's lows.

ASML PE Ratio data by YCharts

Just don't get too picky, or too stingy. Notice ASML's trailing P/E ratio also eclipsed 50 prior to both of those pullbacks. We're still well under that mark. The analyst community is still bullish on the stock as well, despite its sizable run-up. Most of them still rate this ticker a strong buy, with a consensus price target of $1,180.77 that's a bit above the stock's present price. It just means that even if a pullback is in the cards, it doesn't necessarily need to be a major one before finding bottom.

Or, you can just not worry too much about the timing either way and simply step in right now on faith that your exact entry point won't matter much in the long run.

A great option for (most) growth portfolios

ASML is not for everyone. Even when it's rallying and has room to keep running, knowing the stock's historical volatility can make it a nerve-racking name to own. It's also particularly vulnerable to geopolitical trade tensions that ultimately lead to tariffs and counter-tariffs. It would also be naive to ignore the fact that China -- where a credible competitor will eventually surface -- doesn't always seem keenly interested in respecting ASML's patents.

Nevertheless, this is a great holding for any growth-seeking investor who can stomach its volatility. ASML is one of a few companies that effectively enjoys a legal monopoly in a business the world simply can't function without. Indeed, it will need more and more of its equipment for the foreseeable future.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.