What Has PM Stock Done for Investors?

Key Points

Especially lately, investors have cheered the company's pivot into next-generation products.

It sells proportionally more of these than some of its top rivals.

- 10 stocks we like better than Philip Morris International ›

For years, Philip Morris International (NYSE: PM) has been a reliably well-performing investment for investors willing to buy in a "sin stock." Although global consumption of traditional cigarettes continues its long, downward spiral, the company has done well developing and selling next-generation alternatives like its Iqos heated tobacco product and the Zyn nicotine pouches.

Let's examine a few charts to see how well Philip Morris has performed over time.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

The power of the pivot

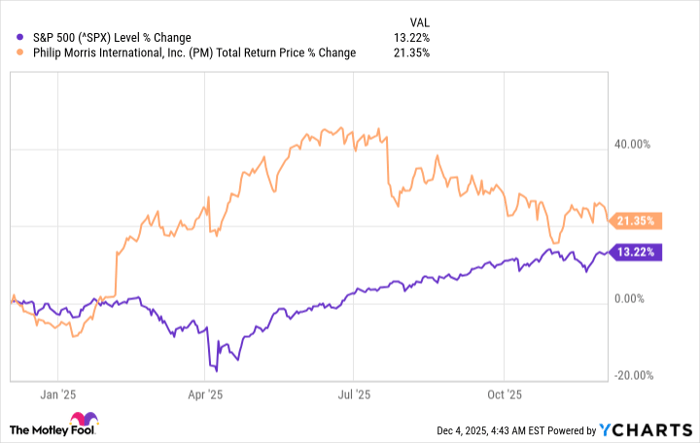

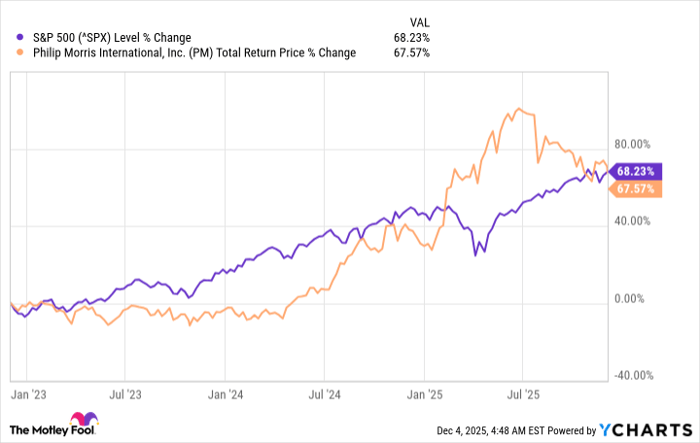

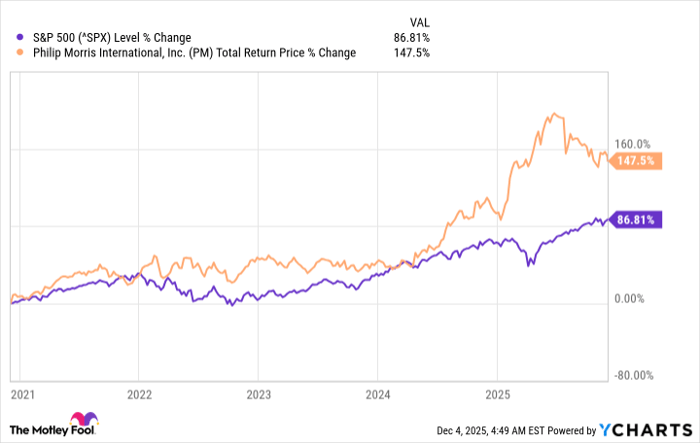

Below are the one-, three-, and five-year graphs comparing the total return (i.e., stock performance plus dividend payouts) of Philip Morris' shares with that of the S&P 500 index. In all three, you can see an extended period of outperformance with the stock recently.

Data by YCharts.

To a degree, that's the market rewarding Philip Morris for its success pivoting away from traditional combustible tobacco products (mainly cigarettes), into those ostensibly healthier alternatives. Cigarette unit sales have been in decline for years, as people around the world collectively try to live healthier lives (and tightened anti-smoking regulations, plus excise taxes, make it prohibitive to puff a ciggie).

In its third quarter of this year, Philip Morris derived 41% of its $10.8 billion in net revenue from "smoke-free products," as the company refers to such alternatives. These goods contributed roughly the same share to gross profit for the period.

This compares quite favorably to Altria, the successor business to the company Philip Morris International was spun out of in 2008. Altria remains dependent on sales of smokables, which accounted for 89% of its revenue in its latest completed quarter. Ditto for another incumbent company in the sector, British American Tobacco, with an 82% share as per its first-half 2025 earnings report.

The magic growth and income combination

Any kind of pivot is difficult for a company, especially if it has spent decades making the same products the same way. Philip Morris International has been adjusting better than others, clearly, and what's more, it has managed to grow key fundamentals and keep margins nice and high (an enviable feature of the traditional tobacco industry).

In the aforementioned third quarter, that $10.8 billion on the top line was 9% higher year over year. Attributable net income according to generally accepted accounting practices (GAAP) rose by almost 14% to $3.48 billion.

This sort of performance has benefited free cash flow (FCF), which surged by 38% to almost $4.1 billion. It easily funded the $2.1 billion the company used to pay its high-yield dividend, another classic aspect of traditional tobacco. Philip Morris' quarterly payout is $1.47 currently, a 3.9% yield. That's well above the 1.1% average of all S&P 500 index component stocks.

So what we have here is a fine income stock that, at the same time, is producing attractive fundamental growth. Sin stocks aren't for everyone, but for those accepting of them, Philip Morris International should keep delivering strong returns for years to come.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $521,982!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,137,459!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.