Don't Be Fooled By Tomorrow's Earnings: Oracle is Undergoing a Once-in-a-Decade Value Re-rating

The spotlight on Wall Street is fixed on Oracle once again this week. In the final 24 hours before the earnings release, an air of unnecessary tension hangs thick. Traders are glued to the options chain, and analysts are scrutinizing every decimal point: Is Cloud growth 1% faster or 1% slower? Is the capital expenditure too high? While this tension is understandable, it is strategically critically near-sighted.

If you focus only on whether revenue "meets expectations" tomorrow, you are likely making a costly mistake—missing the genuine, once-in-a-decade structural value re-rating that is currently underway at Oracle. It is no longer the legacy dinosaur collecting "tolls" from its database business. The September earnings report fully ignited AI Cloud demand, sending the stock surging 36% in one day to an all-time high of $328. However, it has been in a sustained correction over the past three months, pulling back to around $220, a maximum drop of 34% from the high, nearly erasing all the September gains. The current position is very far from the high point.

This brutal correction is, in itself, concrete evidence that the market is still severely underestimating the scale of the transformation. Under Larry Ellison's almost aggressive stewardship, Oracle is rapidly accelerating its evolution into the rarest type of infrastructure arms dealer for the AI era. Regardless of tomorrow's earnings, we must look beyond superficial EPS figures to understand the three mutually leveraging foundational logics Oracle is building.

Gating the Compute Bottleneck: Why OpenAI and Musk Can’t Live Without It

The first thing we must understand is the unique moat Oracle has established in the cloud. Oracle Cloud Infrastructure (OCI)'s strategic positioning is not a full-scale ground war against Amazon AWS or Microsoft Azure. Instead, it is a very smart focus on the most valuable, technically demanding area of cloud computing: large-scale AI model training—a "special operation."

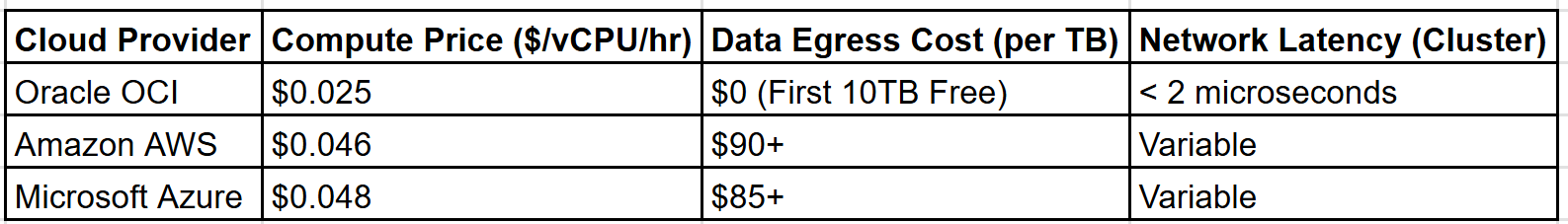

Imagine traditional cloud services as busy city roads with traffic lights, where data transmission experiences stops and delays when tens of thousands of GPUs work together. What OCI does is remove all the traffic lights, providing a "Bare Metal" architecture coupled with a super-network based on RoCE v2, effectively building a data transmission "Super High-Speed Rail." This allows tens of thousands of GPUs to collaborate seamlessly as if they shared a single brain, with inter-node latency as low as 2 microseconds. For companies burning millions of dollars a day on model training, this means a significant reduction in training time for equivalent models, eliminating costly GPU idle time.

This "Super High-Speed Rail" architectural advantage, combined with a highly aggressive pricing strategy (nearly half the cost of competitors), has made Oracle the "darling" of the AI community. This is why top AI giants such as OpenAI, Elon Musk's xAI, Meta, Mistral, and Anthropic are bypassing other cloud vendors and queuing up to sign contracts with Oracle. For instance, the five-year, $300 billion contract with OpenAI, with an estimated annual compute consumption rate of about $60 billion, is the hard currency delivered by a technical moat.

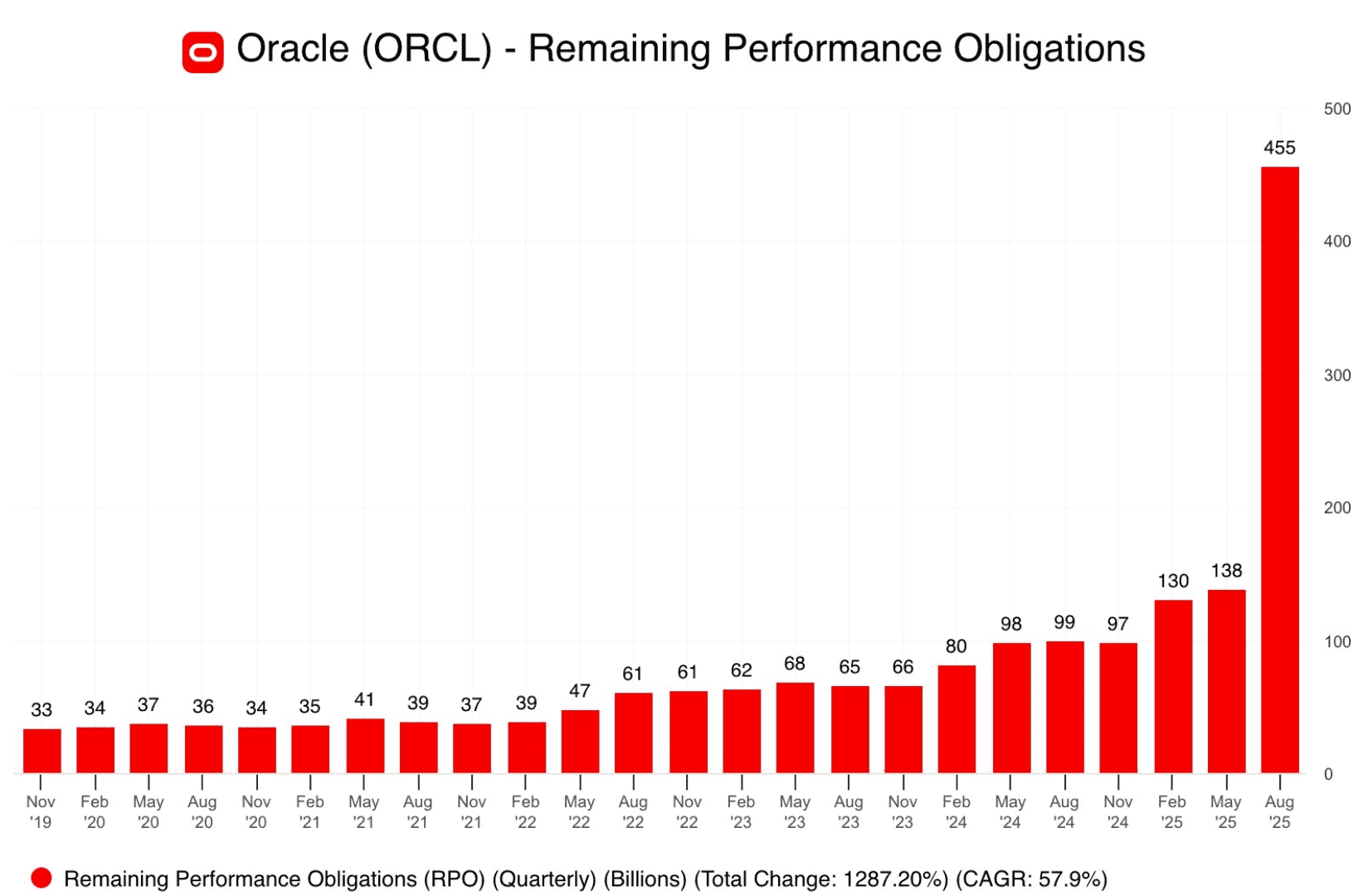

These clients are signing multi-year, colossal commitments, which are reflected in the financial metric called "Remaining Performance Obligation (RPO)," which has now surged past $455 billion. This is akin to a landlord already holding signed leases for the next five years—the money is certain to be collected sooner or later. Therefore, the current massive capital expenditure, while seeming to pressure free cash flow, is essentially a high-certainty investment based on a "sign the contract first, build the data center later" model. For investors, as long as the RPO figure continues to grow like a snowball, short-term profit fluctuations are just an accounting book game.

Once You're In, You Can't Get Out: How AI Becomes the "Super Glue" Locking In Customers

If OCI is the high-performance engine Oracle sells, then the subsequent SaaS business is the operating system that makes it impossible for customers to leave that engine. Oracle is rapidly transforming its SaaS business (including Fusion and NetSuite) into an intelligent decision-making brain with built-in AI.

Oracle holds a significant share of the global ERP market. This isn't just about selling software; it's about weaving a massive net. Core processes for large enterprises like FedEx, Marriott International, and Uber—including finance, supply chain, and human resources—run on Oracle's systems. Now, Oracle is deeply embedding generative AI agents into these processes. Imagine a future CFO who no longer needs to pore over Excel sheets because Oracle's AI can automatically generate cash flow forecasts and directly suggest how to optimize shipping routes or set sales discounts.

This "Super Glue" effect means that once AI begins managing an executive’s key decisions, the enterprise can never go back. To remove this AI brain, the customer must simultaneously dismantle the underlying OCI infrastructure, the middleware database, and the upper-layer application software. This is akin to replacing the engine and cockpit of a plane mid-flight; the cost and risk are prohibitively high. This extremely high switching cost, coupled with double-digit growth in cloud application revenue (NetSuite revenue has surpassed $1 billion), turns every existing customer into a perpetual cash cow.

A Bold Bet: Unlocking a New Gold Mine by Integrating US Healthcare Data with AI

After stabilizing the enterprise software base, Larry Ellison did not stop, turning his attention to humanity’s most complex and expensive data domain—healthcare. This is the true ambition behind Oracle's acquisition of Cerner. It is not merely a software acquisition but a bold gamble on a national-scale health network.

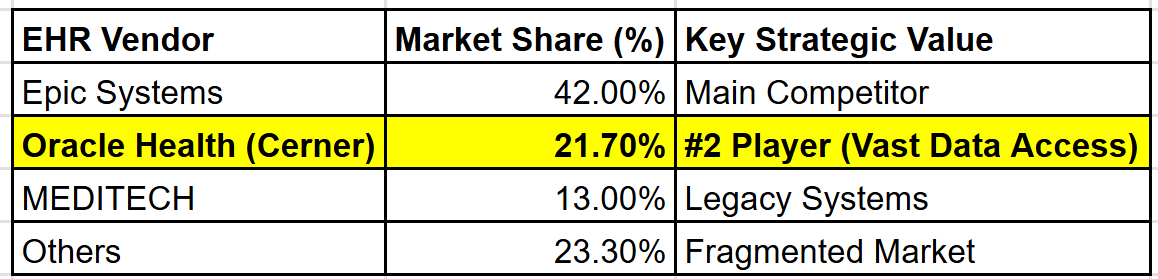

Ellison's goal is to transform traditional electronic health records (EHRs) into an AI health platform capable of "predicting the future." Cerner holds a 21.7% market share in the US hospital emergency department, meaning it controls a massive volume of real patient data. Ellison's envisioned future is one where, with just a single drop of blood, AI can instantly detect cancer signals through genetic sequencing. Processing this massive volume of genomic data requires the "Super High-Speed Rail" compute power of OCI, thus forming a perfect, self-reinforcing loop.

Although this business is still in the integration phase and its revenue contribution may appear low, the US Department of Veterans Affairs (VA), one of the world's most demanding clients, has continuously renewed its contract and is entering large-scale deployment. Once this national-level project is successful, it serves as a globally recognized "Golden Ticket," capable of leveraging the tens of trillions of dollars in healthcare markets in other countries. Much like how no one understood Amazon's early foray into cloud services, Oracle Health is poised for an imminent explosion.

Conclusion: Contract-Driven Growth Outweighs Operational Noise

Ultimately, for long-term investors, the Oracle story is no longer a quarterly earnings guessing game. While the current P/E ratio might appear high, considering the massive gold mine behind the RPO, its PEG ratio is only 1.3, far from being overvalued. The negative free cash flow and large capital expenditures, while seemingly a burden, are essentially a strategic deployment to monetize the already secured $455 billion RPO and the subsequent $300 billion AI long-term contracts—sign the contract first, build the data center later. The risk has been fully offset by customer prepayments, and the sacrifice of short-term profit is exchanged for the highly certain, high-margin cloud revenue realization over the next few years.

Current consensus on Wall Street also confirms this: OCI's compound annual growth rate is projected to be nearly 70% in the coming years, with price targets generally seen as high as $332–$346, representing over 50% upside from the current price. Our task is simply to watch if the RPO is continuing to snowball. As long as this snowball keeps growing, any stock price pullback due to short-term delivery delays or increased spending is a gift from the market to long-term investors. After all, in the AI Gold Rush, there is no safer business than owning an "arsenal" full of signed contracts.