Why I'm Buying Duolingo Stock Like There's No Tomorrow

Key Points

Duolingo attracts new users and turns them into paying subscribers at an impressive rate.

This business could expand into many educational opportunities, potentially providing years of growth runway.

- 10 stocks we like better than Duolingo ›

It's rare to find a profitable business growing revenue at a rate of more than 40% annually. Rarer still is finding a profitable growth stock that has dropped 66% in value. But app-based education company Duolingo (NASDAQ: DUOL) meets all of this rare criteria. And since this doesn't happen very often, I'm buying like there's no tomorrow.

I'm channeling the wisdom from my favorite investor, the late Charlie Munger. As he said, "Life is not just bathing you with unlimited opportunities." Therefore, Munger believed that a good opportunity deserved decisive action. And that's what I've done with Duolingo stock.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Duolingo.

At one time, Duolingo was a stock that I avoided because I didn't believe it had a sustainable business model. But the stock landed on my watchlist as I've been proven wrong. And now, with the stock price way down, it was time to act.

Why buy Duolingo stock?

I've found language learning to be a discouraging process over the years -- I couldn't imagine a company finding a way to attract and retain long-term learners. But through relentless A/B testing, Duolingo has found a way to make language learning fun and attract 135 million monthly active users, as of the third quarter of 2025.

More impressive still is Duolingo's ability to get users to pay. There is a free version of the platform, which is monetized through advertising. But the company has 11.5 million paying subscribers (accounting for 84% of revenue) as of Q3, which is up 34% year over year.

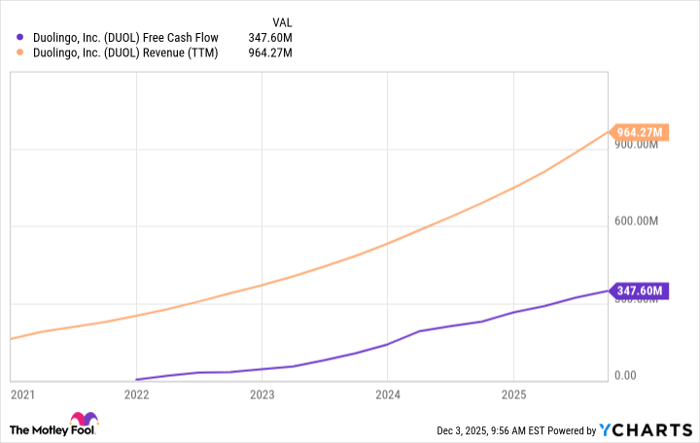

This is the fast growth I referenced at the start. But Duolingo isn't only growing fast, it's also generating substantial free cash flow -- nearly $350 million over the last 12 months. That's the benefit of scaling a digital business such as this.

In short, Duolingo has a knack for finding users and turning them into paying subscribers. This not only sustains its strong growth rate, but it also delivers attractive profits. This is the basis of my investment thesis for Duolingo stock.

DUOL Free Cash Flow data by YCharts

However, Duolingo is eyeing years of growth ahead. There are plenty of potential additional users for its language learning platform. And less than 10% of its current user base is a paying subscriber, representing a significant upside opportunity.

This is just an opportunity with learning a language. But Duolingo seeks to expand into all realms of education. Right now, it's developing products for chess, math, and literacy. But in the long term, almost anything could be turned into a gamified learning experience.

Given its success thus far, Duolingo isn't a business that I would bet against. It continues to grow fast and earn profits for investors. And that's why I'm excited to buy this dip with the stock. That said, I don't believe that this opportunity will last long, which is why I'm buying shares with a sense of urgency.

Should you invest $1,000 in Duolingo right now?

Before you buy stock in Duolingo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Duolingo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Jon Quast has positions in Duolingo. The Motley Fool has positions in and recommends Duolingo. The Motley Fool has a disclosure policy.