1 Unstoppable Stock to Buy Before It Joins Nvidia, Apple, Microsoft, and Alphabet in the $3 Trillion Club

Key Points

Amazon's stock success boils down to AWS and advertising.

Its growth rate has accelerated in recent quarters.

- 10 stocks we like better than Amazon ›

The $3 trillion valuation club is an exclusive group that only a handful of companies have ever joined. Currently, all four companies that have crossed this threshold are still in the club, with Nvidia, Apple, Alphabet, and Microsoft all valued at $3 trillion or greater. And there's another company knocking on the door: Amazon (NASDAQ: AMZN).

Amazon currently has a market cap of $2.5 trillion, so it's only a stone's throw away from entering the $3 trillion club. However, I think that's just the beginning for the company since it has a lot going for it right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Amazon isn't the company you think it is

The first thing that comes to mind when you hear the name "Amazon" is its e-commerce platform, which sells nearly every product available. That's its most forward-facing segment to the consumer and what allowed it to grow from an upstart to the $2.5 trillion behemoth it is today, but it's not what I'm most excited about as an investor.

Two of Amazon's most important segments are ones that few people interact with on a daily basis. Its most important segments are the Amazon Web Services (AWS) cloud computing business and its advertising division. Both of these are the company's fastest-growing segments, which align with importance and performance.

AWS is capitalizing on two major tailwinds in cloud computing: artificial intelligence and a general migration to the cloud. Companies are starting to move away from on-premise computing equipment because it shifts the system maintenance to a third party and requires fewer equipment purchases.

AI is obviously huge in the broader market right now, and cloud computing providers play a significant role in delivering AI computing power to non-AI hyperscalers. Few companies have the resources to build large data centers to drive their AI aspirations, so they turn to a cloud provider like AWS to fulfill those needs. This is a tailwind that won't decrease anytime soon, and it's starting to show up in AWS' results.

During the third quarter, AWS grew revenue 20% year over year, the best in multiple quarters. The cloud provider is a crucial part of Amazon's profitability, too, as it accounted for 66% of total operating income during the third quarter. With a strong 35% operating margin, AWS' continued success will be a key part of driving Amazon toward a $3 trillion market cap.

Advertising isn't as large a component as AWS, but it's Amazon's fastest-growing segment, with revenue rising 24% year-over-year in the third quarter. Management doesn't break advertising out into its own business unit, but we know from other companies, such as Meta Platforms or Alphabet, that advertising profit margins are quite high.

This likely places advertising services in AWS-like operating margin ranges, showcasing its importance to Amazon's overall profitability picture.

The ad market is currently strong, and Amazon is expanding its dominance in this space. It will likely continue to have outsize growth compared to the rest of the business (besides AWS) and will lead the company to a $3 trillion market cap.

But how soon will it get there?

Amazon is only a year away from joining the club

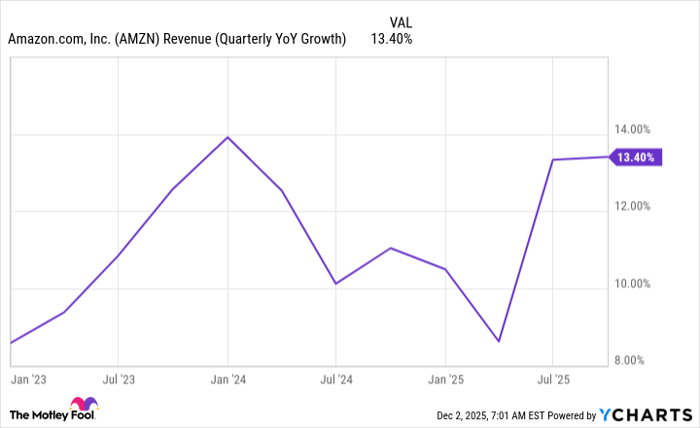

With Amazon needing about 20% growth to join the $3 trillion club, it may not take that long to get there. Its growth rate has been accelerating in recent quarters, and if it keeps its spending under control to boost profits, it could easily reach the $3 trillion threshold by the end of next year.

AMZN Revenue (Quarterly YoY Growth); data by YCharts. YoY = year over year.

Amazon is a strong pick for 2026, and I think it could reach the $3 trillion club by next year. If it fails to do so by 2026, I think it's likely to achieve it by 2027, as long as nothing drastic happens to the company or the market.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.