If You'd Invested $1,000 in Plug Power Stock 1 Year Ago, Here's How Much You'd Have Today

Key Points

Plug Power specializes in both generating hydrogen and building the fuel cells that use it to generate electricity.

Hydrogen fuel cells could be a game-changing technology in the energy space.

Plug Power stock has struggled this year due to the company's unprofitability and President Trump's lack of support for the clean energy sector.

- 10 stocks we like better than Plug Power ›

Electricity has become a rising theme in the stock market. The growth of artificial intelligence data centers is expected to put significant pressure on the current electric grid, and it appears that the world will need as much power as it can generate from traditional sources, as well as from new sources. One such innovative source of power is hydrogen energy.

Green hydrogen company Plug Power (NASDAQ: PLUG) is developing an end-to-end ecosystem that encompasses the production of hydrogen and its conversion into electricity by fuel cells for commercial use. Investors have shown significant interest in the company. If you'd invested $1,000 in the stock one year ago, here's how much your position would be worth today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Plug Power stock has struggled

While Plug Power appears to have immense potential, the company has struggled financially. After a few decades as a public company, it's still losing a significant amount of money each quarter, and recently warned that it could lose access to $1.7 billion in loan guarantees from the U.S. Department of Energy.

The company chose to pause activities that were being supported by those loans, citing President Donald Trump's actions to end the clean energy commitments made under President Joe Biden's administration. Due in part to these events, Plug Power's stock trades down close to 13% over the past year, and off by close to 92% over the past five years.

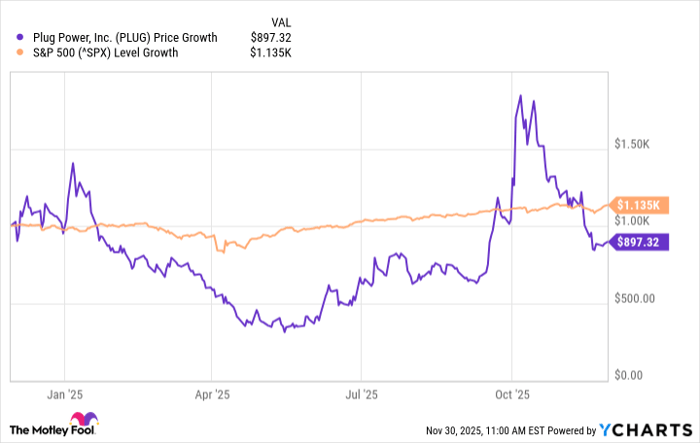

Data by YCharts.

As such, $1,000 invested in Plug Power a year ago would be worth a little less than $900 now. Had you invested $1,000 in the broader benchmark S&P 500 index instead, your position would be worth $1,135.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $588,530!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,102,885!*

Now, it’s worth noting Stock Advisor’s total average return is 1,012% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.