This Utility Stock Gained Nearly 400% This Year. Here's 1 Key Reason Why Investors Are Bullish.

Key Points

Oklo is soaring on the promise of one day powering data centers that are managing AI applications.

Investors are pleased that Oklo is making huge strides toward commercialization.

The company is pre-revenue and needs regulatory approval before it can make money off its reactors.

- 10 stocks we like better than Oklo ›

Oklo (NYSE: OKLO) is a nuclear energy start-up with a reactor design that purports to solve one of the tech's biggest problems: how to meet the exorbitant demand for energy from increased artificial intelligence (AI) usage.

The reactor design is Oklo's Aurora powerhouse. Small, modular, and capable of running on specialized fuel, these reactors can be assembled quickly and in places where grid power would never go. That makes them ideal not only for AI data centers, but also for other remote sites, like military camps and research labs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

A rendering shows Oklo's Aurora powerhouse. Image source: Oklo.

Because the world of tomorrow will need more power than today's power facilities can provide, Oklo seems well-positioned to grow. But that isn't the only reason investors are so bullish in 2025 on this nuclear stock.

Oklo is making progress on regulatory approval

Oklo's reactors could unlock massive energy potential for AI. The only hang-up is that it needs to pass the regulatory process of the Nuclear Regulatory Commission (NRC) to operate its reactors commercially.

In 2022, the NRC denied Oklo's first application. Since then, the company has reconnected with the agency and submitted its pre-application readiness review in July 2025. Normally, this process could drag on for several years. Yet a few nuclear-focused initiatives from the Trump administration have put Oklo on a faster track to deployment.

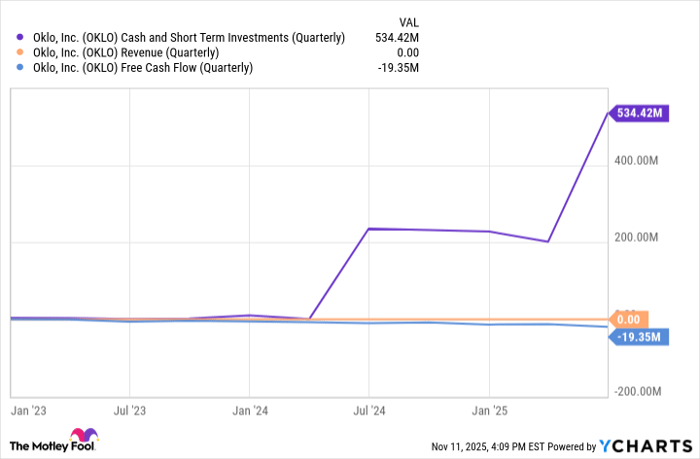

Over the summer, President Donald Trump signed several executive orders aimed at accelerating advanced nuclear technology in the U.S. In September 2025, Oklo began construction on its first Aurora powerhouse at Idaho National Laboratory (INL). Progress is encouraging, but it's not translating into revenue yet. Until Oklo reaches commercialization, its revenue is zero, and it's spending about $20 million a quarter on various projects.

Data by YCharts.

At its current cash burn rate, Oklo has enough to stay afloat for several years before it'll need a fresh cash injection.

Oklo stock has promise, but until the company has the license to operate commercially, it'll remain a highly volatile play on nuclear energy.

Should you invest $1,000 in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,230!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,187,967!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Steven Porrello has positions in Oklo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.