Down 14%, Should You Buy the Dip on Palantir?

Key Points

Palantir's revenue jumped 63% in the third quarter, but the stock price still slipped after the report's release.

A high valuation continues to be a sticking point amid fears of an AI bubble.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) reported what most would describe as a fantastic third quarter, setting all-new highs for revenue and profits while reeling in multimillion-dollar contracts at a breakneck pace.

However, in the week following the Nov. 4 release of the earnings report, Palantir stock is down 14%, reportedly on fears that artificial intelligence (AI) is approaching a bubble similar to the dot-com bubble in the late 1990s. The stock's incredibly high valuation is doing nothing to ease the fears of Palantir bulls.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Is the stock still a buy today? I believe it is -- here's why.

Image source: Getty Images.

It's impossible to ignore Palantir's momentum

Palantir can probably best be described as a data mining company, but it's really more than that. It has massively powerful tools that it uses to help its customers sift through data and provide meaningful, real-time analysis. It offers platforms for commercial use and for military/government work, both of which integrate with Palantir's powerful Artificial Intelligence Platform (AIP), allowing users to gain insights with minimal training. AIP rolled out in mid-2023, and Palantir stock hasn't looked back since.

In the past, a great earnings report added more gas to Palantir's flame. Back in August, when Palantir issued its second-quarter report, investors couldn't run fast enough to scoop up the stock. Share prices rose more than 15% in the week following the report as Palantir marked its first-ever quarter of $1 billion in revenue.

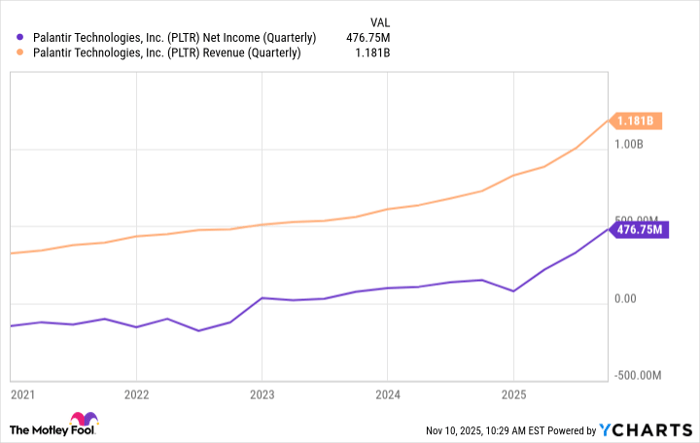

Palantir's third-quarter report was even better. Revenue jumped 63% on a year-over-year basis to $1.18 billion. Net income rose 40% to $475.6 million, and the company's adjusted earnings per share were $0.21. Palantir's U.S. commercial revenue increased 121% to $397 million, and its U.S. government revenue jumped 52% to $486 million.

Here's the stat that really got me, though: Palantir reported closing 204 deals in the quarter valued at more than $1 million -- with 91 of those worth more than $5 million and 53 more than $10 million. It closed $2.76 billion of contracts, with $1.31 billion of that coming from U.S. commercial clients.

CEO Alex Karp said that Palantir is only at the beginning of its growth story. "It is worth remembering that the business is now producing more profit in a single quarter than it did in revenue not long ago," he wrote in a letter to shareholders.

Data by YCharts.

Palantir issued fourth-quarter guidance that includes revenue in a range from $1.327 billion to $1.331 billion and full-year guidance for revenue between $4.396 billion and $4.4 billion.

You also can't ignore the valuation

This is where people get nervous about Palantir. Its price-to-earnings ratio of 623 and forward P/E of 217 are eye-watering, to say the least. Palantir also has a price-to-sales ratio of 137 and a forward P/S of 103 -- and those numbers have been steadily climbing in recent years.

Let me put it into perspective. The average P/S ratio for an application software company is currently 8.8. So, to buy Palantir, you have to be comfortable paying $137 for each dollar of Palantir's revenue -- or $107 if you're looking at forward revenue. That's way too much, no matter which measurement you use.

But Karp would argue that none of that matters, and I think he's right.

"Some of our detractors have been left in a kind of deranged and self-destructive befuddlement," he wrote in his letter to shareholders. "It has indeed been difficult for outsiders to appraise our business, either its significance in shaping our current geopolitics or its value in the vulgar, financial sense. The reality is that Palantir has made it possible for retail investors to achieve rates of return previously limited to the most successful venture capitalists in Palo Alto. And we have done so through authentic and substantive growth."

Putting it all together

If you are investing solely by the numbers, then Palantir is a scary stock. And I do agree there's value in numbers. But the bottom line for Palantir stock is that it defies expectations. There's too much growth happening here for an investor to disregard, and dips like this are golden opportunities to invest.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,230!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,187,967!*

Now, it’s worth noting Stock Advisor’s total average return is 1,069% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Patrick Sanders has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.