88% Chance of Rate Cut: Why Is Bitcoin Crashing While Silver Soars?

Precious metals rally to multi-week and all-time highs as Fed easing expectations climb, but crypto markets tell a different story amid ETF outflows and macro headwinds.

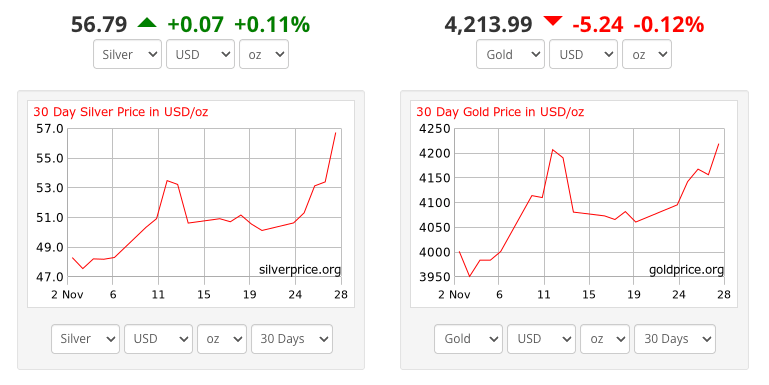

Gold prices touched a six-week high on Monday while silver struck a record, buoyed by growing expectations of US interest rate cuts and a weakening dollar.

Silver Shines on Supply Squeeze

Spot gold climbed to $4,241 per ounce, its highest level since late October, while silver soared to a record $58.83 before retreating slightly. The white metal has more than doubled in value this year, far outpacing gold’s impressive 60% gain.

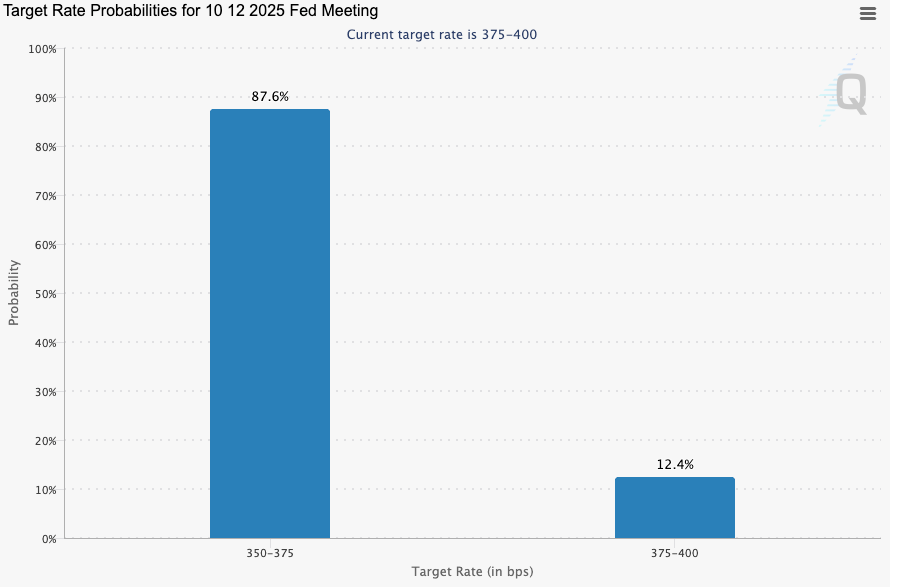

The primary driver behind this rally is growing expectations for Federal Reserve rate cuts. According to CME FedWatch data, traders are now pricing in an 87.6% probability of a 25-basis-point rate cut at the Federal Reserve’s December 10 meeting, with only a 12.4% chance of rates remaining unchanged.

Beyond monetary policy expectations, silver is benefiting from acute supply constraints. A historic squeeze in London during October drew record amounts of the metal into the trading hub, subsequently draining inventories elsewhere. Shanghai Futures Exchange-linked warehouses recently hit their lowest levels in nearly a decade, while one-month borrowing costs for silver remain elevated.

Silver’s industrial use is still growing, especially in electronics and renewable energy. Solar panel manufacturing uses large volumes of silver, sustaining strong demand. Combined with investment flows seeking inflation protection, these drivers have propelled silver’s price higher.

The long-term track record remains strong. In five years, silver prices increased by 135.79%. Over 20 years, they have been up 563.06%. This trend highlights both recurring policy cycles and enduring industrial demand.

Source: CME FedWatch

Source: CME FedWatch

The dollar’s slide to a two-week low has further enhanced the appeal of precious metals for holders of other currencies. Dovish remarks from Fed officials, including Governor Christopher Waller and New York Fed President John Williams, have reinforced expectations for continued monetary easing.

Bitcoin Bucks the Trend

Yet Bitcoin, often touted as “digital gold,” has moved in the opposite direction. The leading cryptocurrency plunged to around $86,000, down roughly 30% from its October all-time high near $126,000.

Several factors explain this divergence. US-listed Bitcoin ETFs recorded approximately $3.4 billion in net outflows in November, reversing earlier inflows. A $9 million Yearn Finance hack on December 1 rattled DeFi sentiment, while Bank of Japan Governor Kazuo Ueda’s hints at a potential rate hike sparked fears of global carry trade unwinding. Additionally, over $1 billion in leveraged crypto positions were liquidated during the recent selloff.

Although gold, silver, and Bitcoin are all non-yielding assets, precious metals are benefiting from independent bullish drivers—namely, physical supply shortages. Bitcoin, by contrast, remains far more sensitive to ETF fund flows and leverage liquidations.

While rate-cut expectations should be favorable for Bitcoin over the medium to long term, short-term headwinds are currently exerting greater influence.