Bitcoin's correlation with NASDAQ stronger during market downturns

- Bitcoin maintains its high beta against the NASDAQ-100 but only during market downturns.

- Capital rotation from cryptocurrencies toward equities has been a major catalyst for the occurrence.

- The dynamic indicates exhaustion from Bitcoin investors.

Bitcoin (BTC) has maintained its strong correlation with the NASDAQ-100 index. However, recent price action shows the top crypto only follows the index during periods of price declines.

"When equities rally, BTC's reaction is muted. When they sell off, BTC tends to move more sharply in the same direction," noted crypto trading firm Wintermute in a Thursday report.

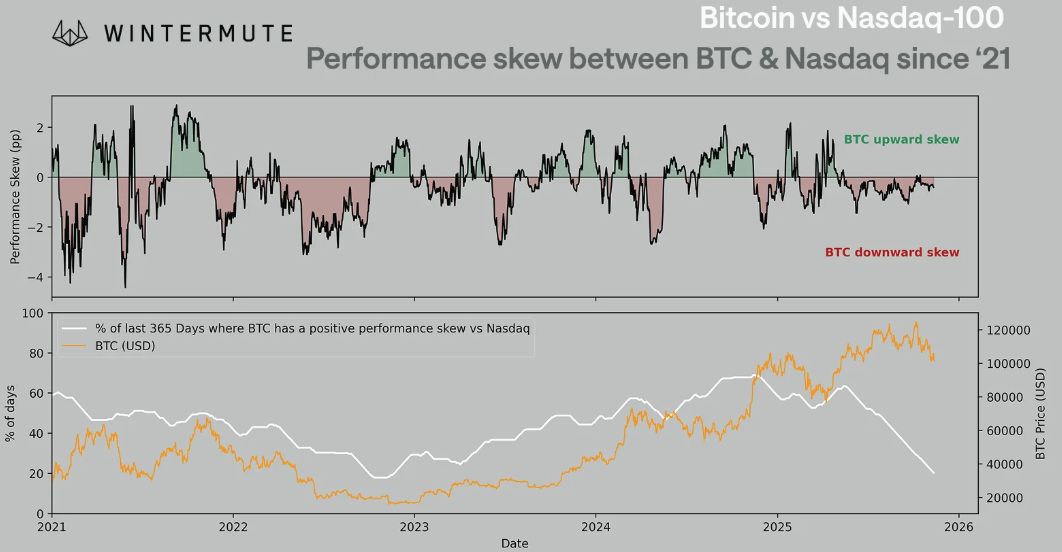

The relationship is evident in the performance skew between BTC and the NASDAQ. While their correlation remains strong at 0.8, the skew has been largely negative, indicating Bitcoin maintains its high-beta characteristics, "but only when it cuts the wrong way," the report states.

Although asymmetry between both assets is tightening, the number of days with positive skew versus the NASDAQ-100 has hit its lowest level on a 365-day rolling basis since the 2022 bear market.

Why the trend accelerated in 2025

Wintermute highlighted that one potential reason for the occurrence is a shift in institutional and retail attention toward equities. "For much of 2025, the narrative capital that usually circulates within crypto, new token launches, infrastructure upgrades, fresh retail participation, has instead rotated toward equities," Wintermute wrote.

The market maker noted that the NASDAQ-100 has attracted much of the rising US Dollar risk appetite in recent months, rather than the crypto market. Bitcoin's 18% loss vs the NASDAQ-100's 3.7% gain since the Federal Reserve (Fed) began easing rates on September 17 aligns with the thesis.

"It reacts as a 'high-beta tail' of macro risk rather than a standalone narrative, the downside beta remains, the upside narrative premium does not," the report states.

Wintermute added that reduced ETF inflows, plateaued stablecoin issuance and compressed market depth have further expanded its performance skew.

The firm noted that periods of strong negative skew are mainly evident during bearish cycles and market bottoms. However, Bitcoin has remained closer to all-time highs despite the negative skew.

Wintermute concluded that the current dynamic suggests Bitcoin investors are exhausted.

Bitcoin has declined below the $100,000 key level and is trading around $95,000, down 3.5% over the past 24 hours at the time of publication on Friday.