Is Bitcoin Treasury Hype Fading? Data Suggests So

Bitcoin treasury companies have seen a record-breaking 2025 so far, but CryptoQuant data shows momentum has started to slow down.

Bitcoin Treasuries May Be Observing A Slowdown

In a new post on X, on-chain analytics firm CryptoQuant has discussed how the latest trend is looking when it comes to Bitcoin corporate treasuries. Popularized by Michael Saylor’s Strategy (formerly Microstrategy), the treasury playbook refers to a model where a publicly listed entity buys and keeps BTC as a reserve asset on its balance sheet.

The previous cycle saw this treasury strategy gain some steam, but things have gone up a notch this cycle as the success of Strategy has encouraged companies to go bolder.

As the below chart shows, 2023 peaked at just 15 new treasury buyers of Bitcoin, but the number more than doubled to 38 in 2024.

2025 has only continued this trend of acceleration, with 89 companies already having added BTC to their balance sheets, when there are a few months left to go for the year.

That said, while 2025 has certainly been impressive so far, granular data could show early signs that a shift may be underway.

As is visible in the above graph, the Bitcoin treasury strategy hype saw an increase over the year, peaking at 21 new firms in July. In August, however, the number dropped to 15, and in the first half of September, so far, just one new company has employed this model. Based on the data, CryptoQuant concludes, “the slowdown has begun.”

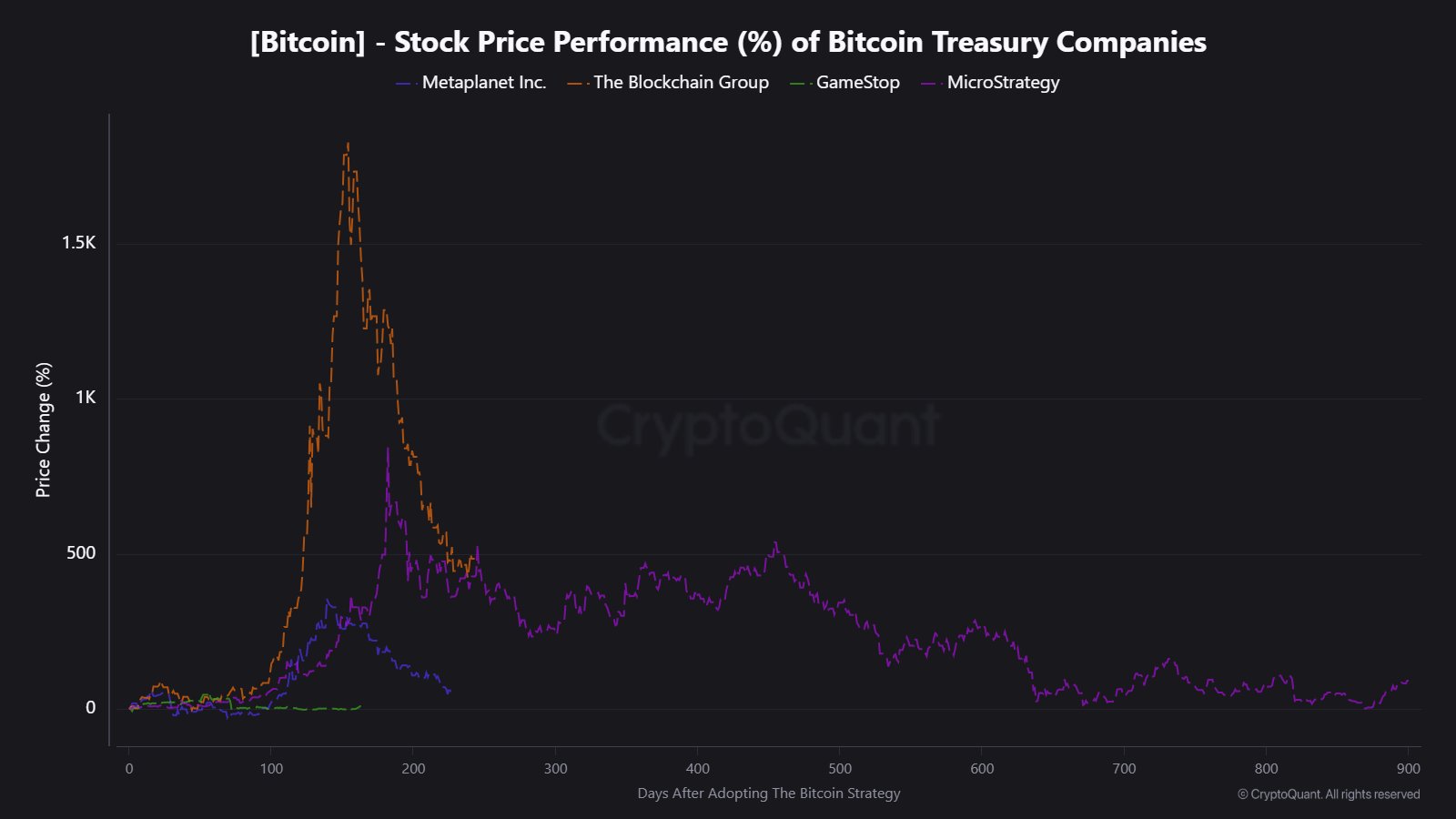

The cooldown in momentum is also evident in the stock charts of some of these firms.

Examples of this include The Blockchain Group, which was sitting at +1,820% at its peak before seeing a decline to +443%, and Metaplanet, down to +55% from its +355% top. “Signs the hype is deflating as reality sets in,” notes the analytics firm.

Though while signs have been there for a slowdown, the big buyers haven’t looked done accumulating Bitcoin yet. Strategy has regularly been buying and has added $19.3 billion to its reserves year-to-date. Similarly, Metaplanet has expanded its treasury by $1.92 billion.

Today, Bitcoin treasury companies as a whole control more than 1 million tokens, equivalent to 5% of the entire BTC supply in circulation. Strategy alone makes up for 66% of this stack.

BTC Price

Bitcoin has furthered its recovery over the past day as its price has surged to $116,600.