Forex Today: July Nonfarm Payrolls data to keep volatility high heading into weekend

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

- AUD/USD sticks to gains above 0.6600, highest since late October after Aussie trade data

- AUD/USD holds steady above 0.6600; remains close to two-month high ahead of US PCE data

Here is what you need to know on Friday, August 1:

Markets turn quiet early Friday as investors assess the latest headlines surrounding the United States' (US) trade regime, while gearing up for the July employment report, which will feature Nonfarm Payrolls, Unemployment Rate and wage inflation figures. The European economic calendar will offer Eurozone inflation data and later in the day the ISM will publish the US Manufacturing PMI report for July.

US Dollar PRICE This week

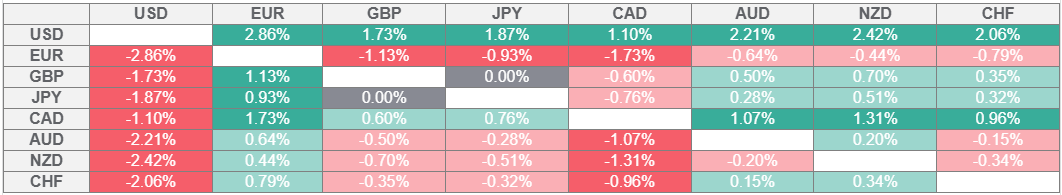

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) Index continued to stretch higher following Wednesday's impressive rally and registered gains for the sixth consecutive day. The index is up nearly 2.5% this week and remains on track to register its biggest one-week gains since September 2022. The White House announced late Thursday that the US will set a baseline tariff rate of 10%. Meanwhile, US President Donald Trump signed an Executive Order increasing the tariff rate on Canadian imports from 25% to 35%, while extending the current trade agreement with Mexico for 90 days. The USD Index stays in a consolidation phase at around 100.00 in the European morning and US stock index futures lose between 0.3% and 0.4%. Nonfarm Payrolls in the US are forecast to increase by 110,000 in July.

Canada’s Prime Minister Mark Carney said they are disappointed with the US on the fresh tariff rate. "While negotiations continue with the US, Canada is focused on what we can control; that is on the Building Canada Strong campaign," he added. USD/CAD stretches higher early Friday and trades at its strongest level since late May above 1.3860.

Following a sharp decline that lasted for three days, EUR/USD found a foothold on Thursday and closed the day virtually unchanged. The pair stays in a consolidation phase above 1.1400 in the European morning.

GBP/USD extended its weekly slide on Thursday and ended the day in negative territory. The pair struggles to gather recovery momentum early Friday and fluctuates at around 1.3200.

USD/JPY rose nearly 1% on Thursday and climbed above 150.00 for the first time since early April. The pair stays relatively quiet in the European session and trades near 150.50. Japanese Finance Minister Katsunobu Kato on Friday alarmed over the foreign exchange (FX) moves, including those driven by speculators. Kato further stated that he will need to closely monitor impact on US tariffs on exports.

Gold failed to gather bullish momentum after rising above $3,300 and ended the day marginally higher on Thursday. XAU/USD moves sideways at around $3,290 on Friday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.